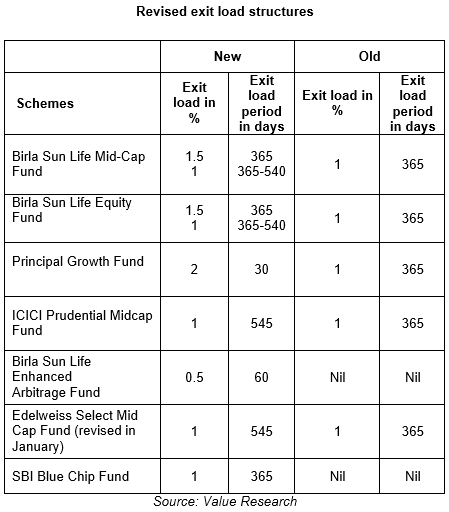

Five fund houses have either increased their exit load structure or extended the exit load period across seven equity schemes in last two months.

After increasing expense ratios of equity funds across all categories, some fund houses have now turned their focus on revising exit load structures. In the last two months, five fund houses have either increased their exit loads or extended the exit load period across seven schemes, shows a Value Research data. Last month, the industry saw an average of 13% increase in total expense ratios (TER) in equity funds.

In fact, large fund houses like ICICI Prudential, SBI and Birla Sun Life have revised their load structures for select equity funds. Experts are of the view that these fund houses want to discourage redemptions due to the recent rally in equity markets.

Birla Sun Life MF has increased its exit load by 50 basis points in Birla Sun Life Mid-Cap and Birla Sun Life Equity Fund. Similarly, Principal Growth Fund has increased its exit load structure by 1%; however, the scheme has reduced the tenure of exit load to 30 days.

While SBI Blue Chip Fund has converted its no load fund to a load fund, a few schemes like ICICI Prudential Midcap Fund and Edelweiss Select Mid Cap Fund have extended the period of exit loads.

DP Singh, Executive Director & Chief Marketing Officer (Domestic Business), SBI Mutual Fund said, “SBI Blue Chip Fund was a no load fund earlier. We have converted this fund to a load fund for the tenure of one year after the fund’s size has grown. We don’t want to take redemption pressure especially in such a large and better performing fund.”

A senior official from ICICI Prudential MF told Cafemutual that his company has revised exit load structures in order to dissuade investors from redeeming their investments in the recent rally so that they can make money in the long term.

Vidya Bala, Head – Mutual Funds Research, FundsIndia.com seconds the view and said that heavy redemption pressure at the time of market revival affects the performance of the fund. Therefore, the fund houses have revised their exit load structure, she added.

Nikhil Kothari of Etica Wealth Management believes that hiking exit load structure is a good practice. “A high exit load maximizes the chances of investors remaining invested in the fund. An equity fund is a long term product and needs time to deliver performance. Also, many investors have redeemed their investments in the recent rally even if they don’t want money. Revision in exit load may deter such investors to move out of the fund.”