Listen to this article

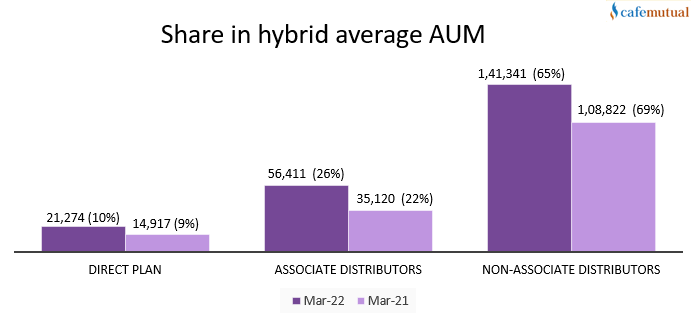

Among all distribution channels, non-associate distributors like MFDs and NDs are the largest contributors to hybrid fund assets, shows an analysis of average monthly AUM of top 30 fund houses done by Cafemutual.

As on March 2022, MFDs and NDs account for 65% of the total hybrid assets. They contribute Rs. 1.41 lakh crore of the total hybrid assets of top 30 fund house of Rs. 2.19 lakh crore.

The direct plans and associate distributors individually bring in Rs. 21,274 crore or 10% and Rs. 56,411 crore or 26%.

As against the previous year, there is a 4% dip in the total share of non-associate distributors. This is largely due to the rise in share of associate distributors. In March 2021, non-associate distributors, direct plans and associate distributors accounted for 69%, 9% and 22% of the total hybrid assets, respectively.

* Figures mentioned above are Rs in crore

Fund house wise facts

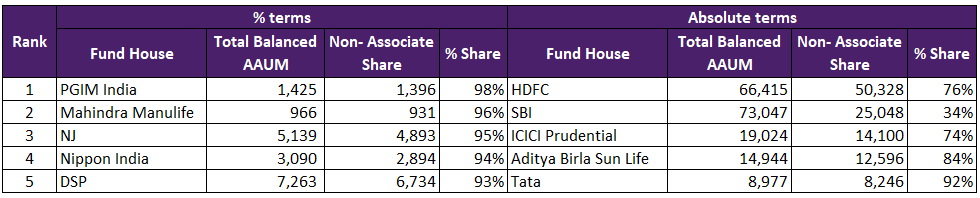

In March 22, PGIM India MF, Mahindra Manulife MF, NJ MF, Nippon India MF and DSP MF procured 98%, 96%, 95%, 94% and 93% of their total hybrid business from MFDs and NDs. Additionally, IDFC MF, Tata MF and UTI MF also derived over 90% of their hybrid business from them.

In absolute terms, HDFC MF, SBI MF, ICICI Prudential MF, Aditya Birla Sun Life MF and Tata MF are the top five fund houses that receive 50,328 crore, Rs. 25,048 crore, Rs. 14,100 crore, Rs. 12,596 crore and Rs. 8,246 crore, respectively from non-associate distributors.

*Figures mentioned above are Rs in crore

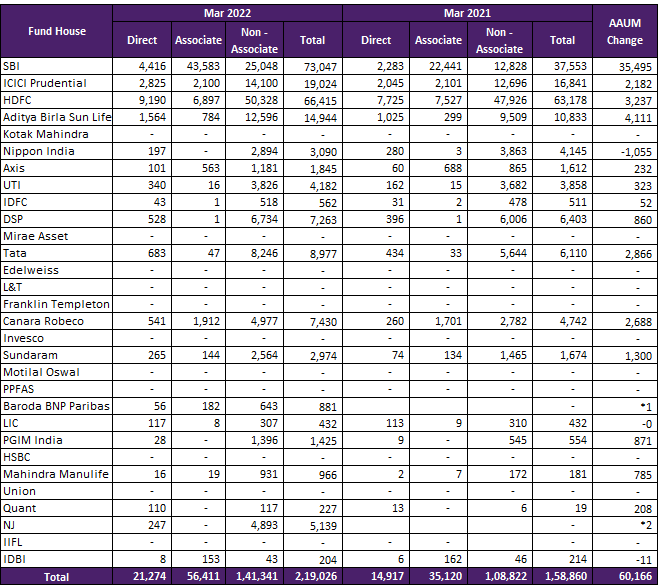

Here is a detailed break-up of the top 30 fund houses’ hybrid AAUM.

* Figures mentioned above are Rs in crore

*1 - Baroda MF and BNP Paribas MF formed ‘Baroda BNP Paribas MF’ in Mar 2022

*2 - NJ MF made its debut in Oct 2022