Due to improved market sentiments, the industry has added close to 45,000 folios in equity funds in June, shows SEBI data.

After

witnessing a steady decline in folio count, the mutual fund industry has

finally managed to grow its investor base in equity funds. The industry saw a record Rs. 7,309 crore net

inflows in equity funds in June. This helped the industry grow its folio count

in equity funds by close to 45,000 in June, shows SEBI data.

After

witnessing a steady decline in folio count, the mutual fund industry has

finally managed to grow its investor base in equity funds. The industry saw a record Rs. 7,309 crore net

inflows in equity funds in June. This helped the industry grow its folio count

in equity funds by close to 45,000 in June, shows SEBI data.

Experts attributed this increase in folio count to equity market rally, improving market sentiments and the resultant inflows in equity funds. The S&P BSE Sensex was up 1,196 points in June. While S&P BSE Sensex breached 25k mark in June, CNX Nifty closed at it’s the then all-time high of 7600 points in June.

Largely due to fall in redemption and fresh inflows in existing as well as new schemes, equity funds saw a net inflow of Rs. 7,309 crore in June.

The total investor count in equity funds stands at 2.92 crore now.

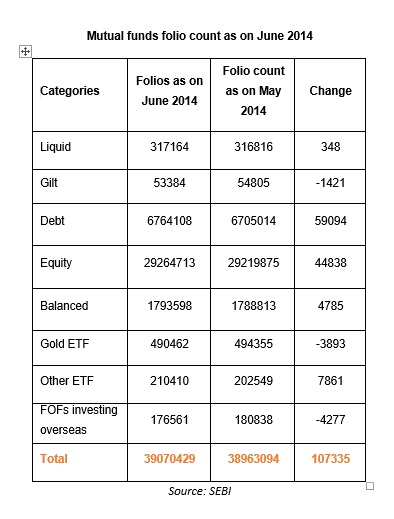

SEBI data shows that the industry has gained close to one lakh folios across all scheme categories in April-June 2014. The folio count has increased from 3.89 crore in May 2014 to 3.90 crore in June 2014.

Similarly, the debt category also saw a moderate increase in investor accounts. Close to 60,000 new folios were generated in debt funds in June.

Likewise,

balanced funds and other ETFs saw a marginal increase in folios count in June. Both

the categories have added close to 12,500 folios.