Listen to this article

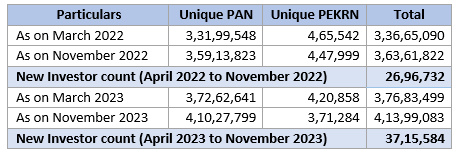

AMFI data shows that the MF industry added 78,045 investors in November 2022, the lowest since April 2022. Between April and October, the industry added over 3.75 lakh new investors on a monthly basis.

Experts attribute this massive decline in new investor registration to change in KYC norms.

SEBI had revised KYC norms effective from November 1, 2022, in which it has done away with scanned copies of KYC documents. Now, it is mandatory for investors to submit KYC documents with wet signatures.

Industry participants believe that the new guidelines have made the entire process cumbersome, thereby dissuading investors.

Earlier, Mumbai MFD Sadashiv Phene told Cafemutual that the new KYC norms have made it difficult for many investors to invest in mutual funds. “Many women don’t have passport and driving license. Here Aadhaar is the only option. Since investors have to follow a due process to download eAadhaar, they procrastinate their investment decision or decide not to pursue mutual funds for investments.”

Another Mumbai MFD Ritesh Sheth told Cafemutual that he does not encourage investors to submit eAadhaar for physical KYC. “Since obtaining eAadhaar is a tedious process, I don’t prefer taking it. Even if you obtain e Aadhaar, the next step is to ensure that QR is in good condition and can be scanned by the KRA systems for authentication.”

The new investor count recorded an eight-month low in November 2022. Consequently, the rise in total folio count was also modest.

Apart from the revised KYC norms, modest returns kept investors away from mutual funds. Vinod Jain of Jain Investment said, “Existing investors experienced not so good returns over the last six months. We have thus seen a decline in referrals from existing investors. This could probably be another reason for the decline.”