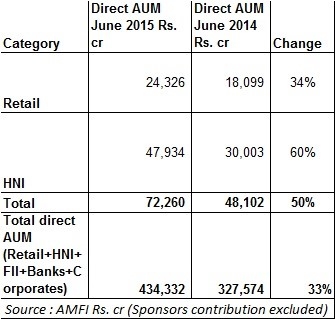

Retail assets in direct plans have increased to Rs. 24,326 crore (across all scheme categories) in June 2015, up 34% from Rs. 18,099 crore in June 2014, shows the latest AMFI data. A major chunk of the direct retail AUM is held in equity funds. Of the total Rs. 24,326 crore direct retail AUM, 64% or Rs. 15,497 crore is held in direct plans of equity funds.

The direct retail equity AUM has increased by 40% Rs. 11,047 crore in June 2014 to Rs. 15,497 crore in June 2015. This increase can be partly attributed to the mark to market gains as the Sensex rose 9% during the same period.

While direct retail assets have grown 34% from June 2014 to June 2015, it still constitutes a small portion of the overall assets of the industry. Of the total Rs. 12.64 lakh crore AUM of the industry as on June 2014, retail investors’ exposure to direct plans remains very low at 2% or Rs. 24,326 crore. The growth in percentage terms might appear higher because of the small base of direct AUM.

Direct plan AUM

HNIs

The direct plan HNI AUM also increased from Rs. 30,003 crore in June 2014 to Rs. 47,934 crore in June 2015. As compared to retail, the direct HNI AUM as a proportion of the overall industry assets stood higher at 4%.HNIs have invested Rs. 11,759 crore in direct plans of equity funds.

Overall

In addition to retail and HNI, if you take into account the contribution from corporates, FIIs and banks, direct plans account for 34% or Rs. 4.34 lakh crore of the total Rs. 12.64 lakh crore industry AUM as on June 2015. Corporates were the largest investors in direct plans of debt funds. Of the Rs. 4.34 lakh crore total direct plan AUM, corporates had invested Rs. 2.81 lakh crore in debt schemes while banks had invested Rs. 52,371 crore.

Excluding retail and HNI, banks and corporates have invested Rs. 17,158 crore in direct plans of equity funds.

The contribution from sponsors/associates in direct plans was excluded from this study.