‘Going digital’ seems to be the mantra of wealth management industry in India. On one hand, regulators are easing the regulatory framework. On the other hand, market players are integrating digital technology in their business. The growing prominence on online transaction platforms, entry of ecommerce players in wealth management space and launch of multiple online wealth management firms all point towards faster growth in the digital wealth management industry.

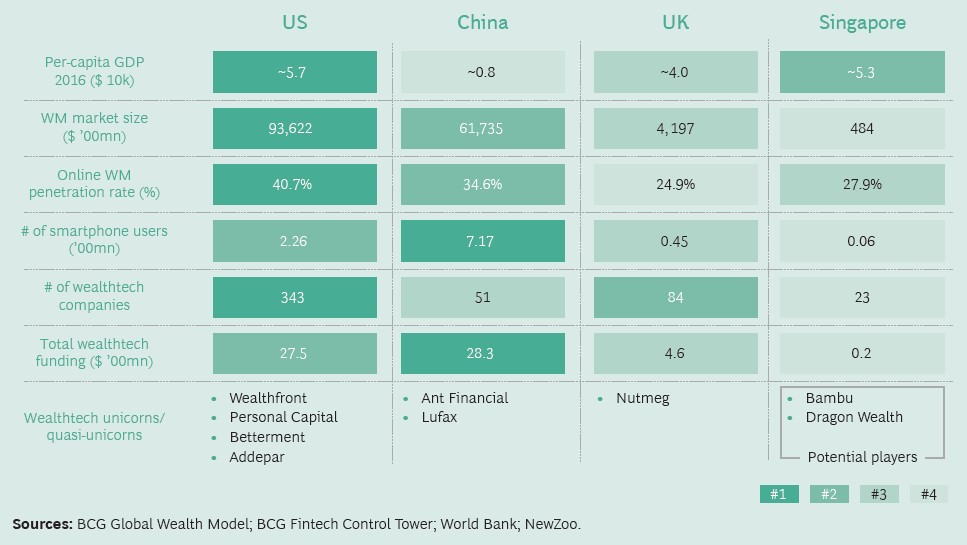

In its ‘Global digital wealth management report 2018’, BCG and Lufax analysed the evolution of digital wealth management in four key markets (US, China, UK and Singapore).

Status of world’s four major digital wealth management markets

Let us have a look at the key findings in the report to understand the four indispensable factors necessary for the healthy development of this industry in India.

Wealth accumulation

The study reported that accumulation of wealth, especially amongst the affluent middle-class will increase the demand significantly for wealth management services. This leads to the emergence of new service providers. Digital wealth management players with lower cost and higher efficiency will be better positioned to serve a wider group of clients.

India has seen a phenomenal increase in its wealthy population in the last few years. The personal wealth in India is expected to grow at 13% CAGR over the next 5 years according to the report. Moreover, India is already the fifth largest Asian market in terms of affluent, HNW (high net worth) and UNHNW (ultra-high net worth) individuals as per the BCG report. These factors position India as a sweet spot in terms of wealth accumulation.

IT foundations

According to the report a strong and robust IT foundation, which, includes network infrastructure, penetration of smartphones and receptiveness to online offerings, is indispensable for adoption of digital wealth management.

India’s internet adoption especially on mobile has spread drastically post the launch of Reliance Jio. Many financial institutions and wealth management companies are launching their mobile apps. Mutual fund industry is a prime example of an industry where investors have readily adopted digital payments. (As per a recent AMFI – CRISIL report, the share of digital payments have grown from 0.5% to nearly 10% over the last two years ending June 2018). Moreover, we see launch of many new online platforms advising clients on investments. This indicates that investors are increasingly open to investing online. However, we still have a long way to go in terms of enabling and educating the investor.

Market regulation

The history of the four aforementioned markets shows that regulatory attitude has a huge impact on development of the digital wealth management space. Sensible regulatory framework, reasonable access and sales rules, an effective system for qualification of investment advisors, regulation on all types of products and constant investor education foster a healthy market according to the report.

SEBI has been a forward thinking regulator encouraging the growth of digital wealth management, be it dematerialisation of shares, allowing ecommerce players to enter the wealth management space, permitting online MF transactions and accepting eKYC. These regulatory reforms coupled with stringent investor protection laws by SEBI have helped the growth of the digital wealth management space. In addition, SEBI has been forward thinking in terms of pushing MFs to launch investor education initiatives to educate investors on the benefits of investing.

Client sophistication

As per the report, a sophisticated investor not only embraces technology but also has the requisite financial knowledge including grasp of the specialised nature of financial business and risks of investments.

Financial understanding is still low in India. However, investor education initiatives in the mutual fund space are expected to equip investors with mutual fund products. However, investor knowledge is still low in case of other financial products. A similar initiative by other financial regulators may help bring about better investor awareness about financial products.