Just as staying on the pitch matters the most for a cricketer, staying invested is crucial for an investor.

Saugata Chatterjee, Co-Chief Business Officer, Nippon India Mutual Fund spoke at the recent Cafemutual Confluence Investment Marathon 2021 (CCIM 21), where he took the attendees from a cricket pitch to a financial pitch.

Here are the key highlights of the session:

Invest in the right products for creating wealth

Investing in equity markets holds huge growth potential as the market moves with the economy. IMF (International Monetary Fund) has forecasted 11.5% growth in FY 22. Further, India is expected to be the third-largest economy by 2030.

In the past, equity markets have delivered superior returns. Between 1980 and 2019, it has delivered impressive growth as against gold, silver and FDs.

Investors should consider investing in equity markets through mutual funds to reduce concentration risks and diversify their investment portfolio. Mutual funds also offer professional management of money at a very low cost.

Be mindful of biases that can hinder wealth creation

Greed and fear are two emotions that can impact financial decisions unfavourably. When the markets are high, investors typically anticipate a further rise and purchase in greed. Likewise, when the market runs low, fearing a further dip, investors exit. It is imperative to keep these aside and remain invested across market cycles for wealth creation.

Let’s understand this better with the help of an example.

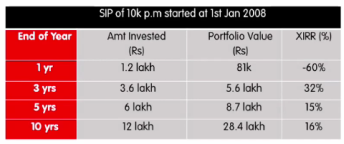

Markets crashed due to the global crisis during 2008. The table below depicts the returns across various time horizons. A fearful investor exiting in the first year missed growth opportunities.

Know determinants of wealth creation

Wealth creation can be illustrated through the formula of compounding, which is A=P (1+r/100)^t. P stands for principal, r for rate of interest and t for time period.

Investors typically focus on the interest rate rather than the time period. Instead of obsessing about returns, the focus should be on asset allocation, risk, time and behaviour. The longer the investors stay invested in equity, higher the chances of generating wealth.

Saugata’s session simplified wealth creation for investors as he presented some interesting facts and graphs while sharing his insights. He ended his session on a high note by taking up a few common investor concerns.

Watch this video to know every bit of what Saugata spoke in his 20-minute session - ‘Wealth Creation in Good & Bad Times’.