In today’s times, when you sit down to do your clients’ investment allocation, you are hard pressed for choice.

- Equity markets are volatile. Though the market has recovered from the bottom touched in March, it has run ahead of fundamentals and another round of correction is possible.

- In the debt market, the rally has happened. Portfolio yield of debt mutual funds are on the lower side. Yields on tax-free PSU bonds are less than 4.5%. Bank FD rates have dipped; SBI 1-year deposit rate is 5.1%.

- Real estate appreciation would be difficult as economic recovery would be slow.

- Gold has given handsome returns in the recent past, but there is no guarantee how much it would yield from these levels.

- Commodities are specialized investments, not easily accessible to all investors.

In this situation, can we offer a product that cuts through all the uncertainties, gives our clients a guarantee onreturns and a handsome return?Let us look at the most common options in the market today:

|

Product |

Return expectation |

Taxation |

Remarks |

|

Equity |

On the higher side, but highly volatile |

Holding period more than 1 year, 10% |

Allocate for long term only |

|

Debt MF |

6% to 7% |

Holding period more than 3 years, 20% after indexation |

Funds for all horizons |

|

Tax-free PSU bonds |

Post rally, yields are less than 4.5% |

Coupons are tax-free |

Safe |

|

Bank deposits |

Interest rates have come down |

Marginal rate, 30% plus surcharge and cess |

SBI 1-year 5.1%. Other banks may offer higher rates, but if rates are too high, safety is a question |

|

Gold |

Moderate over long term, high in times of uncertainty |

SGB tax-free if held till maturity, MFs taxed like debt |

Suitable only for a small allocation |

|

Real estate |

Low, due to challenges on the economy |

Holding period more than 2 years, 20% with indexation |

Illiquid |

|

Guaranteed income/return products |

High returns, known upfront |

Maturity exempt under Section 10(10D) provided sum assured is 10 times of premium per year. Plus, you get tax benefit on investments U/s 80C |

Lock-in the returns, known upfront. You also knowthe time horizon to invest, hence plan accordingly |

As you can see, guaranteed-return insurance products score well in all regards. Moreover,IRDAIlooks at the solvency margin of the insurance company and ensures they maintain it at adequate level.

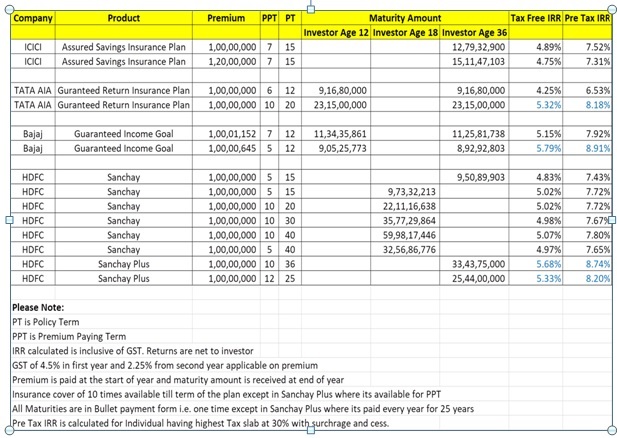

While there are multiple products available, we highlight a few select ones.

Explanation

The premium amount is taken for illustration purposes. For explanation purposes, let us say your clients contribute Rs.1 crore per year in ICICI Assured Savings Investment Plan for 7 years, which is referred to as the premium paying term (PPT). The amount of money they pay is Rs 1 crorex 7 = Rs 7 crore.

Though they pay premium for 7 years, the policy term (PT) is 15 years. That is, they lock in today’s returns for 15 years and if returns go down in future, as interest rates are coming down, theywill not be impacted.

At the end of 15 years, their fund value will be Rs12.79 crore. On top of it, they get insurance coverage of 10 times or more.

The tax-free rate of return is 4.89% annualized. This has been grossed up in the adjacent column (7.52%) for comparison purposes as other avenues like bank deposits are taxable. The rate used for grossing up the return is for individuals at a higher tax bracket, 30% plus surcharge and cess.

The products with relatively higher returns are Bajaj Guaranteed Income Goal (GIG) 5.79% / 8.91%, HDFC Sanchay Plus 5.68% / 8.74%, Tata AIA Guaranteed Return Insurance Plan offering 5.32% / 8.18%. (Post tax returns/pre tax returns)

Returns shown are net of all expenses.

Comparison with tax-free PSU bonds

|

|

Insurance tax-free |

Tax-free PSU bond |

Uptick per year |

|

ICICI Assured Savings Insurance Plan |

4.89% |

4.4% |

0.49% |

|

Tata AIA Guaranteed Return Insurance Plan |

5.32% |

4.4% |

0.92% |

|

Bajaj Guaranteed Income Goal |

5.79% |

4.4% |

1.39% |

|

HDFC Sanchay Plus |

5.68% |

4.4% |

1.28% |

The uptick per year compounds over the period of the product, which is the policy term of 12 to 40 years.

Conclusion

We position guaranteed insurance products over debt mutual fund products and direct bonds, over the requisite horizon. For shorter investment horizon, we recommend debt mutual fund products.

Deepak Jaggi is Co-founder and Managing Director at Satco Wealth Managers.The views expressed in this article are solely of the author and do not necessarily reflect the views of Cafemutual.