Unless we really manage to screw our economy very badly, interest rates generally move in cycles.

The revaluation of the portfolio of securities is actually a good thing for many reasons:

1) It is fair to new investors

While existing investors suffer, the revaluation of a portfolio provides new investors with an opportunity to invest and earn a fair market related return. Without revaluation new investors will suffer and existing investors would benefit. New investors will end up subsidizing existing investors. I’m sure none of us would like to be in such a situation.

This phenomenon can already be witnessed in liquid funds. Prior to July 15, liquid fund returns averaged about 8.0-8.5% per annum. After the fall in prices on July 16, returns started averaging about 10.0-10.5% per annum. This reflected the fact that yields in the money market had gone up by about 2% per annum. For new investors this provided an entry point to earn the higher return. If funds had not revalued (to avoid that negative one day return), new investors would still earn only 8-8.5% per annum.

This is a fundamental principle of any market mechanism and we should recognize its utility and fairness.

2) Interest rates do not rise (bond prices do not fall) indefinitely:

Unless we really manage to screw our economy very badly, interest rates generally move in cycles, meaning if they’re on the way up, they’re more than likely to reverse and start moving down. Conversely, if they’ve been moving down, they’re more likely to start moving up in the near future.

What this means is that, unlike equities, bond investments do not, generally, suffer from the “catching a falling knife” metaphor.

(Assumption: We’re considering only credit default free bonds. Prices of bonds issued by entities which default can fall continuously and even be worth nothing.)

3) Bond price movements actually become less sensitive at higher interest rates

Bond prices are most sensitive when interest rates are low - meaning, price changes can be large for even small changes in interest rates. However once interest rates have risen, this sensitivity goes down.

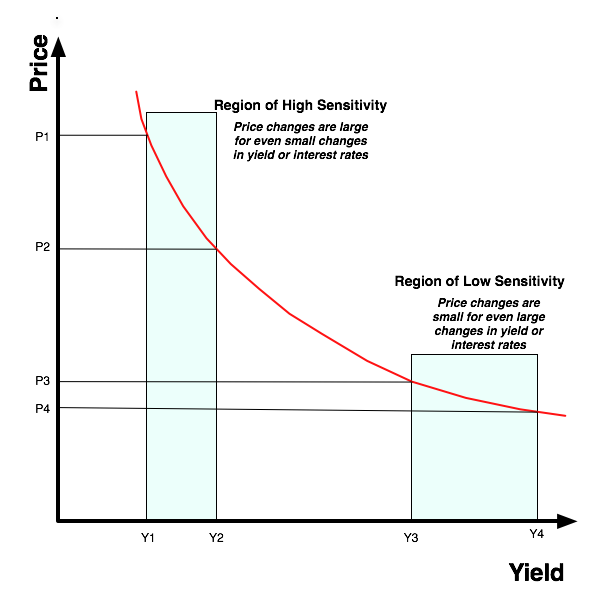

This is better understood visually. The chart below depicts the price behaviour of a typical bond for different levels of yield.

(This is the general shape of the price yield curve of all option free bonds. The curve is downward sloping convex to the origin. While some bonds will display a more convex shape others may show a lesser convex shape. Higher convexity is a desirable feature in bonds).

Looking at the graph one can infer that prices movements are larger (P1 to P2) even for small yield changes (Y1 to Y2) when the absolute yield levels are low. Price changes are smaller (P3 to P4) even for a larger change in yield (Y3 to Y4) at higher levels of yield.

In effect, once you invest at higher interest rates, the price risk that you take is much lower compared to the price risk that you take when you invest at lower interest rates, even if the portfolio of bonds remain identical.

This alone should dispel any doubts about investing in bonds or bond funds when yields have risen sharply and are likely to remain high only for a relatively short period of time. Conversely, if yields have fallen and are unlikely to sustain the fall, that is the time to start getting worried about your bond or bond fund investments.

The reality is when yields fall the positive price changes inflate our return. This manifests in complacency at the very time that caution is advisable. On the other hand, when yields have risen and are likely to fall sometime in the near future, it is possibly the best time to invest in bonds and bond funds with greater enthusiasm.

Dheeraj Singh was the Head, Fixed Income at IL&FS Mutual Fund before it was taken over by UTI Mutual Fund. Prior to this, he was heading the fixed income desk at Sundaram BNP Paribas Mutual Fund (now Sundaram Mutual Fund).

The views expressed in this article are solely of the author and do not necessarily reflect the views of Cafemutual.

Investing in bond funds: What you actually need to know? – Part I