I have been in the financial distribution business for 30 years. My experience has taught me that keeping records of clients and their business and following well-defined processes not only help grow your business, these practices also prove useful in complying with key industry norms like due diligence.

At the end of a financial year, many advisors are expected to comply with due diligence norms. Though I do not have expertise in advising on how to comply with due diligence norms, I have made a checklist for advisors based on my experience that I hope will help you with this requirement.

Let us first see the records you are required to keep.

Ensure that you have maintained key business records such as leases, contracts, payroll and personnel records, and a range of accounting and financial information, such as invoices, receipts, payables and inventory.

Similarly, you should keep records of details of clients such as name, address, date of birth, place of birth, family members’ details, marriage anniversary, family income, PAN, Aadhaar number and bank account details. However, you have to ensure that you have taken the clients’ consent to keep such confidential records. One way to do it is to take confirmation in writing or in an email.

Another key record that you need to maintain is details of investment and insurance portfolio of clients. You can offer services such as reminder on premium due, assisting clients on investment of maturity proceeds, product information and wish them on birthday, anniversary, compliment them on life events such as acquisition of house, new car and new job. This will have dual benefits: strengthen your relationship with existing clients and help you keep crucial records for due diligence.

Now, let us look at the key documents that you need to maintain.

Act in the best interest of your clients by maintaining documents on their risk appetite and product suitability.

Share rationale for products you recommended. The aim is to maintain documents that prove your advice is appropriate to your clients. This also reflect that you have put the interest of your clients first.

Keep these documents for at least seven years. Ensure that you have kept a scanned copy on your desktop or cloud.

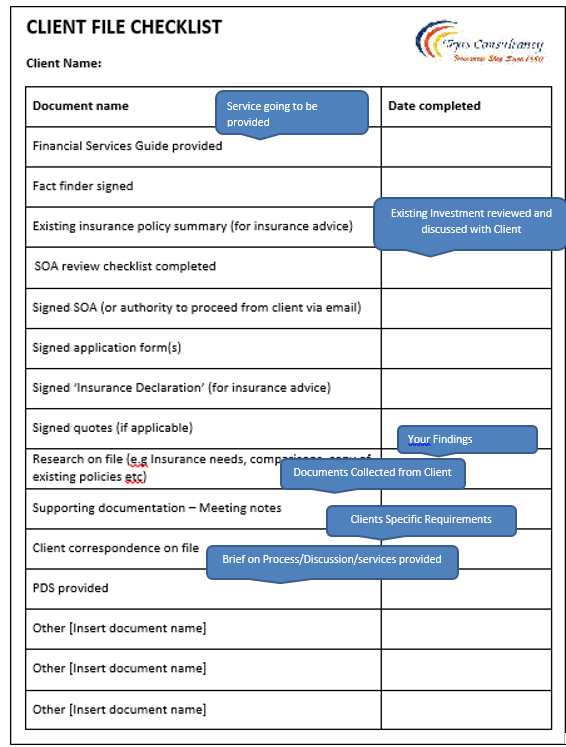

One of the easiest ways to ensure that you have kept all relevant records and documents in place is to use a checklist. Here is a checklist that you can make to keep records and documents for due diligence.

In our initial days, we used to staple this checklist inside the file meant for records and documents for due diligence. However, with digitalisation, keeping records and documents has become simpler and easily accessible.

In addition, you can maintain a source document i.e. a document from which you have sourced information. For instance, keep a copy of the application form every time your clients execute transactions.

Finally, there is no harm in consulting professionals with tax expertise. In my view, keeping all the relevant records such as ITR returns, balance sheets and expense details can be fruitful.

Mumbai based Ritesh Sheth is the co-founder of Tejas Consultancy. Ritesh has taken his family business to new heights through very energetic and innovative marketing. Today he manages over 400 crore for 7000 folios.