In a risk-averse country like India, it is hard for any new age investment option to find mass acceptance. Most investors in India still prefer putting their money into bank FDs and physical assets than market-linked investment options.

However, the situation is slowly changing as traditional instruments are losing sheen on the back of declining interest rates. And one option that's emerging as an alternative low risk investment is corporate bond fund.

An analysis of AMFI data shows that corporate bond funds have the highest net assets under management (as on September-end 2021) among all debt funds except for liquid funds. The AUM of the category went up from Rs.1.2 lakh crore in September 2020 to Rs.1.6 lakh crore in September 2021.

So, what is it about corporate bond fund that makes it an all-weather investment option that can suit the requirements of most investors?

The biggest reason is that there's hardly any 'low risk' investment option across asset classes that can match the returns of corporate bond funds. A report by Mirae Asset MF lists five reasons that explain why corporate bond funds should be the preferred option for risk-averse investors and also for those who have a short-to-medium term goals. Let's look at them one by one:

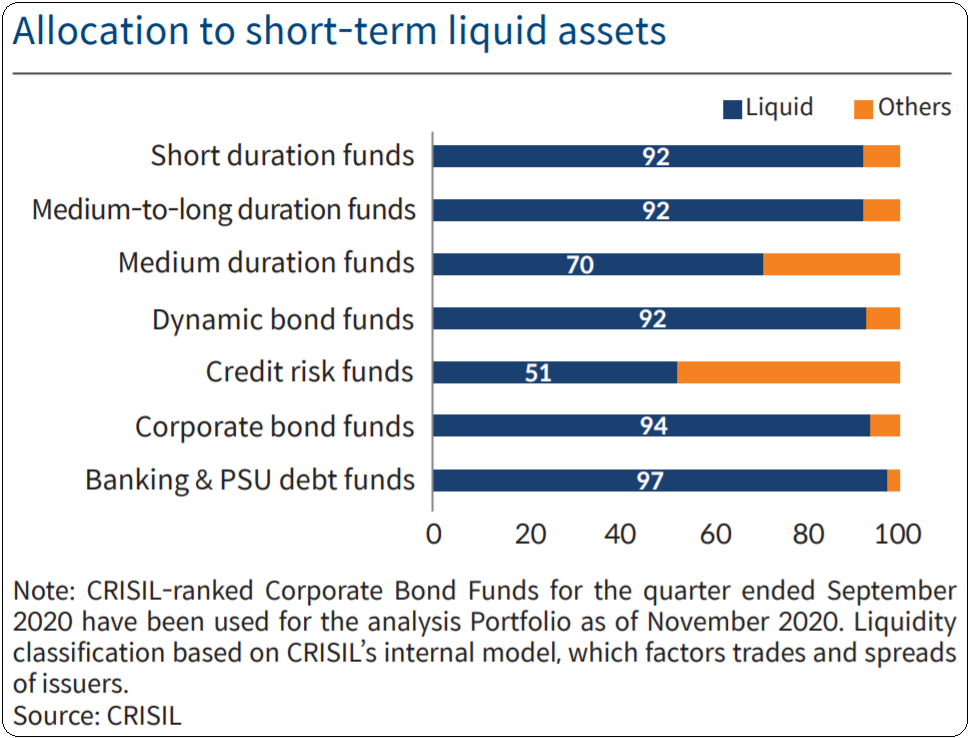

1. High safety: Corporate bond funds are high on safety as they are mandated by SEBI to invest at least 80% of the AUM in AA+ and above rated instruments. A comparison done by the fund house shows that corporate bond funds have the highest exposure to top rated papers among all debt categories. Although the data used is from September 2020, it establishes the fact the corporate bond fund is among the safest investment options in debt space.

2. Steady performance: In the 3-year period, the returns generated by corporate bonds funds is 8.16%, shows data from Value Research. The return is impressive considering the decline in interest rates post covid. In fact, the returns delivered by corporate bond funds is only marginally lower than banking & PSU funds' 8.21% return, which is the highest among shorter duration funds.

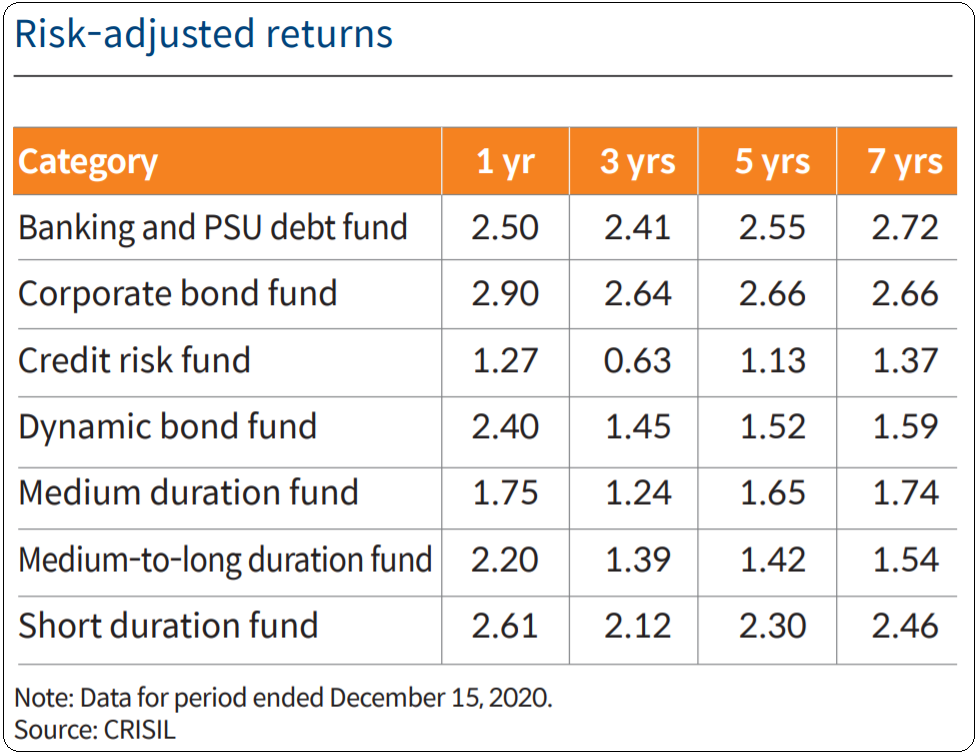

3. Higher risk-adjusted returns: The report shows that the risk-adjusted performance (measured by Sharpe ratio) of corporate bond funds is among the best across time periods.

4. Tax benefits: One major aspect where corporate bond funds or any debt fund beats bank FDs is taxation. Unlike FDs where returns are always taxed as per the investor's tax slab, debt fund investors get indexation benefit if they remain invested for more than three years.

5. Higher liquidity: The high level of allocation to top-rated papers enhances the liquidity aspect of corporate bond funds. This helps fund managers to rebalance the portfolio more efficiently. The report shows that corporate bonds allocate around 94% of their investment to short-term liquid securities, second only to banking and PSU debt funds.

Disclaimer: An Investor Education Initiative by Mirae Asset Mutual Fund

For information on one-time KYC (Know Your Customer) process, Registered Mutual Funds and procedure to lodge a complaint, refer to the knowledge center section available on the website of Mirae Asset Mutual Fund

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.