SEBI has amended the mutual fund regulations in which the market regulator has clarified that the fresh TER slabs will be implemented from April 1, 2019.

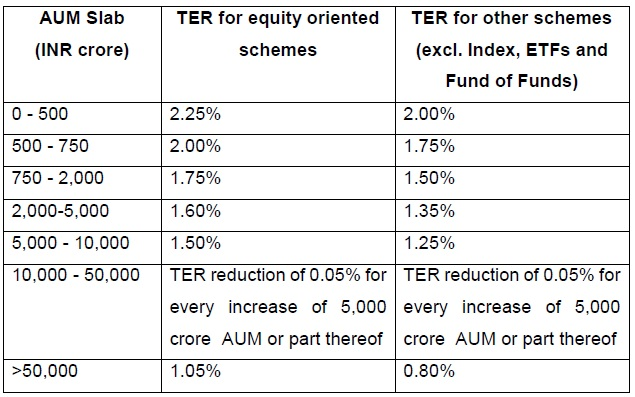

SEBI has announced fresh AUM slabs and given a roadmap to fund houses on how they can make changes to their TER based on asset size of the scheme. While the market regulator has capped TER at 2.25% in equity funds and 2% in other than equity funds, SEBI has followed economies of scale to reduce TER systematically.

Here is the TER for open ended schemes

Similarly, fund houses cannot charge more than 1.25% in close end equity funds and 1% in close end debt funds. SEBI has also asked fund houses to charge a maximum TER of 1% on passive funds such as index funds and ETFs.

On fund of funds (FOFs), SEBI has said that FOFs investing in liquid, index and ETFs cannot charge over 1%. On the other hand, FOFs investing primarily in actively managed funds can charge up to 2.25% in equity funds and 2% in other than equity funds.

SEBI had proposed this TER structure in September 2018. Earlier, SEBI said that the slab wise limits of TER were introduced in 1996 and observed that over time, there have been varying practices in the industry with respect to charging of expenses and payment of commissions. SEBI said, “The Board took note of the benefits of the proposal with respect to sharing of economies of scale, lowering the cost for mutual fund investors, bringing in transparency in appropriation of expenses, and reducing mis-selling and churning.”

SEBI has also clarified that additional expenses of 30 bps for penetration in B30 cities is applicable only if assets come from retail investors. “The additional incentive shall be permitted for inflows from individual investors only and not on inflows from corporates and institutions. Further, the B-30 incentive shall be paid as trail only,” SEBI said.