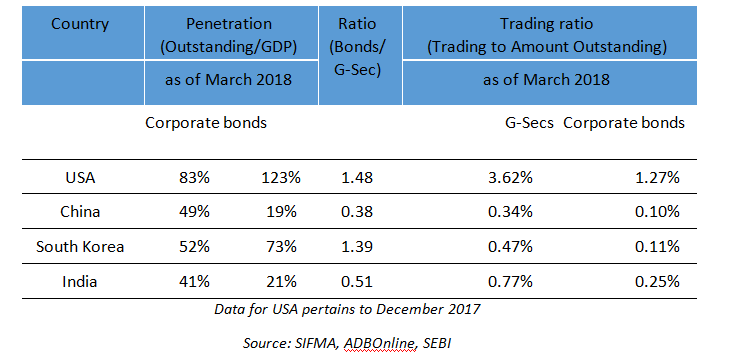

Indian debt market remains marginal compared with developed ones such as the US as banks are still are the preferred lenders of Indian corporates, says an AMFI-CRISIL report. In terms of G-sec penetration (G-sec issuances/GDP) US markets are twice as deep as India (41%). The situation is more severe if we look at corporate bond penetration. Here US stands at 123% compared to 21% in India.

Key metrics of Indian debt market versus global market

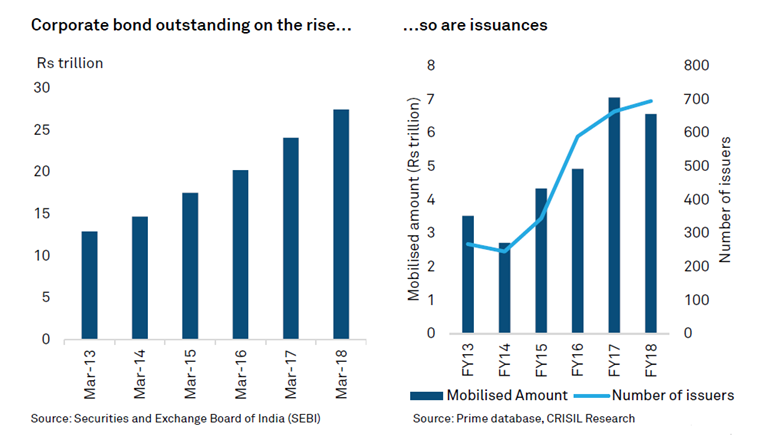

While the Indian debt market is underdeveloped compared to global peers, it has grown at an impressive 13% CAGR in the last five years, said the report. Regulatory reforms, improved demand-supply dynamics, robust growth of economy, and channelling of money from pension funds, insurance and mutual funds have been the key drivers of this growth.

In line with the growth data, corporate bond issuances doubled from Rs 3.5 lakh crore in FY 2013 to Rs 6.6 lakh crore in FY 2018. The number of issuers and the amount mobilised too recorded an increase during the period.

An analysis by CRISIL shows that India Inc would need a whopping Rs 56 lakh crore investment across infrastructure and industrial sectors in the next five years. With banks reeling under the pressure of NPAs, corporates would have to approach the bond market for funds.

The widening of debt markets provides debt investors with an attractive investment opportunity, according to the report. However, majority of investors do not have the wherewithal to invest in debt markets directly. Mutual funds, which are professionally managed and invest across the rating spectrum, are an ideal avenue for investors to take part in the growth in India’s debt market.