Majority of ultra HNIs believe that they can manage wealth on their own.

Only

6% Ultra HNIs prefer to consult financial advisors when it comes to managing

wealth, says ‘Top of the Pyramid 2014’, a report published by Kotak Wealth

Management last week. The report looked closely at the UHNIs in India, the key trends

and their behavior and investment pattern.

A

person with a minimum net worth of Rs. 25 crore is considered to be UHNI as of

2013-2014.

A

person with a minimum net worth of Rs. 25 crore is considered to be UHNI as of

2013-2014.

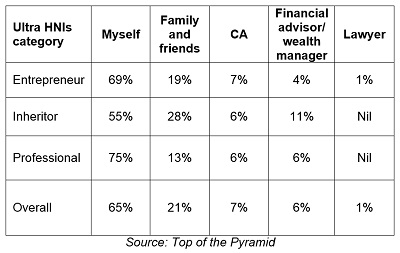

The report says that the majority of ultra HNIs (65%) believe that they can manage wealth on their own. Among ultra HNIs, entrepreneurs and professionals rely more on themselves for investment decision.

Also, the report shows that 21% of ultra HNIs consult their friends and family members for investment decisions with entrepreneurs and inheritors relying even more so.

Interestingly, the ultra HNIs prefer Chartered Accountants (CA) over IFAs for financial decisions.However, among ultra HNIs, only inheritors rely more on financial advisers over CA for managing their wealth.

Decision makers in ultra HNI investments

Murali Balaraman, Partner Advisory Services, Ernst & Young LLP which was commissioned for this report, says, “Trust plays a major role in the investment decision of ultra HNIs. Since ultra HNIs stay in constant touch with their friends, family members and CAs, these people can easily build trust and thus play a key role in investment decision of ultra HNIs.”

Suresh Sadagopan of Ladder7 Financial Advisories believes that the trend will reverse in future. “CAs have a longer history running to 40-50 years, giving an edge over us to build trust among the HNI clients. Sooner or later, the ultra HNIs will understand the significance of financial planning and how it is different from tax planning.”

Shalini Dhawan of Plan Ahead Wealth Advisors advised financial advisors to offer multiple solutions like taxation, succession, estate planning etc. by tying up with experts. “Most banks who cater to Ultra HNIs are offering extensive range of services. IFAs need to build up their offerings to match with other existing players to capture market share.”