As we know, debt mutual funds invest in various fixed income bearing securities wherein each security in the portfolio may have a different maturity. The maturity date of a bond implies the particular future date on which the purchaser will get his principal back i.e. the amount invested in the security will be repaid in entirety. Whenever the topic of debt funds investment surfaces, the average maturity is taken into consideration. Average maturity refers to the weighted average of all the current maturities of the debt securities held in the portfolio. In other words, it tells you about the mean age of every debt security in the fund portfolio. The higher the average maturity of a debt fund, the longer it will take for each security to mature in the portfolio and vice-versa.

As we know, debt mutual funds invest in various fixed income bearing securities wherein each security in the portfolio may have a different maturity. The maturity date of a bond implies the particular future date on which the purchaser will get his principal back i.e. the amount invested in the security will be repaid in entirety. Whenever the topic of debt funds investment surfaces, the average maturity is taken into consideration. Average maturity refers to the weighted average of all the current maturities of the debt securities held in the portfolio. In other words, it tells you about the mean age of every debt security in the fund portfolio. The higher the average maturity of a debt fund, the longer it will take for each security to mature in the portfolio and vice-versa.

Average Maturity - a variable phenomenon

Average maturity is treated as a variable rather than a constant. It indicates the dynamic nature of average maturity. In the case of open-ended debt funds, the average maturity of the fund never remains fixed. It keeps changing with each security nearing its specific maturity date or as and when the fund manager churns the portfolio i.e. adds new securities to the portfolio or sells the already existing securities of the portfolio. In simple words, it can be said that average maturity is a relative concept because an open-ended debt fund has no maturity as such and continues to operate for eternity in spite of addition or deletion of individual securities in the portfolio. It should be noted that it is the fund holdings which mature and not the debt fund itself. The debt fund is available for purchase or redemption in an unending manner.

Computation of Average Maturity

Before investing in debt funds, it is advisable to have a look at the average maturity of the fund. The average maturity of the debt fund can be easily calculated with the help of maturity period of each security and the amount invested therein. Average maturity may be expressed in days, months or years.

Let me take you through an example for an in-depth understanding.

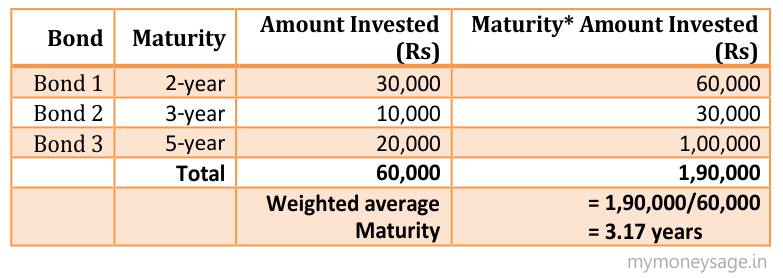

Consider a case where a debt fund holds three bonds each having maturity of 2 years, 3-years and 5-years respectively. The amount invested in 2-year bond is Rs. 30,000, in 3-year bond is Rs 10,000 and in 5-year bond is Rs 20,000. First, multiply the invested amount with the corresponding maturity period. The product of maturity and amount invested is given in the last column. Then, divide the total product (Maturity* Amount Invested) by the total amount invested to arrive at the average maturity of the debt fund i.e. 3.17 years.

The example shows that the average age of the debt fund is 3.17 years although individual bonds have a maturity which is different from 3.17 years.

Average Maturity & Investment Horizon - a risk-return analysis

Average Maturity of debt fund has a considerable impact on the overall returns and risk profile of the portfolio. At the very outset, you need to know the relationship between bond prices and interest rate. The bond prices are highly sensitive to the interest rate regime of the economy. Bond prices and interest rates always move in the opposite directions. As the interest rates rise in the economy, it leads to a fall in the bond prices and vice-versa. As a result of this, the NAV of the fund keeps fluctuating with the bond price and interest rate movements. A debt fund which has several long-maturity bonds in its portfolio would have higher interest rate sensitivity and would be vulnerable to greater NAV fluctuations. It enhances the overall risk profile of the debt fund and thereby increases the standard deviation of the fund. A higher standard deviation, in turn, means greater variability of the returns from its average and your expected return.

To illustrate this, let's take an example of gilt funds & liquid funds wherein the maturity period makes a significant difference in the returns generated by each one of them. Gilt funds invest primarily in G-sec i.e. government security of medium to long term maturity issued by the union & state governments. Liquid funds invest in fixed-interest bearing short-term instruments i.e. treasury bills, commercial paper, certificate of deposit, etc. As liquid funds have a shorter average maturity than gilt funds, these are less volatile to interest rate fluctuations than gilt funds. But as you know, returns are incidental to the risk assumed, gilt funds deliver higher returns than liquid funds. That is why, it is said that gilt funds are suitable for those who value high returns more than stability whereas liquid funds are meant for investors who prefer relatively low risk.

Hence, it becomes necessary for you to match client’s investment horizon with the average maturity of securities. The logic behind this is to provide financial access to a particular financial goal as soon as it arises. A mismatch in the time of the cash inflows and the capital requirement may cause a problem. Investing is all about making the funds available at the right time in the right manner. If your client gets money before she needs it, then it may lie idle or may be diverted to non-priority goals. If she doesn’t get money when it is required the most, then her goal may remain unachieved. So, remember to match your client’s short-term goals with short-term investments and likewise.

Thus, if you hold your investments beyond the average maturity of a fund, you would lose on your returns.

Final Words

In a nutshell, longer the average maturity, the higher the risk associated with a bond fund and, consequently, higher the volatility. So, while shortlisting debt funds for clients, you need to consider their investment horizon as the starting point and align it with the average maturity of the fund to ensure that it is in line with your client’s time horizon and risk profile.

Kishorkumar Balpalli is the Founder of MyMoneysage which provides technology solutions to advisers.

The views expressed in this article are solely of the author and do not necessarily reflect the views of Cafemutual.