Carl Richards, author of the book ‘The Behavior Gap’, gives six tips on how the investment industry can change the world.

“We’re in a moment in time right now where there is so much change going on in our industry, really revolutionary change, and I think for all of us this represents a massive opportunity,” said Carl Richards, author of The Behavior Gap, at the opening session of the 67th CFA Institute Annual Conference in Seattle. “How can we together change the world? What can we do as an industry to make a difference?”

It was a fitting challenge to delegates at a conference billed as “shaping the future of finance.” Indeed, what can be done to restore trust and promote personal integrity?

Using an iPad as a virtual, real-time sketch pad, Richards created simple circle sketches to illustrate truisms about investing behavior and our relationship with money, explaining the six things he believes could make a difference.

1. Admit that we’re part of the problem

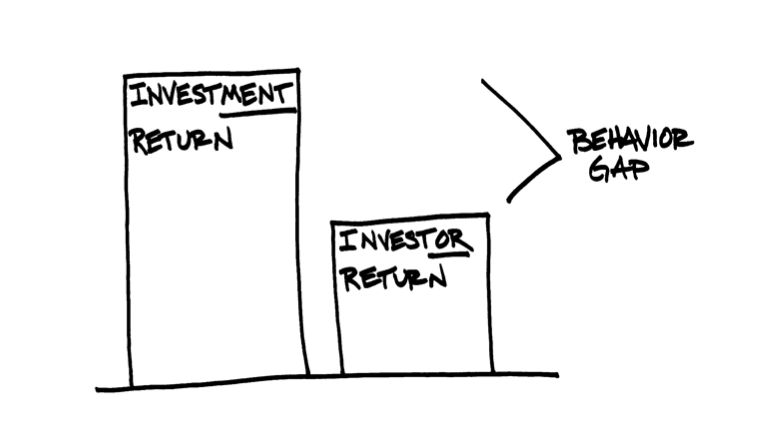

Richards, a weekly contributor to the New York Times, is well known for popularizing the term “behavior gap.” Simply put, the behavior gap explains the difference in investment and investor returns. For example, it is the percentage difference between a fund’s stated returns and the returns that individual investors actually get.

The “behavior gap,” he said, comes from measuring time-weighted versus dollar-weighted rates of return.

“Most of the money in a mutual fund is advised; it gets there because an adviser put it there. So if there is a big difference between the time-weighted and dollar-weighted rate of return on mutual funds, and most of the money is advised, we are part of the problem,” he said. “We are constantly creating new products. It is easy to sell to clients what they want, but it takes a bit more to have them purchase what they need, and often we are facilitating this mess we have created. Our industry has to be one of the most opaque industries in the world. Nobody really knows what they pay. It’s really hard to even figure it out.”

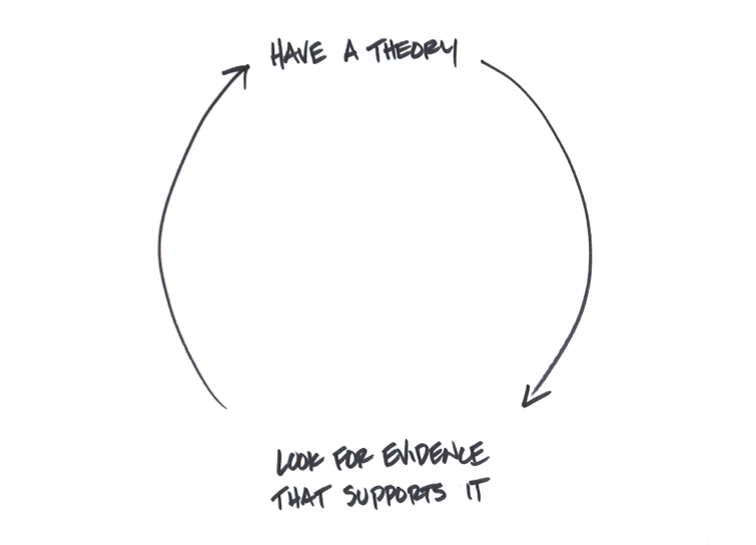

Richards said another reason why he thinks the financial industry is part of the problem is because of the way men make decisions.

“We call it research, but what do is we say ‘I’m going to make a decision, and then I’m going to do my research, and my research is going to systematically dismiss everything I don’t agree with and include everything I do.’ We’re constantly looking for evidence to support our decisions.”

2. Start talking about money (Not markets and investing but personal finance)

“We are helping people with decisions that are going to fund their lifetime dreams and goals . . . [but] we haven’t figured out how to talk about money because every time we go to touch it, it turns into a little argument. We expect it to be like a spreadsheet and a calculator. And it’s not, because it is emotional.”

3. Talk about the right things

“When is the last time you read something in the newspaper that you then acted upon immediately and were glad you acted upon it afterwards? Beating an index may not be as important as what the clients are trying to accomplish with their money or investing goals.”

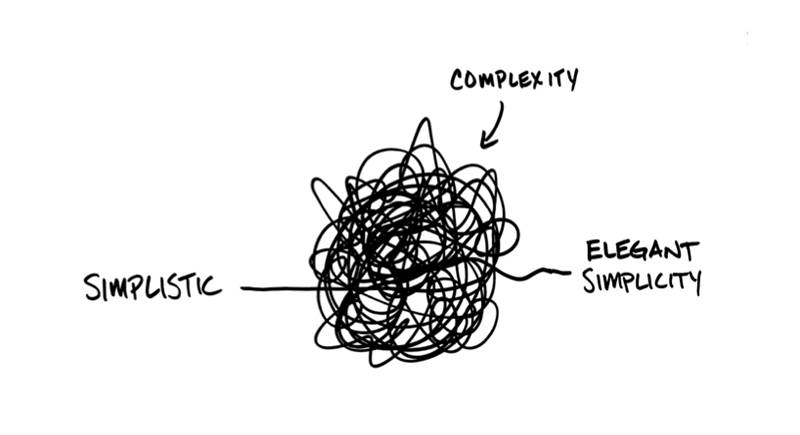

4. Simplify

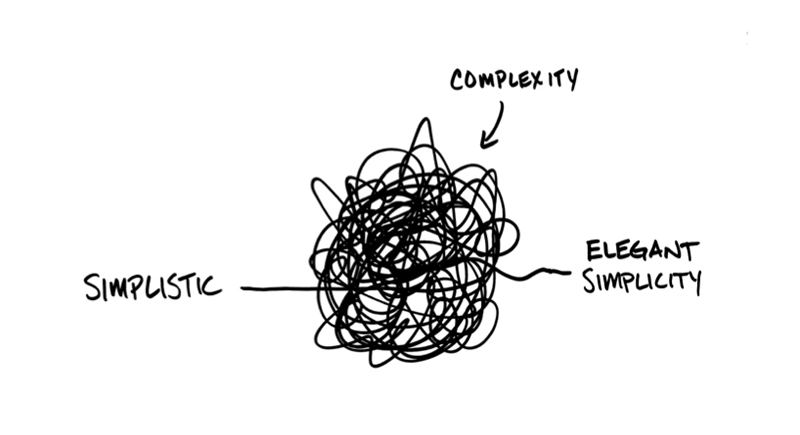

“We’re nervous to make things too simple,” said Richards. “We have a belief that complexity is some sort of sign of intellectual gift, or we think of it as a selling tool in our industry. I’ll dig a hole, throw the client in it, and say: ‘Hey, I’m the only one with the rope.’ Either way, it is a bad model. People just want you to make it simpler.”

Richards said people often get confused between “simplistic and elegantly simple.”

“If you deliver on the promise of making your clients’ financial lives simpler, people will pay you for that.”

5. Ask why

It’s important to ask why. Why are we doing what we do? And, as an industry, what is our ultimate goal?

“A business will only be around for a long, long time if it serves the ultimate goal of the customer,” Richards said. “And when we think about the end goal for anybody who is investing money, most of the time the end goal has something to do with meeting some financial goal, and often it’s about happiness. (‘I just want to be secure,’ ‘I want freedom,’ ‘I just want to be happy.’) It’s important to focus on the plan or objective, not the product.”

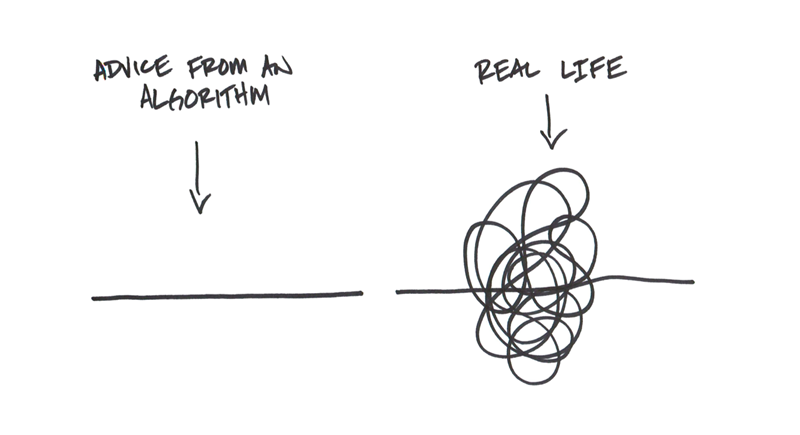

“One thing that has been interesting to me lately . . . is this movement to automated advice, and the anxiety that I sense from the industry about being replaced by an algorithm,” Richards said. “I think we are viewing it the wrong way. . . . As long as trust and empathy are an important part of giving [financial] advice, there will always be a role for humans in that relationship.”

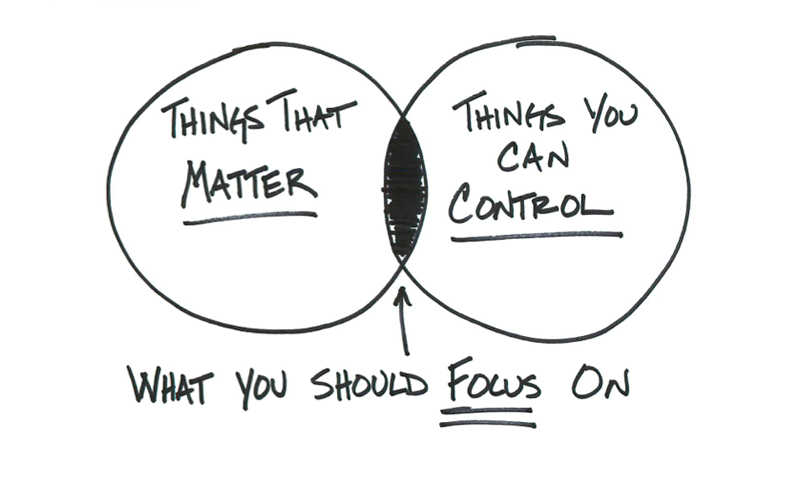

6. Let go

This may be one of Richards’s best-known circle sketches. “Focus on the intersection between things that matter and things that we can control,” he said. “Most of the things that matter — save one, the market — we have control over. We spend all of our time worried about the one thing that we have no control over. If we could just spend more time focused on the things that actually matter, helping clients and the public . . . people would be happier and, as a byproduct, they’d have a better investment experience.”

© 2013 CFA Institute. First appeared in Inside Investing http://blogs.cfainstitute.org/insideinvesting/

The views expressed in this article are solely of the author and do not necessarily reflect the views of Cafemutual.