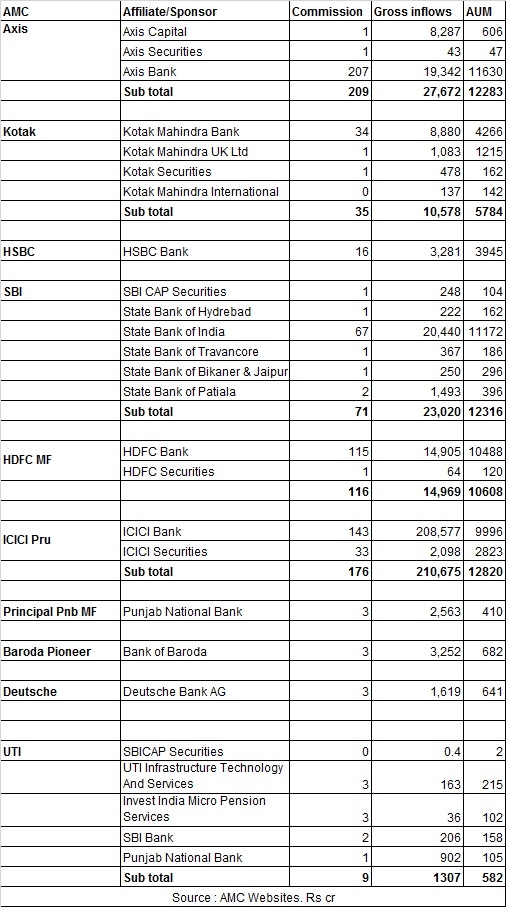

An analysis of the FY2014-15 sales contribution from sponsors in selling their own AMC schemes shows that a few fund houses are heavily dependent on their sponsors, especially bank sponsored AMCs.

Some fund houses like HSBC MF and Axis MF got the highest share of business coming from their sponsors.

HSBC MF paid Rs. 16 crore commission to HSBC Bank, the highest among all its distributors with the bank accounting for nearly 50% of the total HSBC MF AUM. Axis MF paid Rs. 207 crore commission to its sponsor Axis Bank which had AUA of Rs. 11,630 last fiscal, which is 41% of Axis MF’s total Rs. 28,365 crore AUM.

Fund houses like Franklin Templeton, IDFC and DSP BlackRock did not have any associate or sponsors selling its schemes.

While bank sponsored AMCs typically have an edge over others because they have an affiliate distribution arm, not all banks make a meaningful contribution to their AMCs.

UTI MF had the highest number of group and associate companies because of its wide ownership. However, their sales contribution was not very big. Although UTI has three banks as its sponsors – SBI, Punjab National Bank, Bank of Baroda they did not contribute much in terms of sales to UTI.

More than 15 AMCs had a sponsor of affiliate as a distributor. However, larger fund houses like Birla Sun Life and Reliance had less dependence on their sponsors. While Birla Sun Life’s sponsor and group companies were managing AUA of Rs. 4,586 crore, Reliance MF’s sponsors were managed an AUA of Rs. 1,484 crore.

Commission paid to sponsors in FY14-15