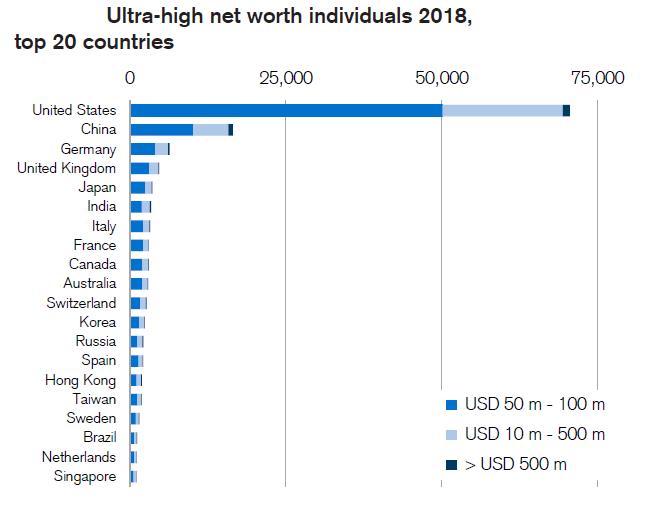

A recent study of Credit Suisse puts India in the sixth spot globally with 3400 ultra-high net worth individuals. Ultra-high net worth individuals (UHNWI) are individuals with net worth above USD 50 million (Rs. 375 crore approximately). The total number of Indian UHNWIs increased by 31% last year.

Meanwhile globally, the UHNWI population grew by 4% (5,790 adults).

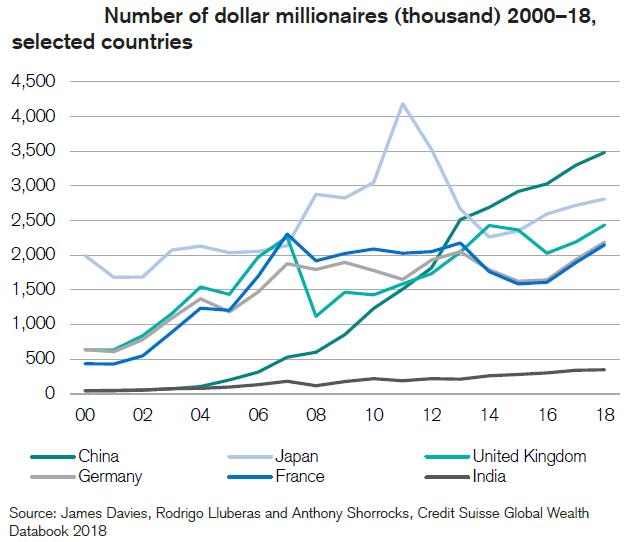

If we look at the total number of wealthy individuals that is individuals with wealth over USD 1 million then the total number of wealthy individuals in India stands at 3.43 lakh. India’s contribution to the wealthy has increased at a substantial pace since the turn of the century. The number of millionaires grew nearly 9 times from 39,000 in 2000 to the current 3.43 lakh.

Globally, USA has the highest number of millionaires 17.3 million or 41% of the world total. In the second place comes China, overtaking Japan who saw a fall in its wealthy population post 2011. Currently, China houses 3.4 million millionaires (8.2% of the world total) compared to 2.8 million millionaires (6.6%) in Japan.

Historical growth in wealthy population

The report also tracked the growth in millionaires since the turn of the century. Pre 2000, out of the 13.8 million millionaires, majority (97%) were concentrated in high-income countries. Since then, more and more new millionaires are coming from emerging economies. Of the 28.3 million "new millionaires" that have appeared between 2000 and 2018, 4.3 million that is 15% of the total increase originated in emerging economies as per the report.

The change in wealth pattern is even more pronounced in the UHNWI segment. While, in 2000, emerging economies accounted for 6% of the total UHNWI population. Rapid economic growth in these countries and most notably in China has led to emerging economies contributing 18% of the world's UHNW population.

Increase in India’s household wealth

Household wealth in India grew by US$ 151 billion at the rate of 2.6% in the last one year. The pace of growth was lower than the global growth rate of 4.6%.

The India’s wealth growth is mainly derived from non-financial assets, which rose by US$ 250 billion (4.3%). House-price movements, which generally act as proxy to the non – financial component of assets, grew by 9% in India during the period.

Value of financial assets on the other hand declined marginally by US$ 16 billion (2.5%). Currency woes were partly responsible for the decline.

According to the report, a substantial increase in debt was observed in majority of the global economies. In India, debt in particular grew by 13.3% (US$ 84 billion) much higher than the global growth of 7.1% during the period.

Women’s share in wealth

The report also noted that women’s share in household wealth was lower in India (between 20% and 30%) compared to the rest of the world (around 40%). However, if we look at proportion of females amongst billionaires in India then India has a respectable 18.6% female representation among the billionaires.