For ages, Indian parents have been giving lump sum money to their daughters as ‘streedhan’. While the court of law has clarified that daughters are entitled to receive share in family’s wealth, many people still believe that married daughters do not deserve share in parent’s property as they receive ‘streedhan’.

However, instead of giving ‘streedhan’ or even after giving ‘streedhan’ that typically goes to husband and in-laws, parents should provide for financial coverage or income flows to married daughters especially those who are homemakers.  Since they do not have income of their own, they are dependent on their husband for household expenditures and money for their own personal use.

Since they do not have income of their own, they are dependent on their husband for household expenditures and money for their own personal use.

In addition, it is observed that the earning woman gets more respect in her new home. It is precisely to ensure continuous respect for the married daughter that parents must plan a regular income plan.

MFDs should consider recommending guaranteed income schemes offered by insurance companies to meet cash flow requirement of married daughters. Such schemes come with lock-in and hence, the husband or the family cannot influence her to withdraw the amount early. Also, pre-defined cash flows for long term ensure that the daughters continue to get respect.

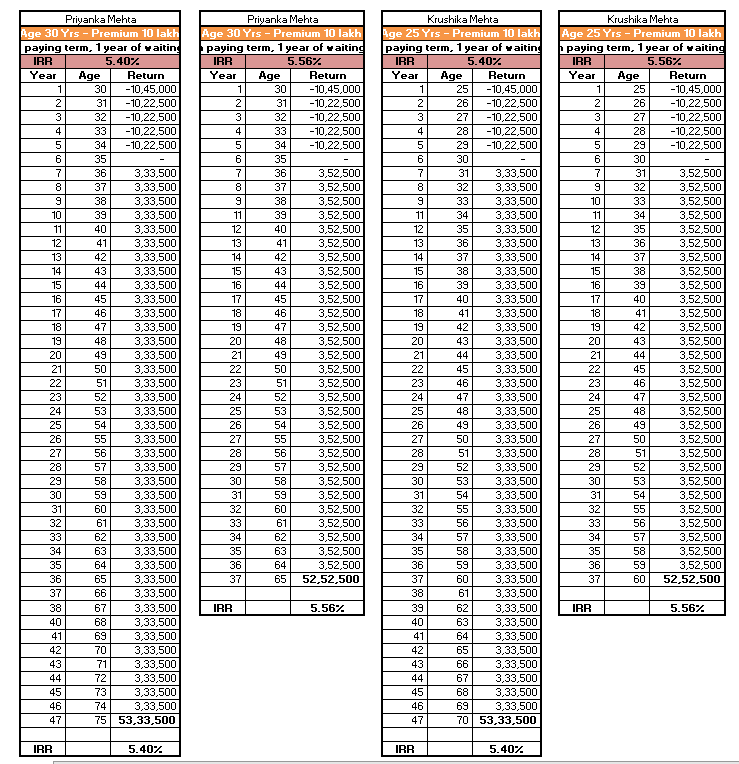

In these products, the parent is the proposer of the insurance policy and the daughter can be the life assured. The parent can contribute for 5 or 10 years and income flows to the daughter for 25 to 40 years. If a daughter dies during premium paying term (the initial 5 or 10 years), insurer pays 10 times of annualized premium to proposer. The best part of this product is that it offers certainty in cash flows.

The other advantages of these insurance company policies are:

- Tax efficiency: Annuity cash flows are tax-free. Other investment products like government securities, corporate bonds, mutual fund schemes are taxable

- Regular income: While there are products like annuity products that offer regular income, it ends with death of the beneficiary in most cases. A guaranteed income product offers cash flow of 30-40 years

- Attractive returns: These funds offer tax free returns of 5.4% and 5.6%

Deepak Jaggi is Co-founder and Managing Director of Satco Wealth. You can write to him at deepak.jaggi@satcowealth.com.