The mutual fund industry has added foot soldiers at a multi-year high pace last year. The 2021 saw the addition of 17,800 individual MFDs as against 4,674 new registrations in 2020.

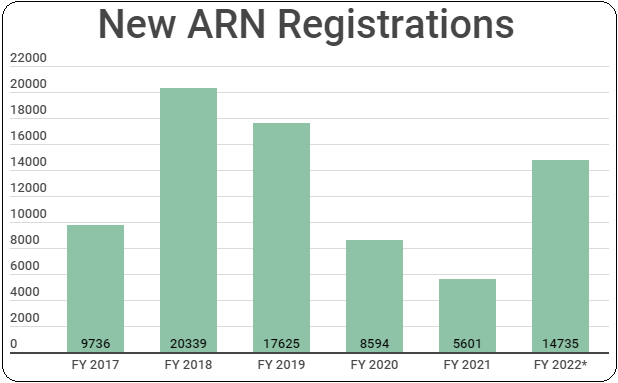

An analysis of new ARN registration shows that the industry has already managed to break the three-year trend of declining MFD registrations this financial year. In FY 2022 (till December), the industry added 14,735 new MFDs compared to 5,601 in whole of FY 2021.

ARN registrations in each financial year:

*FY 2022 data includes registration figures till December 2021

The highest registration was seen in FY 2018 at 20,339 and since then it declined each year to 17,625 in FY 2019 and 8,594 in FY 2020.

The last three months of 2021 has especially been great. The ARN count jumped from 1.04 lakh to 1.26 lakh during the period, resulting in a growth of 22%.

ARN holder count at the end of each half year:

|

Month |

T-30 |

B-30 |

Total |

Growth % |

|

Dec-21*(3 months) |

67,073 |

58,901 |

1,25,974 |

22 |

|

Sep-21 |

55,009 |

48,586 |

1,03,595 |

9.61 |

|

Apr-21 |

50,687 |

43,823 |

94,510 |

5.32 |

|

Sep-20 |

48,400 |

41,337 |

89,737 |

2.4 |

|

Apr-20 |

47,212 |

40,418 |

87,630 |

1.47 |

|

Sep-19 |

46,837 |

39,527 |

86,364 |

— |

According to senior MFDs and industry insiders, NISM restarting physical exams was the biggest reason behind the sudden surge in MFD registration. The steep decline in registrations in 2020 was mostly due to suspension of NISM exam for the major part of the year. Apart from that, the growth in AUM of MFDs on the back of a record market rally post-covid also attracted new talent to the business.

Of the 1.26 lakh MFDs, 67,073 or 53% are based in T-30 locations. The rest 47% are from B-30 locations.

Looking at the ARN data state-wise shows that Maharashtra has the highest number of MFDs (25%). Gujarat and Uttar Pradesh follow Maharashtra as 11% and 8% of the MFDs are from these states.