At one time, long, long back, everything went into the piggy bank. Savings meant putting money in the piggy bank. Then came the trusted old fixed deposits, government schemes and gold. The increase in financial literacy saw the advent of mutual funds, PMS products and AIFs. With so many investment opportunities available, it becomes difficult for an investor to choose investments that are best suited for him and that can help in achieving financial goals.

Our investment journey evolves in different ways, with many twists and turns. We have different types of goals, which have varying return requirements in a landscape of changing risk profiles. As investors, if we just invest in one asset class today and then go to sleep, we are likely to wake up to a rude shock tomorrow. Much like our investment journey, the assets that we invest in also have varying risk/return profiles. In order to ensure that we have the maximum probability of meeting our goals, we must focus on “Asset Allocation”.

The what, why and how of asset allocation

What is asset allocation?

As the name implies, asset allocation entails apportioning or distributing portfolio investments across asset classes such as equity, debt, gold, real estate, cash or alternates. Diversification is the basic premise of asset allocation as investable asset classes are decided based on goals and risks and the need to mitigate portfolio volatility. The main goal of asset allocation is to minimise volatility and maximise returns. The process involves assessing your risk/return profile and then investing money in a certain proportion in asset categories that do not respond to the same market forces, in the same way, at the same time. Asset allocation will vary from one investor to another. For example, an aggressive investor can have 75% in equity mutual funds, 20% in fixed income funds and 5% in gold.

Risk/Return Matrix for major Asset Classes

Why is asset allocation important?

Asset allocation can impact an investment portfolio in four key ways:

- Optimise Returns: Every asset class will generate different returns and react in a dissimilar manner to similar market conditions. Therefore, by spreading investments across asset classes, an investor can optimise portfolio returns.

- Minimise Risks: Risk in inherent in all investments. However, in some investments the risk is high while in others it is low. Asset allocation ensures that the portfolio is diversified and that portfolio risk is spread across asset classes.

Since, each asset class performs differently in various macro and micro economic environments, it is important for investors to build a diversified portfolio and allocate investments to multiple assets.

Source: www.tradingeconomics.com, www.bseindia.com.

Note: BSE returns Calculations do not reflect any dividends paid or any stock spinoffs from original stock.

- Alignment with time-horizon: Time horizon of goals and risk profile of the investor, strongly influence the asset allocation decision. A portfolio needs to have a mix of equities, debt and cash to meet both, short-term as well as long-term needs. Asset allocation helps investors strike the balance between investments for the short-term and investments for the long-term.

- Minimize taxes: Different asset classes are taxed in different ways. By allocating investments across asset classes, an investor can minimize tax liability.

How do we do asset allocation?

The first step towards asset allocation is to examine one’s finances and understanding risk tolerance and risk appetite. One should look at all aspects of his/her finances while allocating assets. Investors can engage with a financial planner to undertake risk profiling tests which can accurately capture their risk appetite. Next step is to be cognizant of one’s financial goals and liabilities and arrive at a required rate of return to meet financial goals.

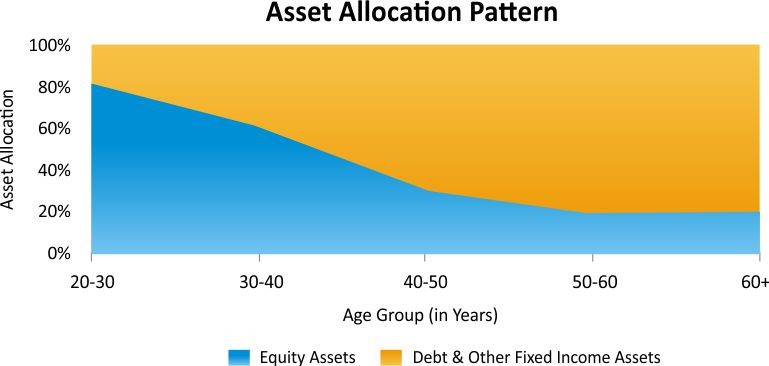

Subsequently, one arrives at an asset allocation that would help minimise risk while at the same time optimise returns. Online calculators or financial advisers help investors in arriving at the ideal asset allocation. While an individual investors' investment portfolio would be unique to his risk/return requirements, there are a few general rules of thumbs that one can take guidance from.

The above is only for illustration purpose.

Generally, an investor's ability to absorb risk is inversely proportional with his age. This means that the younger an investor is, the better is his ability to absorb risk. Consequently, investors just starting off on their investment journey can allocate a higher proportion of their assets to equities. This diminishes as the investor ages.

Asset allocation, once achieved, should be periodically reviewed and re-aligned, if needed, depending on changing circumstances and needs.