Does changing the name of a scheme help change the fortunes of the scheme?

Astrologers and numerologists are said to advice their clients to modify their name by adding or dropping an alphabet or changing your name in order to turn their fortunes. But does the same hold true for mutual fund schemes?

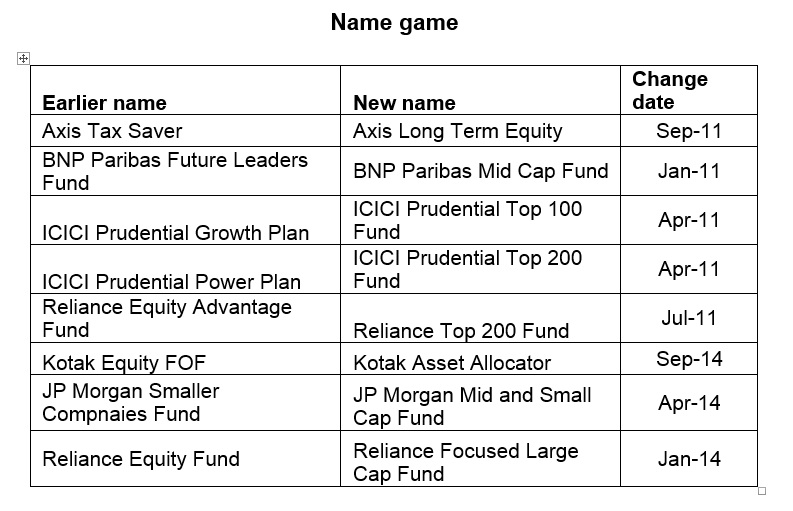

In this article we’ll try to explore why fund houses change the nomenclature of a scheme and whether it helps turn around the fortunes of a scheme. Changing scheme’s name is not a new phenomenon. Back in 2011, at least a dozen schemes had their names changed.

There are a variety of reasons why fund houses change the nomenclature of a scheme.

The change in name could be as a result of scheme merger. For instance, UTI merged its two schemes - UTI Services Industries Fund and UTI-Contra Fund and created a new fund called UTI Multi Cap Fund.

Some fund houses have changed the nomenclature of their schemes to help investors and distributors get a clear idea about the fund’s objective. Very recently, JP Morgan Mutual Fund changed its JP India Smaller Companies Fund to JP Morgan India Mid and Small Cap Fund with effect from April 30. This is merely a change in name of the fund as there were no modifications to the investment objective of the scheme. “We changed the name so that the fund clearly represents the universe of stocks in which it will invest. Earlier, distributors thought that our fund only invests in small cap companies. Now it will be compared to the correct peers and will get its rightful share of allocation,” said Supreet Bhan, Head – Retail Sales, JP Morgan Mutual Fund.

“With multiple funds within a category, we felt it was necessary to clearly define the objective of the scheme through its name,” adds Supreet.

Other fund houses like Axis have adopted this strategy to attract a bigger universe of investors in its tax saver fund. Back in August 2011, Axis had rebranded its Tax Saver Fund to Axis Long Term Equity Fund. Rajiv Anand, the erstwhile CEO of Axis Mutual Fund had said “The universe of investors looking for tax saving is smaller than the universe of people looking for diversified funds. By changing the scheme’s name, I think it will open up a bigger market. There are no changes in the scheme except the name.”

Post the change, the fund has grown to

Rs. 1,335 crore. Besides the change in nomenclature, undoubtedly, the

performance of the scheme’s performance has also helped get inflows.

Similarly, Kotak changed its scheme name

from Kotak Equity Fund of Funds to Kotak Asset Allocator with effect from

September 30. This is not merely a cosmetic change. The scheme’s investment

objective has also undergone a change. The scheme will now invest in open end

debt and equity schemes of Kotak MF. Earlier, it was a pure equity fund which

was investing in open end equity schemes of other funds as well. Now the fund

will invest only in its own schemes. The equity allocation will be decided

based on a combination of factors like trailing PE of CNX Nifty, Yield Gap

Analysis and momentum of Nifty Index. Its benchmark will now be CRISIL Balanced

Fund Index. Kotak Equity FOF was managing a corpus of Rs. 24 crore.

"In the current form, Kotak equity FOF was restricted to only equity as an asset class as also the fund was getting categorized as a debt fund for taxation reasons. We felt there was a need to incorporate debt too as an asset class and try manage the allocations dynamically to each of these asset classes in a more scientific manner, given the rapid changes happening in financial markets. We believe that asset allocation is at the heart of financial investing.

In that, a strategy which seeks to invest dynamically across debt and

equity asset class (through schemes) , through one strategy, in a

way could potentially obviate the need for constant asset allocation by

the investor. With the potential to change allocation between equity

& debt mutual fund schemes of Kotak Mutual Fund, Kotak Asset

Allocator fund would now be in a position to add further

value to investors in an ever changing capital market. The portfolio

would also have the potential to be optimized further by the fund

manager by choosing the schemes of Kotak Mutual Fund which are likely to

do well in the future as per the discretion of the

fund manager," says Lakshmi Iyer, CIO, Debt & Head - Products, Kotak Mutual Fund.

Himanshu Vyapak, Deputy CEO, Reliance Mutual Fund says that fund houses rebrand scheme names to help investors understand the nature of the scheme more accurately. In January 2014, Reliance Equity Fund was renamed as Reliance Focused Large Cap Fund. “We have changed the scheme names so that the scheme’s strategy is clearly reflected in the name. In the case of Reliance Equity Advantage Fund, it was allowed to do naked short which was banned by SEBI. Thus, we changed the name of the scheme to Reliance Top 200 Fund.”

In January 2014, Birla Sun Life and ICICI Prudential had changed their RGESS scheme names to attract more investors. ICICI RGESS was rechristened as ICICI Equity Savings Fund while Birla Sun Life renamed its RGESS to Birla Sun Life Focused Equity.

Hemant Rustagi of Wiseinvest Advisors says merely changing a fund’s name does not help a fund. “Changing the nomenclature makes sense if the underlying objective of the scheme is also changing. Ultimately, the fund’s success will depend on its performance.”

In the past, AMCs had given imaginative names to their schemes which often confused investors and advisors. The erstwhile Executive Director of SEBI, K N Vaidyanathan had complained that schemes with fancy names made it difficult for investors to understand their objectives. In 2009, SEBI asked fund houses to drop ‘liquid plus’ because it felt that the term ‘liquid plus’ was giving a wrong impression of added liquidity.

Does changing scheme name helps the scheme? Let us know your thoughts.