The best performing asset class keeps changing. Markets currently are experiencing K-shaped recovery with some sectors performing well. The volatility hereon will only increase as some parts of the economy open up and others may go into a closure depending on the pandemic situation.

Azeem Ahmad, Head-PMS, LIC MF believes that the easiest way to overcome volatility is through asset allocation.

Asset allocation is the key driver of portfolio returns that helps in overcoming timing issues related to each asset class. Empirical research suggests 90% of the returns are generated through asset allocation and only 10% of the returns are generated from the security selection.

Asset allocation is an important variable over the long term and helps in aligning returns to long term goals and risks. But what is the ideal allocation that investors must look at? In this context, Azeem shared with us his brief guide to multi-asset allocation at Cafemutual Confluence Investment Marathon 2021.

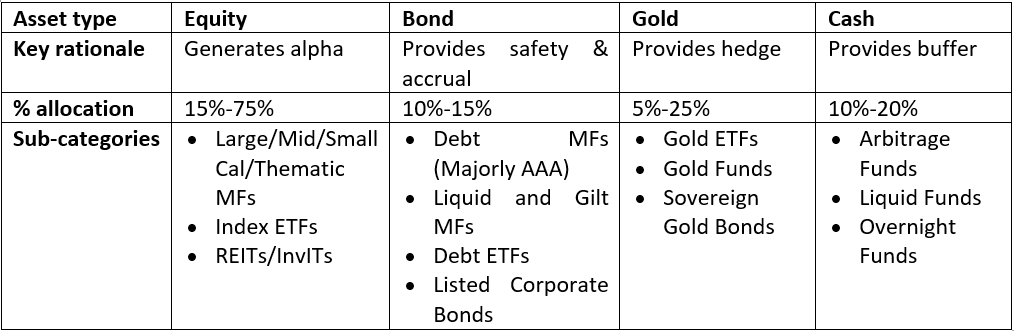

Investors can create a diversified portfolio by investing in equity, bond, gold and cash.

Watch this video to know his step by step guide to diversification.