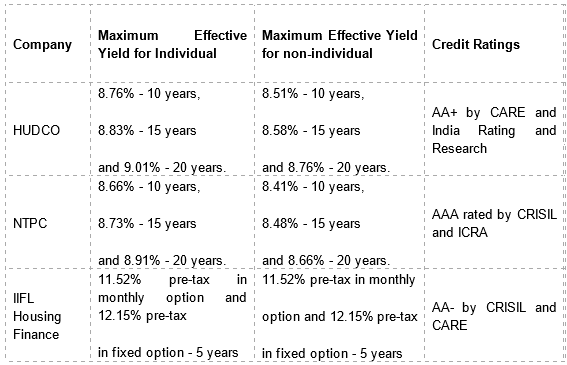

Tax free bonds of HUDCO and NTPC are offering yields up to 9.01% and 8.91% per annum respectively to retail investors for the tenure of 20 years while IIFL Housing Finance NCD offers 12.15% for 5 years for all categories of investors.

With the tax season approaching, companies like Housing and Urban Development Corporation (HUDCO) and National Thermal Power Corporation (NTPC) have recently come out with their tax free bonds. Other firms like Indian Railway are likely to hit the bond market later this month as it had filed a draft offer document with SEBI to issue its tax free NCD.

Also, India Infoline Housing Finance Limited (IIFL Housing Finance) has floated secured redeemable non-convertible bonds (NCD).

While IIFL Housing Finance issue is offering an effective pre-tax yield up to 12.15% per annum to retail investors for 5 years tenure, HUDCO and NTPC have announced attractive tax free coupon rate of 9.01% and 8.91% per annum respectively to individual investors for the tenure of 20 years.

The issues of HUDCO and NTPC are currently open and will close on January 10, 2014 and December 16, 2013 respectively while IIFL Housing Finance NCDs will open on December 12, 2013 and close on December 20. However, NTPC's tax free issue has been oversubscribed 3.3 times.

Who can apply: Resident individuals, HUFs, partnership firms, companies and body corporates, banks, public financial institutions, national investment funds, mutual funds, venture capital, insurance companies, commercial banks, co-operative banks, public/private charitable trusts, industrial research organizations and other eligible categories.

Application size: All issues have a face value of Rs 1000 but minimum application size varies as HUDCO and NTPC have a minimum application size of Rs 5,000 for five bonds while IIFL Housing Finance has decided to keep it at Rs 10,000.

HUDCO seeks to collect Rs 500 crore with an option to retain an additional 2439.20 crore if the issue gets oversubscribed. Similarly, the public issue by NTPC aims to aggregate Rs 1,000 crore and has a greenshoe option to retain another Rs 750 crore if the issue gets oversubscribed.

IIFL Housing Finance also aims to collect Rs 250 crore with an option to retain another Rs 250 crore if the issue gets oversubscribed. The maximum size of issue will be Rs 500 crore.

Who can sell the product: Registered stock brokers with any stock exchange along with their respective sub-brokers, banks and intermediaries selected by the issuing company.

How can an IFA register to sell the product: An IFA has to sign the sub-broker agreement with a stock broker to be eligible to sell the bonds.

Trustee: For HUDCO - SBICAP Trust Company, NTPC - IL&FS Trust Company and IIFL housing finance - IDBI Trusteeship Services

Registrar: HUDCO, NTPC - Karvy Computershare and IIFL Housing Finance - Link Intime India

Listing: HUDCO’s tax free bond will be listed on BSE while NTPC’s and IIFL’s Housing Finance issues will be listed on both BSE and NSE.

Depositories: NSDL and CDSL

Lead Managers:

For HUDCO – Axis Capital, Edelweiss Financial Services, HDFC Bank, RR Investors Capital and Karvy Investor Services.

NTPC - AK Capital Services, Axis Capital, ICICI Securities, Kotak Mahindra and SBI Capital Market.

IIFL Housing Finance - Axis Capital, IIFL, Trust Investment Advisors, Edelweiss Financial Services, RR Investors Capital Services, Karvy Investor Services and SMC Capital.

Allocation: All three - NTPC HUDCO and IIFL Housing Finance have allocated 40% of issues to retail investors.

Besides, IIFL Housing Finance has allocated 40% of NCDs for institutional category and 20% for non-institutional category. HUDCO has assigned 30% of issues for HNIs, 20% for corporates and 10% for QIB whereas NTPC has allocated 25% of NCDs for HNIs, 25% for corporates and 10% for QIB.