Listen to this article

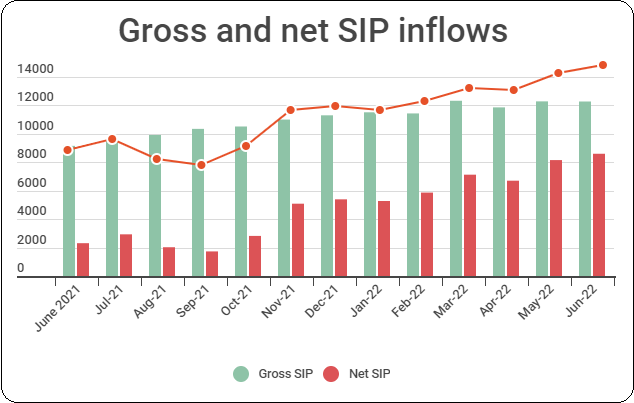

Gross SIP inflows may have plateaued but net SIP collections remain on the growth track. From being in the Rs. 1,500- Rs. 2,500 crore range till October, the net SIP inflows have risen almost every month since then to touch Rs. 8,600 crore in June.

While AMFI does not define net SIP inflows, according to SEBI, net SIP inflow is the difference between gross SIP inflows and outflows from SIP accounts.

This growth has more to do with lower redemptions from SIP accounts than a surge in gross SIP inflows, as evident from the chart below (net to gross ratio). The data shows that net SIP amount in June was 70% of the gross inflows compared to just 20-30% in the July-October period in 2021.

The line shows the trend in ‘net to gross’ inflow ratio

A similar trend is visible in the equity inflow data. Net inflows in equity funds have been robust in the last few months, partly due to a slowdown in redemptions.

According to MFDs and RIAs, the fact that investors are unmoved by volatility is a result of rising maturity and the market conditions.

"There are two angles involved - psychology and market. It's true that investors have matured and now see volatility as the part and parcel of equity investing but there are other factors as well. For example, there are many new investors who want to redeem but are postponing the decision to avoid booking losses,” said Nitesh Buddhadev of Nimit Consultancy.

Lovaii Navlakhi of International Money Matters feels that many investors do not associate mutual funds with short-term gains. Also, many people do not need money. "People have money in their hands. Unlike what's being shown in the media, people are not under tremendous financial stress as of now. So, they do not have any reason to withdraw pre-maturely," he said.

|

Month |

Gross SIP |

Net SIP |

Net to gross ratio |

|

Jun-21 |

9,155 |

2,309 |

0.25 |

|

Jul-21 |

9,609 |

2,932 |

0.31 |

|

Aug-21 |

9,923 |

2,024 |

0.2 |

|

Sep-21 |

10,351 |

1,730 |

0.17 |

|

Oct-21 |

10,519 |

2,820 |

0.27 |

|

Nov-21 |

11,005 |

5,087 |

0.46 |

|

Dec-21 |

11,305 |

5,394 |

0.48 |

|

Jan-22 |

11,517 |

5,277 |

0.46 |

|

Feb-22 |

11,438 |

5,868 |

0.51 |

|

Mar-22 |

12,328 |

7,128 |

0.58 |

|

Apr-22 |

11,863 |

6,705 |

0.57 |

|

May-22 |

12,286 |

8,155 |

0.66 |

|

Jun-22 |

12,276 |

8,600 |

0.70 |