PMS industry has witnessed significant growth in assets under management and many new players have forayed into the PMS business.

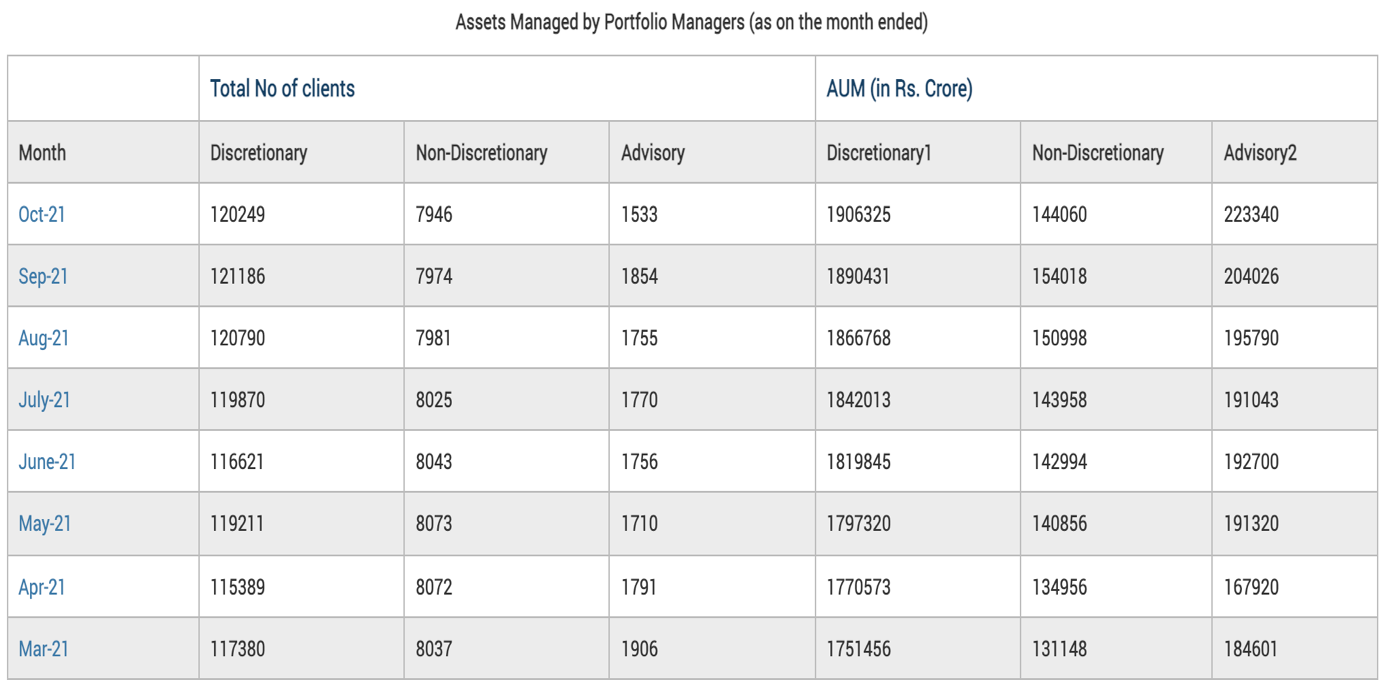

As on October 2021, the total AUM of the PMS industry was Rs 22.74 lakh crore, of which Rs 19.06 lakh crore was in Discretionary PMS, Rs 1.44 lakh crore in Non-Discretionary and Rs 2.23 lakh crore in Advisory. However, the major chunk of assets i.e. Rs 22.74 lakh crore has come from EPFO/PFs.

As on 31 March 2021, the AUM of the PMS industry was Rs 20.67 lakh crore. It was Rs.18.14 lakh crore and Rs.16.05 lakh crore industry in March 2020 and March 2019, respectively.

(Source: https://www.sebi.gov.in/statistics/assets-managed/assets-managed.html)

PMS performance

With the help of pmsbazaar.com, we have tracked performance of 265 PMS spread across various strategies like multi cap, large cap, small cap and so on. Of these categories, the most prevalent one is multi-cap with 153 funds.

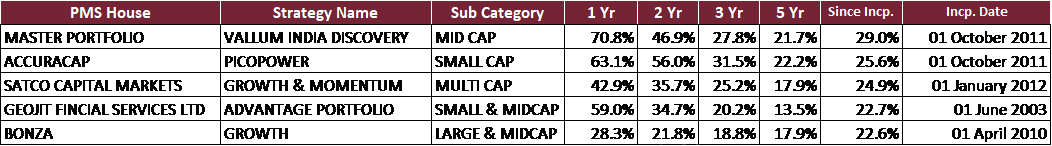

Number of funds that have completed more than 10 years of existence is only 49. We have taken data on performance since inception. Though it is not a fair comparison, as the dates of inception are different, it gives a perspective and more than 10 years is a long time i.e. data distortion would not be as much. Interestingly, the average performance of these funds was CAGR of 17.33% over the last 10 years.

On the other hand, Nifty 500 Index has delivered CAGR of 14.4% between November 2011 and November 2021. This indicates that many PMS have outperformed the broader benchmark in the10-year period.

In fact, Nifty500 has delivered 10.48% over the last years. During the same time frame, many PMSs have delivered CAGR of over 25%.

Top 5 PMS on 10-year performance

Multi-Cap strategies over 10 years

Most PMS funds run on a multi-cap strategy as that gives more flexibility to the fund manager. In our data set, 153 out of 265 are multi-cap strategies. Out of these 153, the number of funds with a track record of 10 years or longer is 29. We have taken this filter because for a meaningful comparison of performance, an adequate horizon is required. In this peer set of 29 funds, the average CAGR since inception is 17.85% against Nifty500 Index CAGR of 14.4% over 10 years.

Top 5 Multi-Cap strategies based on 10-year performance

Conclusion

The market is growing and there are many new entrants in the PMS space. There are new investors coming in, notwithstanding the higher ticket size than earlier. Performance has been decent, as we have discussed above. In the next phase of growth of the economy and markets, PMS as an offering is set to grow significantly along with mutual funds and AIFs. MFDs/RIAs should not miss this bus and start offering PMS to their HNI clients.

Deepak Jaggi is Co-founder and Managing Director of Satco Wealth. You can write to him at deepak.jaggi@satcowealth.com. The views expressed in this article are solely of the author and do not necessarily reflect the views of Cafemutual.