Listen to this article

What differentiates White Oak is our unique manufacturing background. Several new entrants are specialists in distribution yet others have a strong digital/fintech background. While having a strong distribution or a technological background is no doubt a critical success factor, what sets us apart is that we already have a strong track-record of investment management and performance. White Oak Group manages totally in excess of Rs 40,000 crore of assets invested into India from investors globally.

Prashant Khemka, the founder of White Oak Capital Management, was the CIO of Goldman Sachs Asset Management’s India Equity and Global Emerging Markets Equity businesses. In 2017, he founded White Oak Capital. White Oak’s investment team is amongst the most well-resourced teams with several professionals having considerable experience in managing investment assets, both in India and globally. Collectively, the team has over 200 years of research experience across India, emerging markets and developed markets having evaluated approximately 3,000 companies globally.

We are creating our physical presence across the country along with significant investments in digital space. We will look forward to covering India well beyond the metro cities to achieve higher inclusivity through omni-channel presence across physical, virtual and digital channels. Even in our very first NFO, over 2,000 distributors have been prime influencers in enabling investment contributions from both Top-30 and Beyond-30 cities.

Aashish Somaiyaa, our CEO, in his recent interview with ET said it very succinctly and I am quoting here “I don’t see us as traditional or modern AMC, I just see us as an AMC grounded in reality and practicality, I see us as an investor and channel partner focused AMC which believes that the products we make will be good for investors and hence we must strive to make ourself present wherever investors want to access us.”

At a time when passives are making headlines across the globe, WhiteOak MF wants to be an 'active-only' fund house. Why are you so optimistic about actives?

Indeed, there are headlines about the passives and that’s true to an extent that by avoiding costs, one can have better alpha. However, that may be true from large cap perspective, especially for developed markets like the US, where the alpha potential has moved away from indices/stocks to private markets and thus the rapid growth in alternatives investments.

What makes the investing case for India most compelling is that it offers the highest alpha generation potential compared to any sizeable equity market around the world. India comes out on top as the market where active managers have most successfully outperformed their benchmarks over long periods of time with high degree of persistency.

What’s in store for MFDs? Why should MFDs work with WhiteOak MF?

Thanks for asking this question. MFDs have contributed immensely to the growth of this industry. All the MFDs have evolved over last two decades or so and have developed best-in-class practices which the investors have benefited from.

As for what’s in store for MFDs, I would say, they will have a partner who will endeavour to provide meritocratic performance, consistent communication and lot of engagements around skill development.

We also have a lot of emphasis on service quality. We are expanding our physical footprint Also, wherever we are opening offices, we are hiring colleagues in service, which is testimony of our service commitment.

Simultaneously, we are also investing in creating a robust digital infrastructure for MFDs. This digital infrastructure will be around transaction convenience, analytics and marketing support for business growth. For instance, if an MFD goes to the distributor portal on our website, he/she can create co-branded collaterals with few clicks. Similarly, they can send respective ARN-coded digital transaction links to their investors.

Another commitment is to have regular communication. We believe MFDs and distribution partners are integral who should get to know what is important for them to take decisions on behalf of their customers. And hence its imperative for us to provide them with essential and regular information.

WhiteOak has been using the 'OpcoFinco' framework for stock selection in AIF and PMS. This strategy will now be used in MF as well. What is the idea behind this concept and how will it benefit investors?

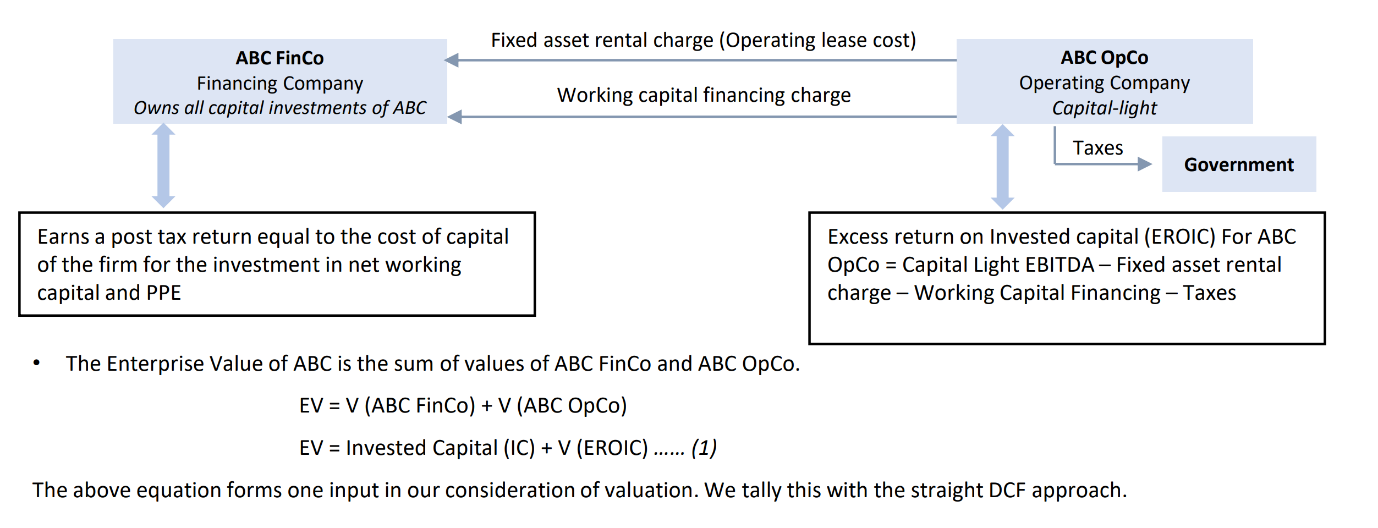

We believe that traditional metrics such as P/E, P/B or EBITDA are often highly misleading and instead, we rely on economic cash flow multiples as derived from our proprietary Opco Finco Framework or the Asset-light cash flow approach which lends itself very well for relative comparison of value not only across companies within a sector but also across sectors.

OpcoFinco™ analytical framework is central to how we think about analysing businesses in line with our investment philosophy.

This framework dissects the value of any company between two distinct components: One that is a function of invested capital in the business and the other that is a function of excess returns on the invested capital. Such a distinction is very insightful in understanding the sources of value in a business.

Currently, there are many midcap funds with good track record. In such a scenario, why should MFDs recommend WhiteOak Midcap Fund to their clients?

While alpha generation opportunities exist across the market cap spectrum, mid and small caps tend to be relatively more under-researched than their large cap counterparts and are hence, more inefficient. Thus, with a well-resourced team, the alpha generation potential in these segments of the market is also higher.

What also stands out is the depth and breadth of investment experience of the team. This brings about a unique pattern recognition perspective and uniquely sets the team apart from any other fund management team.

India, like any other emerging market also exhibits a wide spectrum of corporate governance standards. These deep research capabilities are also important to avoid corporate governance disasters within the mid cap space.

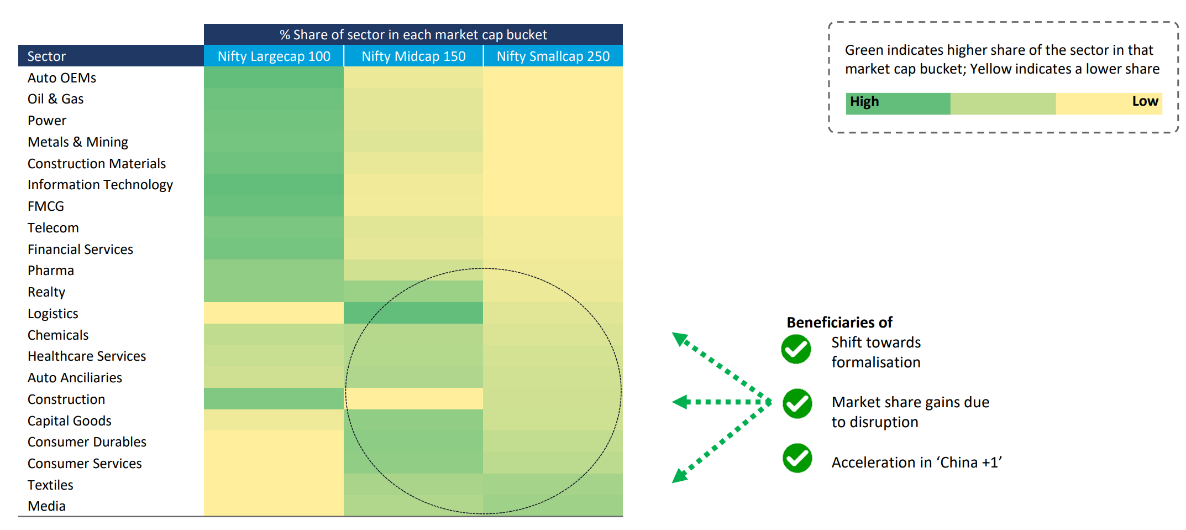

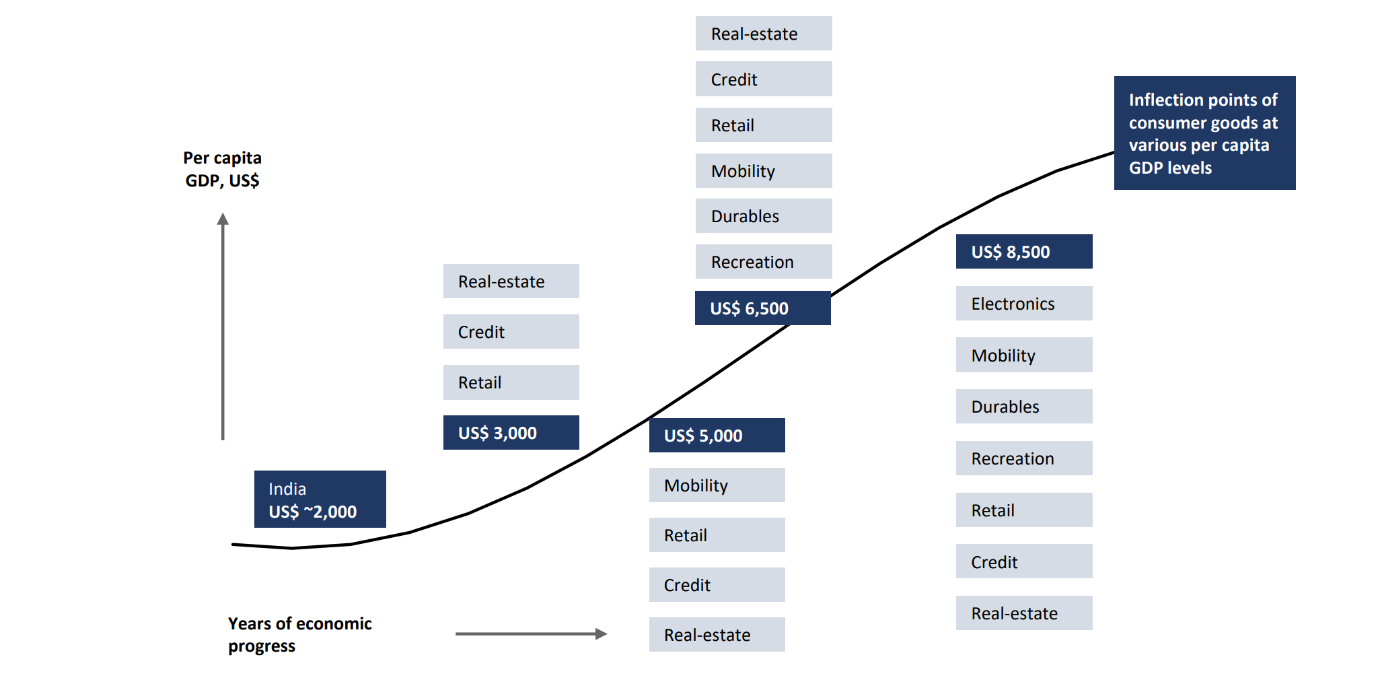

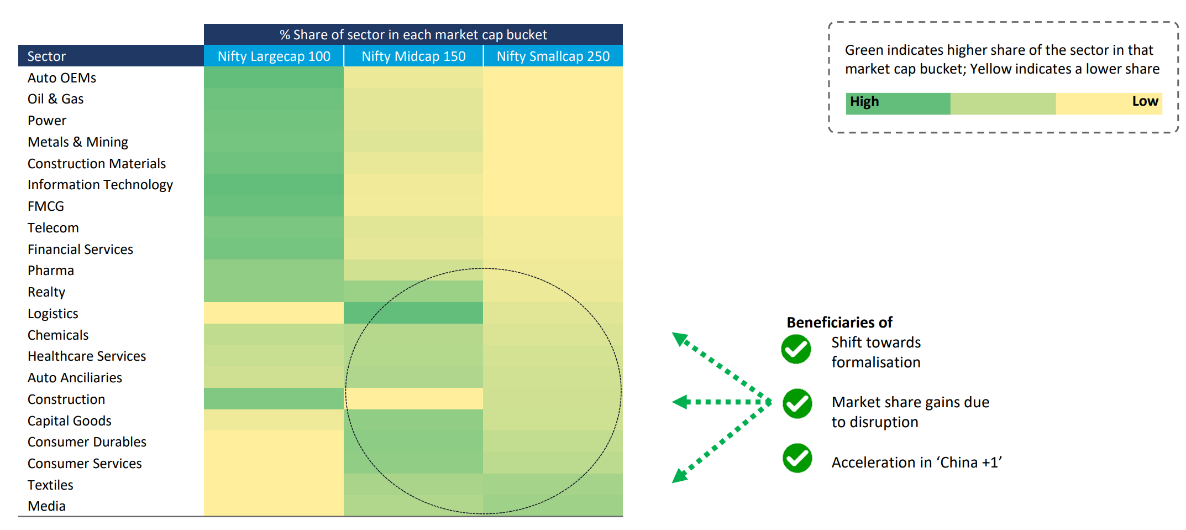

Also, the mid-cap space is more diverse from a stock selection perspective. Many sectors such as logistics, specialty chemicals, light manufacturing and consumer services are dominated by midcap companies with heterogenous business models. These sectors also benefit from additional structural tailwinds such as shift towards formalisation and acceleration in China + 1. Further, India is underpenetrated in many consumption categories and as per capita incomes rise, companies in these segments which are generally mid-caps will tend to benefit more.

So, in nutshell, it is all about having a very well-resourced team which can identify winners within the midcap space which has niche businesses and is well diversified.

Our investment philosophy is that outsized returns are earned over time by investing in great businesses at attractive values. It is a stock selection-based approach of investing in businesses rather than betting on macro. And now, to answer your specific question that how WhiteOak midcap fund can be different from peers, we firmly believe that our bottom-up stock picking philosophy and very well-resourced team of 30+ investment professions will help in identifying great businesses at attractive values. We have a dedicated team for ESG research as well. At the same time, we mitigate macro risks by having a balanced portfolio construction.

Around 65% of the fund will invest in midcap stocks and the remaining 35% in small caps plus some in large caps for liquidity purposes.

We are quite confident of being able to stand apart on merit of performance in times to come.