While equity funds are volatile and very risky for short term, debt funds are somewhat sidelined by return-conscious investors looking to park money for short duration. In such a scenario, investors with slightly higher risk appetite could explore arbitrage funds to park short term money.

Let us look into some of the benefits and concerns of using arbitrage over the short term.

Key benefits of investing in arbitrage funds

- Makes the best of pricing difference/volatilities

Arbitrage funds seek opportunities in price variations of equities across stock exchanges (BSE and NSE) and markets (spot and future).

Let’s understand these with the help of an illustration.

Stock exchanges and arbitrage:

A stock trading at Rs. 98 in NSE, trades at Rs. 100 in BSE. The fund leverages this difference for risk-free returns of Rs. 2 (100-98), by purchasing the share from NSE and selling it at BSE.

Markets and arbitrage:

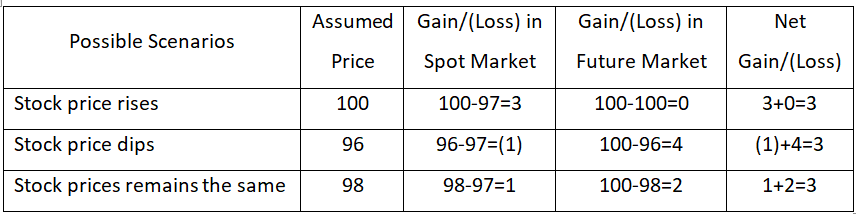

A particular stock currently trades at Rs. 97 in the spot market. The same stock trades at Rs. 100 in the future market. The fund would pick the stock from the spot market and will simultaneously short a future contract i.e. it will sell the stock at Rs. 100 on contract expiry. This gives a risk-free return of Rs. 3 (100-97) which is independent of the price on the settlement date. Let’s understand this further through the tabulation below.

When the contract expires, both the prices coincide and the two positions are squared up i.e. the share is sold in the spot market and purchase is made in the future market.

Amount in INR

The net gain/(loss) under each scenario is the same as the initial difference in spot (Rs. 97) and future market (Rs. 100).

“Investors must have a horizon of 6 months or more for leveraging this mispricing”, shared MFD Rishabh Adukia of Nine Cube.

Seconding this, MFD Rajesh Sarawgi said, “Arbitrage funds offer the ease of liquidity but make more sense when investors can stay invested for at least 6 months.”

- Offers tax-efficiency

“Tax-efficiency gives arbitrage funds an edge over pure debt funds,” said Rishabh.

Arbitrage funds are hybrid funds investing in a mix of equity (at least 65%) and debt. For taxation purposes, they are treated as equity funds and are subject to 15% STCG tax (where the holding period is less than one year) and 10% LTCG tax for gains exceeding Rs. 1 lakh (where the holding period is more than one year).

On the other hand, STCG taxes (where the holding period is less than three years) from debt funds are taxed at applicable slab rates while LTCG taxes (where the holding period exceeds three years) are subject to 20% taxes with indexation benefit.

Key concerns

- Market scenario

These funds strive to make the best of pricing differences amidst market volatilities. They primarily focus on leveraging this difference which fluctuates (i.e. increases or decreases) with market movements.

Rajesh believes that MFDs should consider overall market scenario along with the tenure of future contracts before recommending arbitrage funds.

- Associated costs

Arbitrage funds involve frequent trading and understandably command higher fees. Owing to these frequencies, it involves considerable transactions costs and a higher turnover ratio. This ratio indicates the rate at which a fund changed its holding in a particular year. Further, redemptions are usually subject to exit loads depending on the number of days invested. Cost parameters must be carefully reviewed for analyzing their impact on the overall returns.

Disclaimer: An Investor Education Initiative by Mirae Asset Mutual Fund

For information on one-time KYC (Know Your Customer) process, Registered Mutual Funds and procedure to lodge a complaint, refer to the knowledge center section available on the website of Mirae Asset Mutual Fund

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.