After September 2019 saw outflows in several categories of debt mutual funds due to advance tax obligations and elevated credit risk environment, inflows were reported in the month of October 2019.

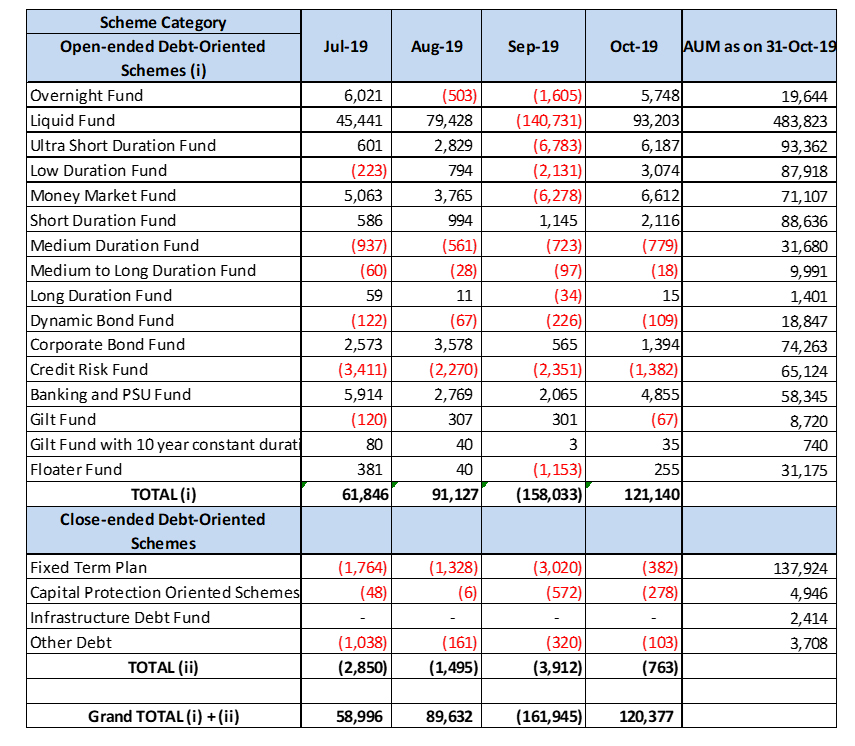

Table 1: Outflow/inflow of open-ended and close-ended debt funds (Rs in crore)

(Source: ACE MF)

The key reason for the renewed interest in debt mutual funds was the prevalence of comfortable liquidity condition and its favourable effect on bond yields.

Liquidity was largely in surplus and it was allowed to remain that way by the Reserve Bank of India (RBI) recognising the economic slowdown and inefficient transmission of policy rates.

The bond yields, as a result, benefited from the liquidity conditions, particularly the short-term corporate bonds. The 10-yr G-Sec yield reduced by 5 basis points (bps) in October 2019.

Besides, given the fact that interest rates have gone down pursuant to policy repo rate cuts by RBI, investors looked at alternative avenues while allocating money to debt. They are now deploying money in debt mutual funds to clock a slightly better rate of return than bank FDs and other small savings schemes.

Table 2: How have debt mutual funds fared?

|

Debt Scheme Category |

Returns (%) |

||||

|

1 Week |

1 Month |

3 Months |

6 Months |

1 Year |

|

|

Category Average of Banking & PSU Debt Funds |

0.1 |

1.1 |

2.2 |

6.4 |

11.2 |

|

Category Average of Corporate Bond Funds |

0.1 |

1.0 |

1.7 |

2.4 |

7.1 |

|

Category Average of Credit Risk Funds |

0.1 |

0.6 |

0.8 |

-1.2 |

2.0 |

|

Category Average of Dynamic Bond Funds |

0.0 |

0.7 |

1.3 |

5.0 |

9.7 |

|

Category Average of Floating Rate Funds |

0.1 |

0.7 |

2.0 |

4.7 |

9.4 |

|

Category Average of Gilt Funds |

-0.1 |

0.5 |

0.7 |

7.8 |

13.9 |

|

Category Average of Long Duration Funds |

-0.1 |

0.6 |

-0.4 |

8.7 |

16.4 |

|

Category Average of Medium-to-long Duration Funds |

0.0 |

0.3 |

0.8 |

5.1 |

9.8 |

|

Category Average of Medium Duration Funds |

0.1 |

0.8 |

1.3 |

2.5 |

6.3 |

|

Category Average of Low Duration Funds |

0.1 |

0.6 |

1.2 |

-0.6 |

3.6 |

|

Category Average of Short Duration Funds |

0.1 |

0.7 |

1.4 |

1.8 |

6.3 |

|

Category Average of Ultra Short Duration Funds |

0.1 |

0.5 |

1.8 |

3.6 |

7.4 |

|

Category Average of Liquid Funds |

0.1 |

0.4 |

1.4 |

3.0 |

6.7 |

|

Category Average of Money Market Funds |

0.1 |

0.6 |

1.9 |

4.2 |

8.4 |

|

Category Average of Overnight Funds |

0.1 |

0.4 |

1.3 |

2.7 |

5.9 |

Data as of November 13, 2019, and the returns presented are point-to-point on an absolute basis

(Source: ACE MF)

With most of the rally at the longer end of the yield curve already coming about since the time RBI started reducing policy rates, debt mutual funds with exposure to the longer end of the yield curve, i.e. medium-to-long duration funds, long-duration funds, and gilt funds have delivered good returns in the last one year (see table 2).

Money flows now in the medium-to-long duration, long duration, and the gilt fund category has been either very thin positive or negative (see table 1). This means perhaps investors are wary of taking exposure to the longer end of the yield curve and rightly so.

In contrast, the money flow into low duration funds, short duration funds, ultra-short duration funds, liquid funds, money market funds, and overnight funds have turned positive indicating that investors are deploying hard-earning in the shorter end of the yield curve.

Assessing the credit risk, investors, in general, seem to be staying away from credit risk funds. Also, since the IL&FS crisis broke out, the total mutual fund assets in Non-Banking Financial Companies (NBFCs) has dropped by 30% to Rs 1.86 trillion as of October 2019, according to CARE Ratings. And investments in commercial papers (CPs) of NBFCs have been on a consistent decline. Debt fund managers are now paying attention to the quality of debt papers –––mainly looking at ‘AAA’ and ‘AA’ ones–––after having learnt a lesson in the heightened credit risk environment.

How to approach debt mutual funds now?

It appears that we are in the last leg of the policy rate cut cycle. The RBI has, so far, reduced repo rates by good 135 bps since February 2019 to support growth, plus adopted an ‘accommodative stance’ since the 2nd bi-monthly monetary policy statement for 2019-20 held in June.

The future course of policy rate actions will, of course, depend on the incoming data points, mainly the CPI inflation. CPI inflation reading for October 2019 has come in 4.62% (16-month high) mainly due to high food prices, shows the data released by the Ministry of Statistics and Program Implementation in November 2019.

The data, of course, breaches the RBI’s comfort range. But what is consoling is that the ‘core inflation’, which excludes food and fuel prices, has eased to 3.44% reflecting the weakness in the economy. Hence, when the six-member Monetary Policy Committee of RBI meets again in December 2019 (the 5th bi-monthly monetary policy statement for 2019-20), we can expect a 25 bps policy rate cut ---pushing the policy repo rate to 4.90%. But beyond that, the RBI may also be compelled to look at the interest of depositors.

Therefore, investors will be better off deploying their hard-earned money in shorter duration debt mutual funds. But financial advisors need to ensure that their clients approach even short-term debt funds with eyes wide open and pay attention to the portfolio characteristics and quality of the scheme.

In this environment, give preference to the safety of principal over returns. Stick to debt mutual funds where the fund manager doesn't chase returns by taking higher credit risk. Further, assess the risk appetite and investment time horizon of your client while recommending debt funds.

While investing in shorter duration debt funds, consider keeping an investment horizon of at least 2-3 years. If the investor has an investment horizon of 6 to 12 months, ultra-short duration or low duration funds may be suitable.

And if she has an extreme short-term time horizon (of 3 to 6 months), consider liquid funds with high-quality debt papers. They should not have high exposure to commercial papers issued by private entities. Alternatively, if the investor/client wishes to park in a much safer category, recommend overnight funds to her.

Investors should stay away from longer duration debt funds and gilt funds now as most of the rally already has come about at the longer end of the yield curve.

Finaaly, a word of caution - you should help your clients recognise that investing in debt funds is not risk-free.

Jimmy Patel is the CEO of Quantum Mutual Fund.

The views expressed in this article are solely of the author and do not necessarily reflect the views of Cafemutual.