Everyone is talking about India as one of the largest economies in the world, growing at a very fast pace. Then why should investors leave the comfort of Indian equity markets and invest overseas?

In the words of Nobel prize laureate Harry Markowitz, ‘Diversification is the only free lunch in investing’. This simply means you should not put all your eggs in one basket.

Apart from diversification, global investing offers better returns with lower volatility and gives access to cutting edge technology companies and leading global brands. Anish Mathew CEO & CIO, Sundaram Asset Management Singapore spoke about each of these in detail at Cafemutual Confluence Investment Marathon 2021 (CCIM 21).

- Better returns with lower volatility

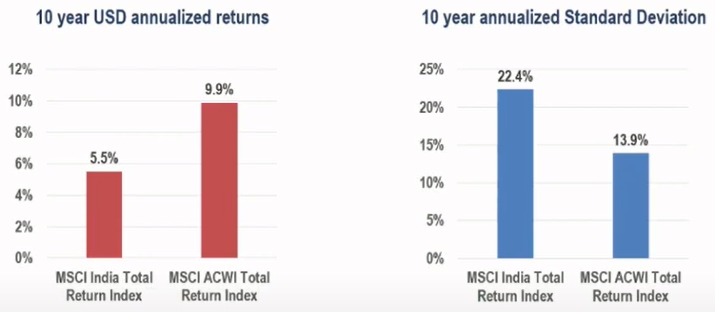

10 year annualised returns show that MSCI India has underperformed over 4% per annum. Moreover, the volatility of returns in the Indian market is over 8% higher than the volatility in the global markets. As graphically shown, the underperformance in the Indian market has come with higher volatility; international investing could lead to better returns with lower volatility.

Source: Bloomberg, Data from June 30, 2011 to June 30, 2021 in %terms

Source: Bloomberg, Data from June 30, 2011 to June 30, 2021 in %terms

Past performance may or may not be sustained in future

- Gain access to cutting edge technology companies

Another key reason why you should consider investing in international markets is to gain access to cutting edge technology companies. Out of the top ten weights of Nifty’s Index, six are a part of the financial sector while only two form a part of the information technology domain. Moreover, these two players are software services players and not technology product players. On the other hand, reviewing the top 10 weights of S&P 500 reveals seven out of the ten companies are cutting edge technology product companies.

Source: Bloomberg, Data as of June 30, 2021

Source: Bloomberg, Data as of June 30, 2021

- Gain access to leading global brands

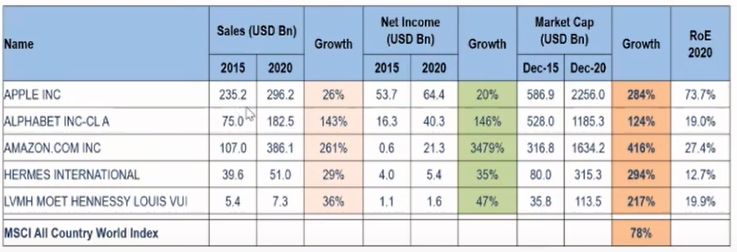

Investing in leading global brands is a simple strategy to execute and make good returns over the medium and long term. Strong competitive positioning leads to exceptional returns for stakeholders. A strong brand creates a competitive advantage which in turn leads to superior earnings growth and premium sustainable valuation.

A look into the performance of five leading global brands during 2015 and 2020 shows consistent growth and handsome rewards for stakeholders. This is despite the year 2020 being a washout owning to the pandemic.

Source: Bloomberg and in-house analysis, Sales and net income data as of CY 2015 and CY 2020

Source: Bloomberg and in-house analysis, Sales and net income data as of CY 2015 and CY 2020

Market cap data as of Dec 31, 2015 and Dec 31, 2020

Likewise, the concept of brands has worked well in India too. However, the difference between the Indian brands and global brands is valuation, where global brands are trading at cheaper valuations.

Watch this video for understanding international prospects and related data better.