DSP BlackRock’s views on the implications of CRR cut by RBI on the fixed income market

The Reserve Bank of India (RBI) has announced the following steps today in the Credit Policy:

- Cash Reserve Ratio reduced by 25 basis points to 4.25% effective November 3, 2012. This step is likely to infuse around Rs. 17,500 crore in the banking system.

- Repo Rate and Reverse Repo Rate kept unchanged at 8% and 7% respectively

- March-end inflation target has been revised upward to 7.5% from 7%

- FY2013 GDP growth forecast has been revised downward to 5.8% from 6.5%

While the Reserve Bank of India has taken note of the recent steps taken by the government to address the fiscal deficit and to foster economic growth, it has decided to keep the Repo Rate unchanged primarily to anchor inflationary expectations. This possibly highlights the RBI’s continued focus on inflationary pressures, which are likely to remain around 7.5% to 8% till December 2012.

Significantly, the Reserve Bank of India has provided a forward looking assessment in the form of reasonable likelihood of further easing in Q4 of FY2013. Market participants interpret this as a possible timeframe for Repo Rate cuts as this period will likely coincide with declining headline inflation and further clarity on the fiscal front.

Bond Market Reaction:

Despite a 25-bp CRR cut, the initial reaction of the market participants was a bit disappointing. The benchmark 10Y government bond yield, which was trading at around 8.12% pa before the Credit Policy announcement and traded at around 8.17% pa thereafter. This may partly be due to higher level of expectations the market participants as well as month-end considerations.

We believe that a 25-bp CRR cut is a good development as it provides instant liquidity to the banking system. This should ease some pressure on the systemic liquidity deficit, which has been hovering at around Rs.90,000 crore mainly on account of seasonal festival-related currency withdrawal and higher government cash balances.

At the same time, this step also underlines the RBI’s commitment on the liquidity front going forward. After the dust settles, the market participants will likely shift their focus on the likely announcement of OMO bond purchases by the RBI starting November 2012.

Scenario Analysis:

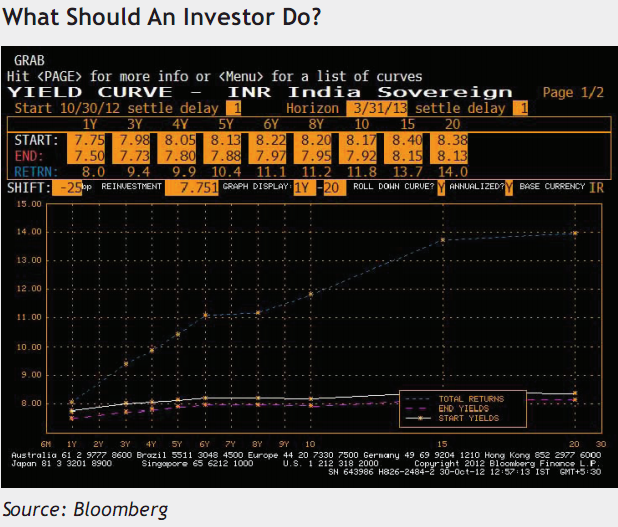

Total Return analysis of Government Bond Yield Curve for the investment period between October 30, 2012 and March 31, 2013, assuming a 25 bps parallel downward shift.

The RBI’s forward guidance has made the job of market participants a bit easier, in our opinion. Now, market participants are likely to focus on evolving growth-inflation dynamics in Q4 of FY2013 for further cues on interest rates as against the mid-December Credit Policy meeting.

The question on everyone’s mind is – How much of a reduction in the Repo Rate will likely happen in the next credit policy meeting due on January 29, 2013?

We believe that the RBI’s likely OMO bond purchases will provide a powerful anchor to government bond yields going forward.

At the same time, we expect the RBI to reduce the Repo Rate by 50 basis points in the Q4 of FY2013.

This should lead the benchmark 10Y government bond yield trading between 7.85% - 7.90% pa by March 2013, in our opinion.

We believe that the current market conditions may provide an excellent opportunity for the investors with an investment horizon of 3-6M to consider investing in higher duration funds. We believe that given the RBI’s forward looking guidance of further easing, the risk-reward ratio is in favor of the investor.