Listen to this article

How will the outcome of upcoming election impact the equity markets?

While there is no data which can predict impact of upcoming election on the equity markets and the GDP growth, the past data reveals some interesting outcomes.

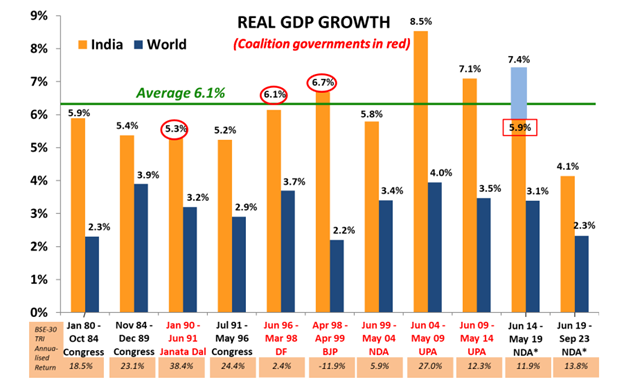

Data compiled by Quantum Mutual Fund shows BSE-30 TRI annualized return and real GDP growth during the tenure of the last 11 governments from January 1980 to September 2023. Let us look at them.

- GDP Growth Rate: The average GDP growth of India since Jan 1980 has been 6.1%. The only times when India’s GDP growth has exceeded this average has been from April 1998 to April 1999, June 2004 to May 2009 and June 2009 to May 2014. During all these years, a coalition government was in power which indicates that strong governments with clear majority in parliament do not necessarily lead to the highest GDP growth.

- BSE-30 TRI annualized return: The highest annualized return on the BSE 30 index since January 1980 has been 38.4% from January 1990 to June 1991, when the Janata Dal-led coalition was in power. Apart from this exception, the returns have been generally better during the rule of a coalition government. The record of right-wing governments has been comparatively below par during this period when it comes to delivering returns on the index.

Overall, the equity market delivered stellar returns during the tenure of a coalition government.

While the data from the past is no guarantee of future outcomes, the data is clearly worth noting as we head into the election season.