PSU banks have not been active in selling mutual funds due to low margins.

Market regulator SEBI, in its long term policy for mutual funds, has proposed that public sector banks should take active part in distributing mutual fund products.

“Apart from traditional banking products, PSU banks have recently been very successful in distribution of third party insurance products. However, the same success is not reflected in the case of mutual funds. All PSU banks may be encouraged to distribute schemes of all mutual funds,” stated SEBI.

PSU banks have been actively selling insurance products due to their high commissions. However, low commissions on mutual funds has deterred these banks to take up MF distribution in a big way.

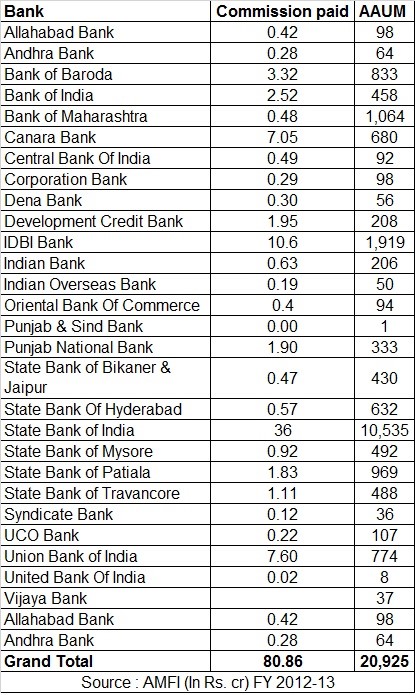

The

disinterest is evident from the low commissions earned by these banks from

AMCs. PSU banks earned Rs. 80 crore by selling mutual funds. Out of this, SBI

earned Rs. 36 crore or 44% of the total commissions earned by PSU banks. In

FY2012-13, State Bank of India, the largest distributor of mutual funds, had

assets under advisory of Rs. 10,535 crore. The second largest distributor among

PSU banks is IDBI Bank which earned a commission of Rs. 10 crore, followed by Union

Bank of India (Rs. 7.60 crore) Canara Bank (Rs.7 crore) and Bank of Baroda (Rs.

3 crore).

There are 21 PSU banks (excluding SBI subsidiaries) in India and all of them already sell mutual funds.

In comparison to PSUs, foreign and private banks have been very active in wealth management space. For instance, Citibank was the largest mutual fund distributor, having earned Rs. 165 crore as commissions in FY12-13, followed by HDFC Bank (Rs. 160 crore).

Fund officials do not expect PSU banks to take up mutual fund distribution in a big way unless there is a strong incentive.

“They are struggling to get deposits from customers. Some PSU banks help mobilize money in their own mutual funds. We don’t expect much business from PSU banks,” said a CEO of a mid-sized fund house.

Apart from low commissions, fund officials say that PSU banks see a threat from debt funds which compete with fixed deposits. “Mutual funds are new products for these banks. It will take some time for these banks to get active in MF distribution. The returns from mutual funds have also not been very attractive over the last five years. They say it becomes difficult to justify to their customers if funds don’t perform well. Also, commissions on mutual funds are not very attractive,” says Debasish Mallick, Managing Director & Chief Executive Officer, IDBI Mutual Fund.

Compared to private banks that are more active in

MF distribution in metros, PSU banks provide reach in semi-urban and rural

areas to AMCs. Most fund officials feel that PSU banks provide a huge potential

in the times to come. Additionally, customers have a good connect with the

branch officials of PSU banks.

Distributors,

however, caution that adequate safeguards must be deployed to ensure that banks

don’t end up mis-selling products.

To

attract distributors from hinterland, SEBI has allowed AMCs to charge a higher total

expense ratio (TER), based on certain conditions, if they receive inflows from

B-15 cities. The higher TER is used to offer higher commissions to distributors

who bring applications from small cities. It remains to be seen if this

incentive will spur PSU banks to take up mutual fund distribution more

aggressively.