He has 32 wisdom teeth. He can answer a missed call and legend has it that he can even make onions cry. Wondering who we’re talking about? Well, let’s just say that when god gets surprised at something, he exclaims, “Oh, my Rajnikanth!”

Yup, we are talking about the god of all things big and small, the man who introduces introduction itself – Rajnikanth. Fondly known as the ‘Thalaivar of Indian cinema’, he has redefined style, acting, action, and investing too!

Here are the top five investment lessons dished out by the man who knows it all, including what came first – the egg or the chicken.

1. En vazhi, thani vazhi. – My way is a unique way.

Rajnikanth has his own unique way of doing things. Wouldn’t you want to chart out your own unique way of doing things too? If yes, then you have to make a start with mutual funds because when it comes to investing in India, mutual funds are the unique way. As of last year, investments in mutual funds in India formed just close to 3 per cent* of the total investment by individual investors in financial assets. Mutual funds are the best investment product ever because:

- They are highly transparent products with detailed disclosure on the portfolio, returns in the past years, expenses, and so on. What’s more, there’s a huge variety of funds, and you will always find one that serves you best.

- They are very tax efficient and low cost products.

- You benefit from the expertise of professional fund managers who will do all the market-watching and economy tracking for you.

Wisdom #1: Don’t be like the 97 per cent of investors in India who stick to conventional investments like fixed deposits, gold, etc. Be unique by investing in mutual funds.

2. Naan eppo varuven, epdi varuvennu yarukkum theriyathu. Aana vara vendiya nerathula. – No one can tell when or how I’ll arrive. But I always do, when the time is right.

Rajnikanth is the king of timing. That’s why we think that timing the market is possible – ONLY if you are Rajnikanth. For all us lesser mortals out there, it is impossible to time the market.

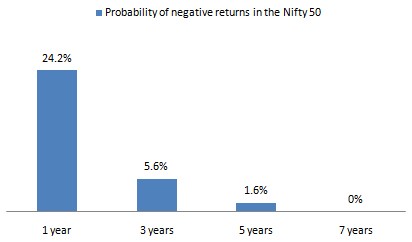

You may think the market is at a high, and that it is a good time to pull out of your mutual funds before you lose any money. But then the market keeps rising on. Or you may think the market has reached its low and will most certainly bounce back. That doesn’t happen either. Why? The market is a beast that can’t be timed. So, to build wealth, invest. And then, stay invested. For instance, equity mutual funds work best when you give it time to work. The longer you stay put, the greater your chances of making more money. The graph below shows the probability of negative returns over several time frames for the Nifty 50 index.

Do we have to say any more? In the last 10 years, you would have had NO negative returns over any 7-year time frame, irrespective of when you had invested.

Wisdom #2: Long-term investing in mutual funds will always make your timing right.

3. Kashtapadaama edhuvum kidaikaadhu. Kashtapadaama kedachu ennikum nilaikaadhu. – You’ll gain nothing without hard work. And if you do, it won’t last for long.

Investing in mutual funds requires some work. When you put in the work before you invest, you’ll be certain to gain well from them. For instance, when you design a mutual fund portfolio, you’ll have to first:

- Identify your goal – It could be your retirement, your children’s education, or even your dream of buying your dream car!

- Identify your investment amount, time-frame to get to your goal, and your risk profile – This is important to choose the right mutual funds for you.

- Choose your mutual funds – The type of funds and the number of funds in your portfolio will depend on the above factors. Remember, opt for funds that have been consistent performers over the long-term, instead of funds that have been chart-busters for a short period of time.

Once you do your initial homework, you can rest assured that you’ve built yourself a healthy portfolio. You could also take the assistance of an investment advisor, or you could benefit from robo-advisory services like FundsIndia’s ‘Plan’ section to help you.

Wisdom #3: An investment in knowledge always pays the best interest. So, do your ground work before you invest.

4. Kanna naan yosikama sollrathile, sollittu yosikrithile. – I don’t speak without thinking. I don’t think after speaking.

When it comes to investments, you need to think, plan and invest. And when it comes to investment success, you need to stick to the plan.

In this time and age, we constantly get updates about the ups and downs of the market. But a smart investor doesn’t get swayed by these updates. Investing in a certain mutual fund just because it did well for a year, stopping your regular investments (SIPs) because you think the market isn’t doing well for you, or foregoing the discipline of investing for your goal for any reason whatsoever are all signs of unhealthy investing.

Wisdom #4: Plan your investment work. And then, work your investment plan.

5. Naan late-aah vanthalum, latest-aah varuven. – Even if I come late, I’ll be the latest.

Higher returns are yours if you start investing in mutual funds early. There’s no magic to this statement. It’s all math. When you stay invested for the long-term, you accumulate more returns by benefiting from the power of compounding. But here’s what Rajnikanth tells you – don’t worry if you’re late to the investment party.

Even if you start investing late, as long as you invest right in new-age investment products like mutual funds, you’re fine. Just get rid of that starting problem, and you’ll be covered.

Wisdom #5: It’s never too late to begin smart investing in mutual funds.

So, we hope you benefit from the wisdom that we think emanates from the legendary lines of Rajnikanth. We hope you think of investing and the benefits of investing in mutual funds every single time you see, think or hear of Rajnikanth (in short, always). And we hope you invest well and build wealth.

Happy investing!

*According to a Deloitte – Indian Chamber of Commerce Report published in January 2016.

Noorain Mohammed Nadim is Senior Executive, Corporate Communications at FundsIndia.com

The article was first published on www.fundsindia.com