Listen to this article

Multi asset allocation funds have found favour among fund houses with seven fund houses - Bandhan MF, BOI MF, HSBC MF, Mahindra Manulife MF, Mirae Assets MF, Sundaram MF and Quantum MF launching them.

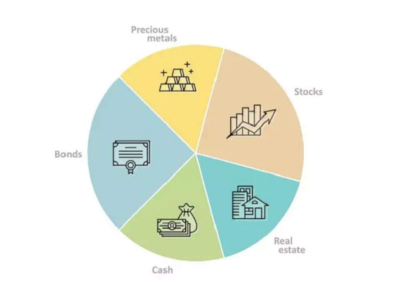

Multi asset allocation funds have to invest at least 10% of the total corpus in three asset classes – equity, debt and gold. While many fund houses have launched equity oriented multi asset allocation funds to offer equity taxation to clients, a few fund houses have come out with funds having equity exposure between 35% and 65% to offer indexation benefits to investors.

We spoke to a few MFDs to understand where multi asset allocation funds fit into the client’s portfolio.

Pune MFD Harshavardhan Bhusari of FIN PALS believes that investors can look these funds to deploy lumpsum money during market rally. “These funds have adequate exposure to other asset classes like fixed income instruments for reducing volatility and gold for hedging against inflation. These funds take care of asset allocation needs and can be recommended to investors with moderate risk appetite.”

Udaipur MFD Rahul Jain of GR Finvisors said that he recommends these funds to senior citizens to generate regular income. He said, “ These funds are more tax efficient than debt funds and suitable for most investors requiring regular flow of income.”

Pune MFD Santosh Pardeshi of Money Lancer feels that many fund houses are filing up their product baskets through multi asset allocation funds. He feels that these funds are more suitable for first time investors having conservative to moderate risk appetite.