The investment management

industry is based on the premise that smart, hard-working managers with

cutting-edge technology can outperform “the market.” These active managers

strive to outperform by trading stocks or other securities in order to capture

the best investment opportunities at any point in time. Although it seems

intuitive that this approach would produce positive results, the evidence

indicates differently.

The investment management

industry is based on the premise that smart, hard-working managers with

cutting-edge technology can outperform “the market.” These active managers

strive to outperform by trading stocks or other securities in order to capture

the best investment opportunities at any point in time. Although it seems

intuitive that this approach would produce positive results, the evidence

indicates differently.

The problem is that all of

the required ingredients for outperformance are expensive. Smart portfolio

managers and analysts don’t come cheap. Cutting-edge technology is also not

cheap. Thus, the hurdle for active managers to achieve outperformance rises

substantially. Just to break even after costs, they have to outperform

significantly on a gross-of-fees basis. A high level of trading activity, which

is characteristic of most actively managed funds, can also result in

significant tax expense. Combined, investment-related costs and taxes can

consume half of your return if not managed properly.

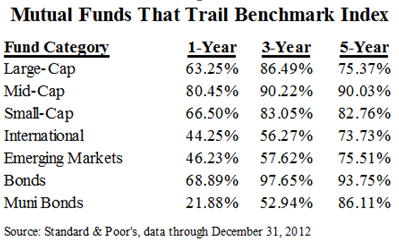

The evidence of these “frictions” is pervasive. Standard & Poor’s recently

updated its biannual study of actively managed mutual fund performance. The

table shows the results. Over shorter periods, the odds of a mutual fund

outperforming its benchmark index are reasonable, although less than 50% in

most asset classes. Over longer periods, however, there are very few mutual

funds that provide returns in excess of what you could earn with index mutual

funds (which generally charge very low fees and are quite tax efficient).

Although there are always some active funds that outperform, past winners are

statistically unlikely to repeat in the future, making the job of finding truly

stellar fund managers exceedingly difficult. This also renders past performance

all but useless when looking for fund managers that will outperform in the

future. Studies showing similar results can be found with data going back to

1927.

Where does that leave us? Well, there are some strategies that have proven to be effective in the investment world. They are all very basic, commonsense strategies, but interestingly, many are largely ignored by the professional fund managers.

Asset Allocation

The first step is finding the right mix of risk and return for your unique investment objectives. You have to get the right asset allocation, or mix of risky and more stable investments. A portfolio that is too aggressive can cause great anxiety, but one that is too conservative may not meet your long-term goals. A balanced approach is necessary, and both financial and psychological factors should be considered.

Long-Term Approach

Staying in the market is also important. Trading in and out of the market can result in higher costs (in the form of commissions and bid–ask spreads), higher taxes (for realized capital gains), and the opportunity for emotional decisions to take over and impair long-term wealth creation. For example, selling out of the market during bear markets and buying in during bull rallies is a comfortable approach, but it is the opposite of what is likely to be financially rewarding. A study by finance professors Terrance Odean and Brad M. Barber showed that less frequent trading can have a meaningful impact on performance. They found that low-frequency traders can outperform high-frequency traders by up to 6.8% annually.

Diversification

Spreading your risk across a number of different asset classes (such as stocks, bonds, cash, real estate, or commodities), subclasses (such as domestic stocks, international stocks, large-cap stocks, or small-cap stocks), and securities is essential to reducing risk and building an efficient portfolio. It also helps protect against a downturn in any one asset class and allows you to stay the course during difficult market cycles.

Low Costs

Keeping investment costs to a bare minimum helps you keep more of your return. These costs include investment management fees, trading costs, commissions, mutual fund expense ratios, and potentially others. In his paper “The Arithmetic of Active Management” and a recent follow-up piece “The Arithmetic of Investment Expenses”, Nobel Prize winner William F. Sharpe showed that added costs all but guarantee that investors will trail the market.

Tax Management

Taxes can be the single largest expense if left unchecked. Fortunately, there are strategies to manage the tax bite. For example, you can put investments that pay income that is taxed at ordinary income rates, such as bonds and REITs, into retirement accounts. You can also use low turnover strategies so that realized capital gains are kept to a minimum. Finally, you can harvest tax losses, when available, to use against current or future realized capital gains.

What do you do?

Although there is no “silver bullet” in the investment world that guarantees a successful investment experience, these commonsense strategies go a long way toward helping regular investors meet their long-term objectives. While it is possible for some actively managed funds to incorporate these strategies and provide solid returns, it is rare to find them in the real world. Index funds offer a convenient vehicle for many of the strategies discussed above, and they are easy to purchase and manage.

© 2013 CFA Institute. First appeared in Inside Investing http://blogs.cfainstitute.org/insideinvesting/

The views expressed in this article are solely of the author and do not necessarily reflect the views of Cafemutual.