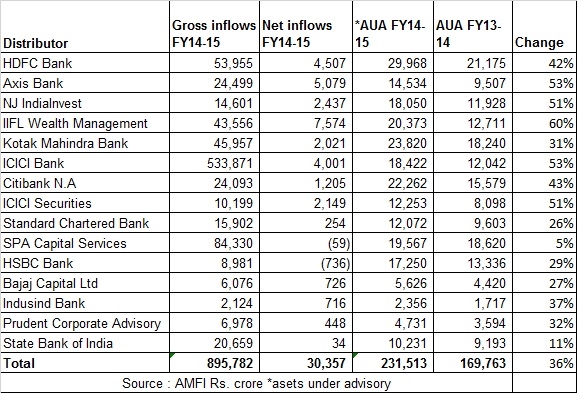

HDFC Bank managed assets under advisory of Rs. 29,968 crore as on March 2015.

HDFC Bank emerged as the largest MF distributor with assets under advisory (AUA) of Rs. 29,968 crore. Its AUA increased from Rs. 21,175 crore in FY13-14 to Rs. 29,968 crore in FY2014-15, a growth of 42%, shows AMFI data.

HDFC bank clocked gross sales of Rs. 53,955 crore (third largest among top 15 distributors) while the net inflows or sales stood at Rs. 4,507 crore.

Kotak Mahindra Bank and IIFL Wealth Management were the second and third largest MF distributors with AUA of Rs. 23,820 crore and Rs. 20,373 crore respectively.

The highest growth (in percentage terms) was recorded by IIFL Wealth Management. It’s AUA increased by 60% from Rs. 12,711 crore in March 2014 to Rs. 20,373 crore in March 2015. Thanks to mark to market gains and healthy sales, all the top 15 distributors saw double digit growth in their AUA.

Gross sales

If you look at the gross sales figures, ICICI Bank had the highest gross sales at Rs. 5.33 lakh crore. (Some distributors say that the data published on AMFI could be erroneous) However, its net sales were much less at Rs. 4,001 crore.

Similarly, Delhi based SPA Capital clocked the second highest gross sales at Rs. 84,330 crore. However, its net sales were negative Rs. 59 crore. Kotak Mahindra Bank and IIFL Wealth Management clocked the fourth and fifth largest gross sales at Rs. 45,957 crore and Rs. 43,556 crore respectively.

Among the top 15 distributors, only SPA Capital and HSBC Bank saw negative net sales. HSBC Bank’s net sales were negative Rs. 736 crore. The top 15 distributors collectively clocked gross sales of Rs. 8.95 lakh crore.

“Large distributors manage a lot of liquid money. The low net sales could be due to liquid fund outflows,” says a Mumbai based distributor.

Net sales

IIFL Wealth Management clocked the highest net sales at Rs. 7,574 crore. Axis Bank and HDFC Bank saw the second and third highest net sales at Rs. 5,079 crore and Rs. 4,507 crore respectively.

The top 15 distributors collectively manage 19% or Rs. 2.31 lakh crore assets under advisory of the total Rs. 12 lakh crore AUM of the industry as on March 2015. Together, these top 15 distributors accounted for 29% or Rs. 30,357 crore of the total Rs. 1.03 lakh crore net inflows received by the industry in FY14-15.