Listen to this article

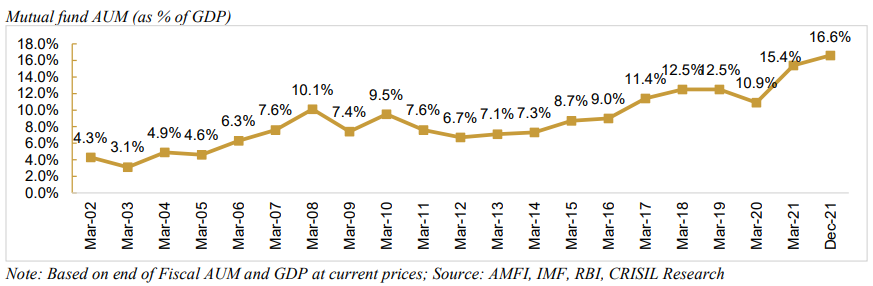

Penetration of Indian mutual fund industry has reached an all-time high in December 2021.

The mutual fund AUM to GDP ratio, which indicates its penetration has touched a new high of 16.6% in December 2021 due to record high inflows, post covid rally in equity markets and a hit on India’s GDP due to the pandemic, reveals KFin Technology’s draft IPO prospectus.

The AUM to GDP ratio has risen significantly in the last couple of years. In March 2020, the ratio stood at 10.9% and it rose to 15.4% by March 2021 and finally to 16.6% in December 2021.

"Mutual fund assets in India have seen robust growth, especially in recent years, driven by a growing investor base. This is due to increasing penetration across geographies, strong growth in capital markets, technological progress and regulatory efforts aimed at making mutual fund products more transparent and investor friendly," the document stated.

However, the penetration of mutual funds in India is still very low compared to other nations. In the US, the mutual fund AUM to GDP ratio stands at 140% and the world average is 75%.

KFin Technology said that the under penetration in India provides huge growth opportunity for mutual fund players. "Under penetration of mutual funds in India and an opportunity to earn annuity income once the fund builds up a good book of assets are the main attractions for many players to foray into the mutual fund business. This has caused 10 houses to apply for mutual fund license," the RTA said in the prospectus.

Debt has a bigger share in the overall mutual fund AUM in India. The report shows that the debt AUM is 7% of the India's GDP and the equity AUM is 6% (based on AUM data of the fourth quarter of calendar year 2020).