Laced with intrigue, hinting at machinations conspiracies theories are irresistible. Their creditability particularly increases when the person propagating it is part of the system. One such theory floating in mutual fund industry since times immemorial talks about how mutual funds manipulate NAVs. We tend to hear this when markets rise in the month of March and more so if there is a sudden spike in markets in the last week of March.

This year when the markets unexpectedly started rising in the beginning of last week of March the conspiracy theorists had a blast. However, the ensuing correction in market turned the entire theory upside down.

In this article, using publicly available data I have tried to analyze whether the theory holds any merit.

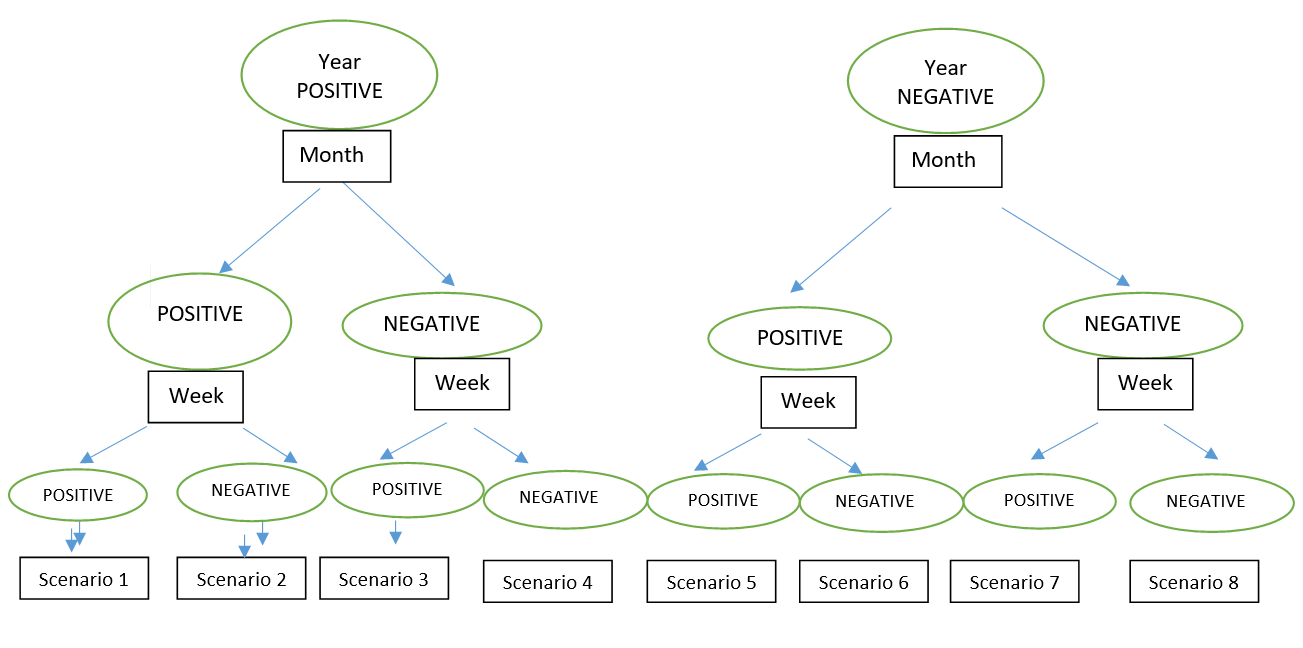

The below chart, analyses returns of last 18 financial years. The annual returns have been bifurcated as returns for the month of March and returns generated during the last week of the March each year.

As explained in the above chart, there are eight potential scenarios.

The below table assigns financial years to above-mentioned scenarios and examines if there was possible NAV manipulation.

|

Various Scenarios |

Return for Financial Year |

Return for the month of March |

Return for the last week of March month |

Is NAV Manipulation possible |

Categorization of all the FY in various scenarios |

|

Scenario 1 |

Positive |

Positive |

Positive |

No |

2005-06,2009-10, 2010-11,2013-14, 2016-17 |

|

Scenario 2 |

Positive |

Positive |

Negative |

No |

2006-07 |

|

Scenario 3 |

Positive |

Negative |

Positive |

May be |

2003-04, 2004-05, 2007-08, 2012-13 |

|

Scenario 4 |

Positive |

Negative |

Negative |

No |

1999-00, 2014-15, 2017-18 |

|

Scenario 5 |

Negative |

Positive |

Positive |

Likely |

2008-09, 2015-16 |

|

Scenario 6 |

Negative |

Positive |

Negative |

No |

None |

|

Scenario 7 |

Negative |

Negative |

Positive |

Very Likely |

2011-12 |

|

Scenario 8 |

Negative |

Negative |

Negative |

No |

2000-01, 2001-02, 2002-03 |

Looking at the above table it is evident that NAV manipulation is possible when market rise in the last week of the March contrary to their performance during the month as well during the financial year. Carrying this assumption forward, I have calculated Nifty returns for the financial year,, for the month of March and for the last week of March. The below table summarizes the results.

I have highlighted in red the scenarios when returns in the last week of March deviate from the annual and/ or monthly returns.

|

Financial Year |

Return for Financial Year |

Return for the month of March |

Return for the last week of March month |

Scenario |

|

1999-00 |

41.78% |

-7.64% |

-2.62% |

Scenario 4 |

|

2000-01 |

-24.88% |

-15.04% |

-1.13% |

Scenario 8 |

|

2001-02 |

-1.62% |

-1.09% |

-0.78% |

Scenario 8 |

|

2002-03 |

-13.40% |

-8.01% |

-3.52% |

Scenario 8 |

|

2003-04 |

81.14% |

-1.58% |

4.72% |

Scenario 3 |

|

2004-05 |

14.89% |

-3.21% |

1.00% |

Scenario 3 |

|

2005-06 |

67.15% |

10.66% |

3.74% |

Scenario 1 |

|

2006-07 |

12.31% |

2.04% |

-1.02% |

Scenario 2 |

|

2007-08 |

23.89% |

-9.36% |

2.70% |

Scenario 3 |

|

2008-09 |

-36.19% |

9.31% |

2.80% |

Scenario 5 |

|

2009-10 |

73.76% |

6.64% |

0.46% |

Scenario 1 |

|

2010-11 |

11.14% |

9.38% |

5.64% |

Scenario 1 |

|

2011-12 |

-9.23% |

-1.66% |

0.33% |

Scenario 7 |

|

2012-13 |

7.31% |

-0.18% |

0.86% |

Scenario 3 |

|

2013-14 |

17.98% |

6.81% |

1.83% |

Scenario 1 |

|

2014-15 |

26.65% |

-4.62% |

-0.61% |

Scenario 4 |

|

2015-16 |

-8.86% |

10.75% |

0.28% |

Scenario 5 |

|

2016-17 |

18.55% |

3.31% |

0.72% |

Scenario 1 |

|

2017-18 |

10.25% |

-3.61% |

-0.01% |

Scenario 4 |

Thus, extrapolating from the above data we realize that holdings during years 2003-4, 2004-5, 2007-08, 2008-09, 2011-12, 2012-13 and year 2015-16 need to be examined to understand if there was any manipulation. In case funds are, purchasing stocks in the last month and week of the year to shore up prices it should be visible in their cash holdings. Let us look at cash holdings at the end of February and March in each of these years. If funds are buying more equity in last month and week of the market then naturally their cash holdings should decline in the March as compared with February end cash holding.

Examining the cash holdings in February and March from the financial year 2003-04 we realize that that except for the year 2008-09, 2009-10, 2012-13, 2014-15 and 2015-16 every year cash holding at the end of March was higher than cash holding in February end.

|

Financial Year |

Cash holdings in MF scheme (Rs. Crores) |

|

|

Feb end |

Mar end |

|

|

2003-04 |

559 |

650 |

|

2004-05 |

262 |

362 |

|

2005-06 |

746 |

797 |

|

2006-07 |

2,063 |

2,166 |

|

2007-08 |

2,474 |

3,145 |

|

2008-09 |

3,945 |

3,656 |

|

2009-10 |

2,631 |

2,372 |

|

2010-11 |

1,263 |

2,646 |

|

2011-12 |

878 |

870 |

|

2012-13 |

1,748 |

1,604 |

|

2013-14 |

1,650 |

2,111 |

|

2014-15 |

3,546 |

3,300 |

|

2015-16 |

3,397 |

3,162 |

|

2016-17 |

5,992 |

6,157 |

|

2017-18 |

12,216 |

|

Even in years when cash holding at March end fell below February end cash holding, the difference is too miniscule for it to have any meaningful impact.

The conclusion

Mutual funds have seen astronomical cash flow in the last two years. However, during both these years, the performance in March was below the annual performance and the cash holdings in March were lower than the February end cash position in schemes.

Thus, based on the factual data, I am of the opinion that mutual funds do not resort to NAV management.

Vijay Mantri is Co-Promoter and Chief Mentor of Buckfast Financial Advisory Services. He was former CEO of Pramerica MF and Deutsche MF. He had also worked with HDFC MF and Aditya Birla Group.

The views expressed in this article are solely of the author and do not necessarily reflect the views of Cafemutual.