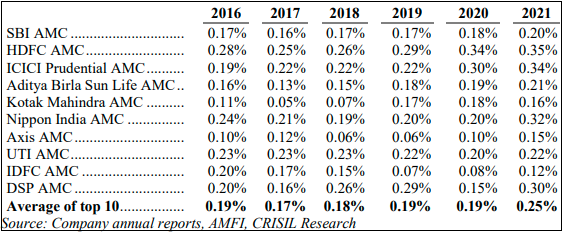

The profit margin of top AMCs surged in FY 2021. The net profit as percentage of AUM, which used to be around 0.19% in previous years, surged to 0.25% in the last financial year, shows data compiled by Crisil Research for ABSL MF's IPO prospectus.

Among the top 10, HDFC AMC and ICICI Prudential AMC have the highest profit to AUM ratio. They make 34 to 35 paise for every Rs 100 worth of assets they manage. IDFC AMC's margin is lowest at 0.12%.

Profit to AUM ratio of top AMCs:

Note: Different accounting standards were used during different periods (IGAAP in FY 2016 and FY 2017. Ind AS from FY 2018 onwards)

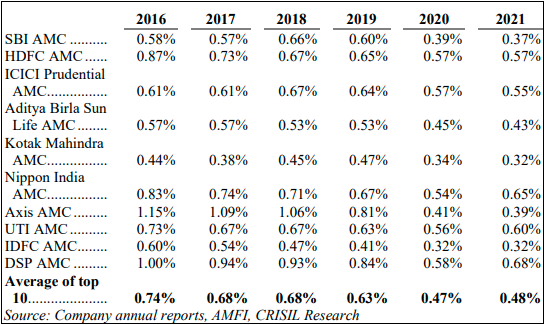

However, the revenue to AUM ratio registered only a slight growth. The ratio went up to 0.48% from 0.47% in FY 2020. Nippon India AMC and UTI AMC have the highest revenue to AUM ratio at 0.65% and 0.6%, respectively.

Revenue to AUM ratio of top AMCs:

CEO of a major fund house cited Covid-led cost efficiencies as the reason behind the mismatch in revenue and profit growth. "Due to Covid, office travel almost came to a standstill. There were hardly any distributor or investor meets. These changes along with the savings in printing expenses brought down overall costs and led to higher profits," he said.

In absolute terms, the profit of top 10 AMCs rose 25% to Rs 5,921 crore in FY 2021 from Rs 4,738 crore a year earlier. HDFC and ICICI Prudential registered highest profit at Rs 1,326 crore and Rs 1,259 crore respectively. Over the 5-year period (2016 to 2021), profits went up at a CAGR of 50% for Axis AMC, which is the highest among top 10 asset managers.