Performance of mutual funds is more commonly discussed across media and is publicly available. However, the performance figures of PMS products are not available in public domain.

Based on pmsbazaar.com data as on August 31, 2021 that tracks performance of 266 PMS strategies, I have tried to give you a gist of the performance numbers of PMS.

Overall

Of the 266 PMSs, 42 funds have track record of more than 10 years. While inception dates of these PMSs are different, it would not be an apple to apple comparison. However, the best performing PMSs are Bonanza Growth Fund with a CAGR of 23.5% and inception date April 2010 and Care Portfolio Managers - Growth Plus Value with inception date July 2011and CAGR of 23.4%.

5-year performance

100 schemes have track record of 5 years or more. The category average CAGR of funds with 5 year track record is 14.89%. For benchmarking purposes, Nifty500 Index, from Aug 2016 to Aug 2021, has delivered a CAGR of 14.21%.

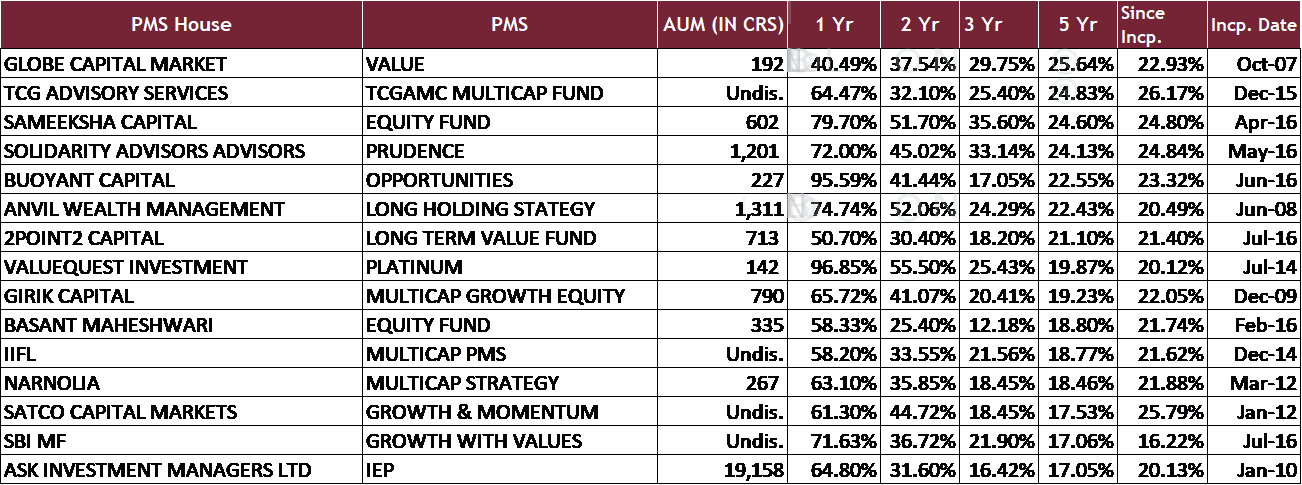

Of these 100 schemes, 52 schemes have outperformed Nifty 500 Index. The best performer among them are - Globe Capital Market - Value Fund with 5-year CAGR of 25.64%, Unifi Capital APJ - 20 with 25.06% and TCG Advisory Services - TCGAMC Multicap Fund with 24.83%.

Multi-Cap strategies

Most PMS funds follow multi-cap strategy as it gives flexibility to fund managers. In the data set, 156 out of the total 266 are multi-cap funds. Of these 156 PMSs, 56 schemes have a track record of more than 5 years.

In this peer set of 56 funds, the average 5-year CAGR is 15.12% against Nifty500 Index CAGR of 14.21%. Number of funds that have outperformed benchmark is 32.

Top 15 Multi-Cap strategies on 5-year performance

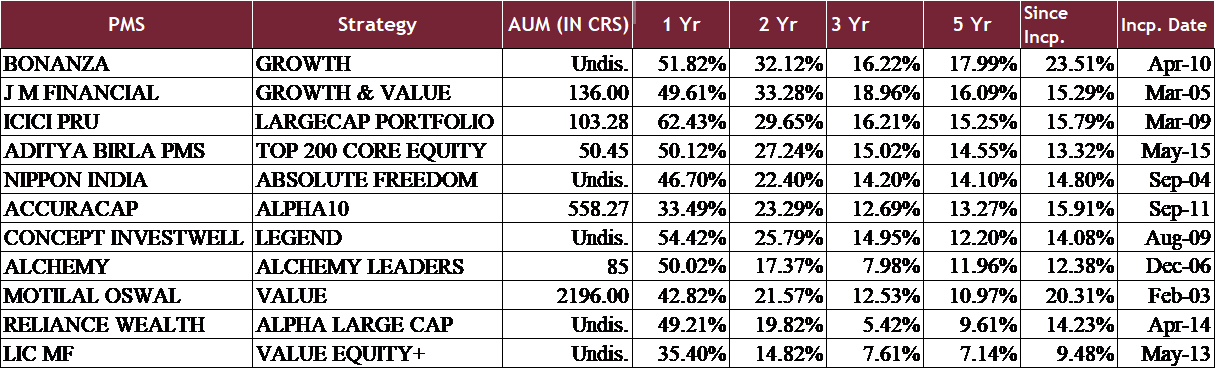

Pure large and large and mid cap strategies

There are 31schemes which are pure large cap and large and mid cap. Of these, 11 funds have track record of 5 years and more. The 5 year CAGR of these is 13.01%. Taking NiftyLargeMidCap250 as the benchmark, this category has underperformed the benchmark, which has delivered 5-year CAGR of 15.23%.

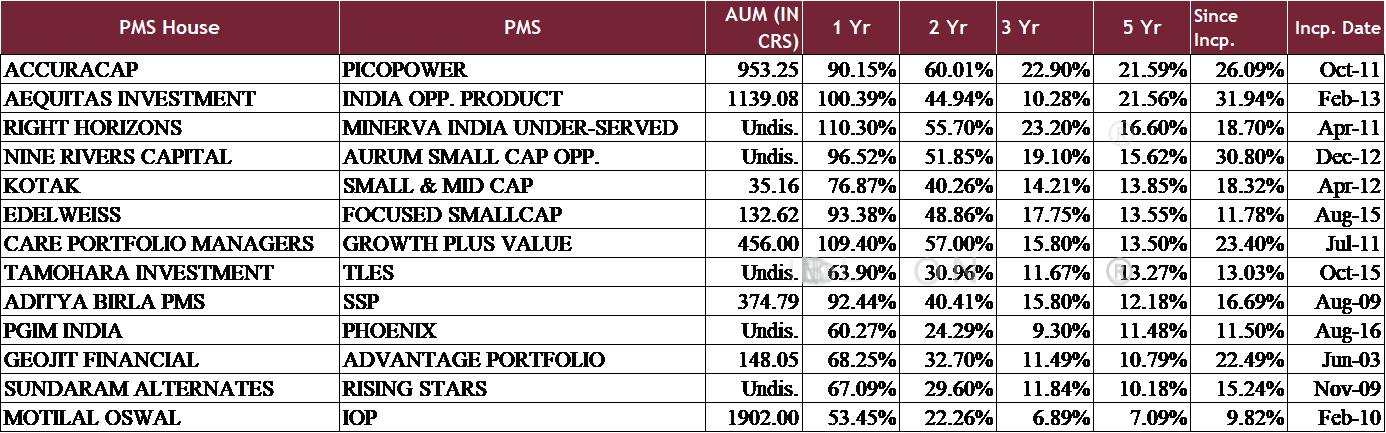

Small and small and mid cap strategies

In this set of small and small and mid cap funds, there are 33 funds, of which only 13 have a track record of 5 years. The average 5-year CAGR of these 13 funds is 13.94%. Compared to its benchmark Nifty MidSmlCap 400, this category has also underperformed as the benchmark has delivered 5-year CAGR of 14.96%.

Conclusion

On performance parameter, multi cap strategies have done better than the pureplay strategies like large or mid or small cap funds.

There are many new entrants in the PMS space in the recent past, say within the last 5 years. The market is expanding, there are new investors coming in. In the next phase of growth of the economy and markets, PMS as an offering is set to grow significantly.

Deepak Jaggi is Co-founder and Managing Director at Satco Wealth. He can be reached on deepak.jaggi@satcowealth.com