Listen to this article

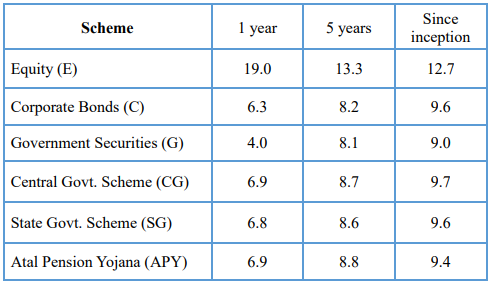

NPS schemes have delivered CAGR in the range of 9-13% since inception, shows a report by pension regulator PFRDA. Equity schemes have led the performance chart with CAGR of 12.7% since inception. The rest of the schemes (debt and government schemes) also have a good track record with CAGR ranging between 9% and 9.7%.

In the 5-year period, the gap between the performance of equity and debt schemes gets wider. While equity schemes have delivered 13% CAGR, corporate bond schemes generated CAGR of 8.2%. In the 5-year period, government and government security-based schemes also delivered CAGR of 8.1%-8.8%.

"The rate of returns in various NPS schemes since inception is in the range 9-12.7% and has been very competitive vis-à-vis alternate saving instruments. In the last five years, the range has been 8.1-13.3%," the report stated.

"An ultra-conservative government-securities-oriented NPS scheme has posted an annual return of over 8%. APY has also posted high average annual return of 8.8 percent in the last 5 years with annual return since inception being 9.4 percent," it added.

CAGR is led by equity schemes (in %)