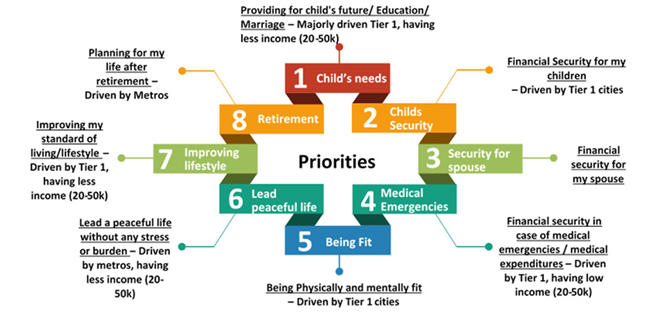

The retirement survey by PGIM India Mutual Fund reveals that retirement planning is the least important financial goal for Indians. The survey finds that retirement planning rated low on people’s priorities, with children and spousal security and even fitness and lifestyle ranking higher.

Though retirement is not a priority, Indians are more anxious about their future and worry about the cost of living, healthcare issues and the lack of family support in the future, shows the report.

Here are some key findings from the retirement survey:

- The conventional model of stable employment and retirement by 60 is increasingly outdated

- People like to plan for happy outcomes and or unknown eventualities and not for unhappy outcomes or known eventualities like retirement

- Elements like break up of joint families, presence or absence of alternate sources of income and fear of dependence on children in old age are playing important roles in people’s attitudes to retirement

- Indians living in a joint family system feel more financially secure and this is still perceived as an important support-system in retirement

- Safety and security as an association to money is shifting to fulfilling dreams and having a better life

- Urban Indians are saving and investing less, allocating nearly 59% of income to current expenses

- Most Indians do not have a ‘retirement fund’ – either because they haven’t begun retirement planning yet, or they just have all-purpose funds and investments that may later be used for retirement, in case any of the other worst-case scenarios do not materialise

- One third of people have some form of alternate income

- 51% of people who have planned their retirement also have some form of alternate income

- 51% of respondents had not made financial plans for their retirement

- 89% of Indians who feel unprepared for retirement, do not have any alternative income

- Barely 1 in 5 Indians consider inflation while planning for retirement

- 41% of respondents said they had focused their retirement investments on life insurance, while 37% preferred fixed deposits

- 48% respondents are not aware of amount required for life after retirement; whereas 52% are aware of the corpus required

- On average, urban Indians aim to gather a corpus of about Rs.50 lakh. Our respondents, who had an average annual income of around Rs.5.72 lakh, at an average age of 44 years, believed that they would need a corpus of around Rs.50 lakh for retirement, or about 8.8 times their current annual income

- 39% of Indians say they have no trusted advisor to guide their retirement planning as one of the concerns related to retirement

Ajit Menon, CEO, PGIM India MF said, “The only financial goal for which you do not get a loan for in today’s world is retirement. You can get a loan for everything else from higher education, house, car, starting a business etc. This puts the onus for being prepared squarely on each of us. Our first study has indicated retirement planning is not a top priority for Indians, and therefore, already a point of concern. Given the current economic challenges emerging in the wake of the global pandemic, the need for future financial security or financial freedom is even more pertinent today. The study has revealed a new and changing facet of our society and we will study this on a periodic basis to track and hopefully impact the issue positively."

The survey across 15 cities focuses on some key questions including when do Indians plan their retirement and what are the possible reasons; what financial instruments are utilized; is lack of awareness undermining retirement planning; are Indians eager to learn more on retirement planning; and how employers play a vital role in raising awareness.

The Financial Priorities of Indians