Birla Sun Life, UTI, ICICI Prudential and Reliance emerged as the best performing fund houses during June quarter.

Small and mid-cap funds emerged as winners during June quarter as compared to their large cap and diversified peers.

CRISIL–AMFI Small & Midcap Fund Performance Index, which represents the performance of small and mid-cap funds, appreciated 28.99% during the June quarter, significantly higher than the CRISIL–AMFI Large Cap Fund Performance Index (up 18.92%) and CRISIL–AMFI Diversified Equity Fund Performance Index (up 23.95%), stated a CRISIL research.

Attractive valuations coupled with positive market sentiment helped small and mid-cap stocks outperform the broader market, said the research note. For instance, the PE multiple of CNX Midcap was 14.3x on March 31, 2014, a perceptible discount to its historical peak of 26.3x in January 2008.

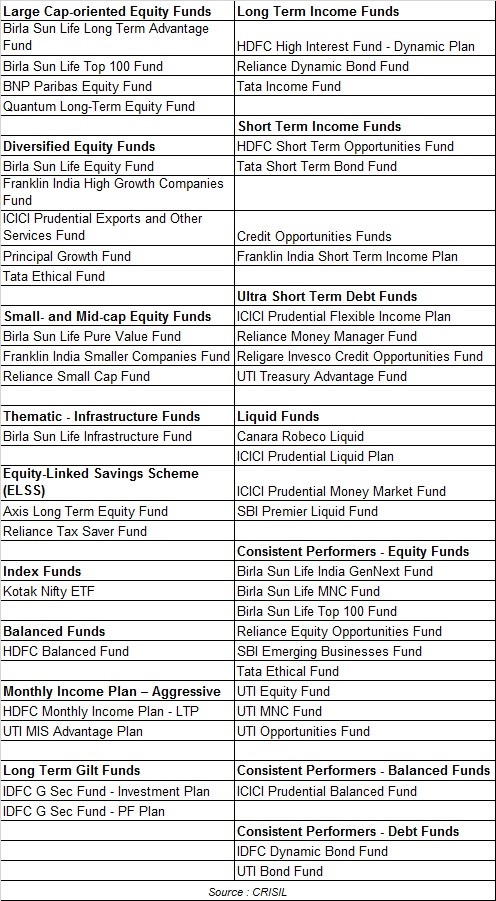

At the fund house level, Birla Sun Life Mutual Fund led the tally of top-ranked funds for the quarter with eight funds under CRISIL Fund Rank 1, followed by UTI Mutual Fund with six, and ICICI Prudential Mutual Fund and Reliance Mutual Fund with five funds each. The latest CRISIL Mutual Fund Ranking covers close to 90% of the average assets under management of open ended schemes at the end of June.

Within the small and mid-cap category, CRISIL Fund Rank 1 funds (as of the quarter ended June 2014) were overweight on sectors such as industrial products and chemicals. The average over-exposure of CRISIL Fund Rank 1 funds vis-à-vis the category average to these sectors during the quarter was 4.91% and 3.10%, respectively. This helped them outperform the category.

While CRISIL–AMFI Small & Midcap Fund Performance Index outperformed the broad market - CNX 500 (up 18.69%), it could not beat the category benchmarks CNX Midcap Index (up 30.32%) and CNX Smallcap Index (up 48.41%). The underperformance was mainly due to average exposure of about 22% to large-cap stocks (top 100 stocks based on daily average market capitalisation on the National Stock Exchange)

CRISIL Fund Rank 1 schemes