Listen to this article

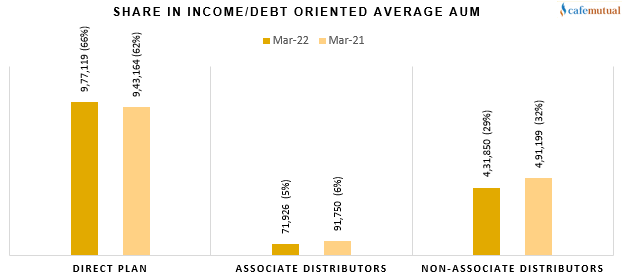

An analysis of monthly average AUM data of top 30 fund houses by Cafemutual shows that non-associate distributors like MFDs and NDs accounted for 29% of the total fixed income AUM. As on March 2022, they brought in Rs. 4.32 lakh crore of the total average AUM of Rs. 14.81 lakh crore.

On the other hand, direct plans formed a sizeable share of 66% or Rs. 9.77 lakh. Also, associate distributors accounted for a modest 5% or Rs. 72,000 crore.

A similar trend was seen last year. In March 2021, the share of non-associate distributors, direct plans and associate distributors was 32%, 62% and 6%, respectively.

* Figures mentioned above are Rs in crore

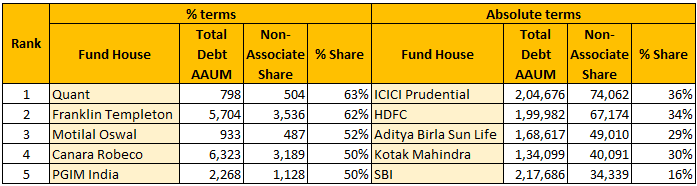

As on March 2022, five fund houses - Quant MF, Franklin Templeton MF, Motilal Oswal MF, Canara Robeco MF and PGIM India MF derived 50% or more of their fixed income business from MFDs and NDs. In absolute terms, ICICI Prudential MF, HDFC MF, Aditya Birla Sun Life MF, Kotak Mahindra MF and SBI MF topped the list.

* Figures mentioned above are Rs crore

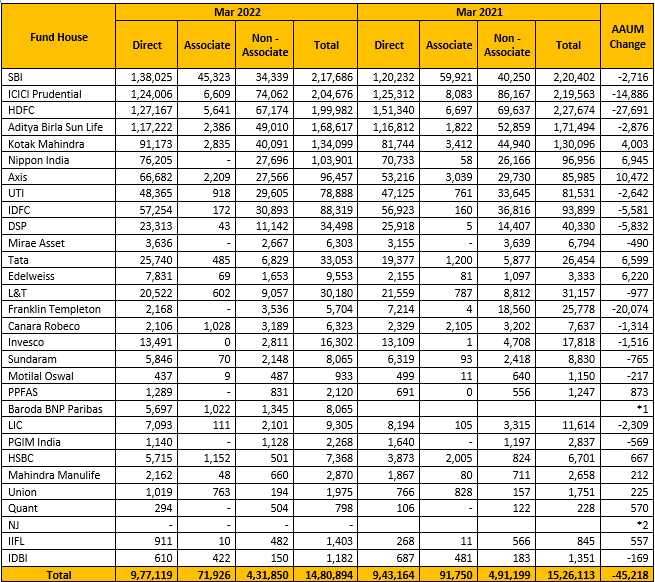

Here is the bifurcation of income/debt-oriented AAUM of top 30 fund houses into direct plans, associate distributors and non-associate distributors.

* Figures mentioned above are Rs crore