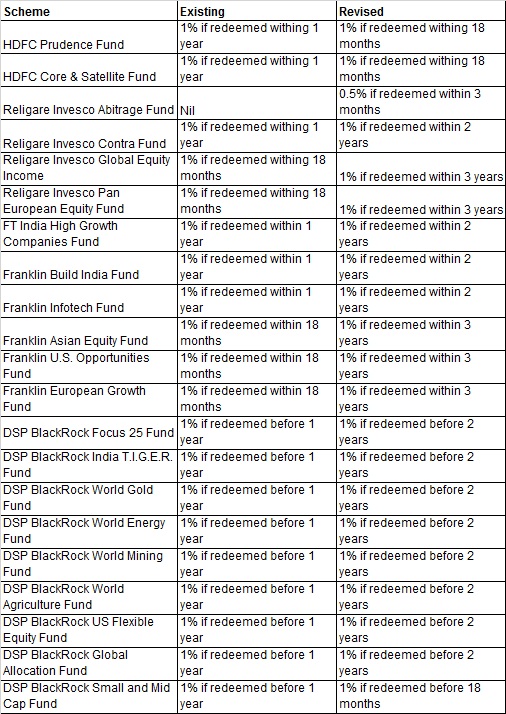

Fund houses have extended the tenure of exit loads under some of their equity funds.

Fund houses like HDFC, DSP BlackRock, Franklin Templeton, JM Financial and Religare Invesco have revised their exit loads under a number of schemes.

HDFC Prudence Fund and HDFC Core & Satellite Fund will charge an exit load of 1% if units are redeemed before 18 months of the allotment. This exit load period was 12 months earlier.

Similarly,

DSP BlackRock has increased the tenure of exit load to two years in some of its

thematic and international fund of funds.

“We

wanted to align products to an indicative holding period. Our DSPBR Micro Cap already

had a two year exit load tenure. Thus, we aligned DSPBR Small & Mid Cap to

18 months and thematic/concentrated funds like DSPBR T.IG.E.R and DSPBR Focus

25 to two years,” said Ajit Menon, EVP & Head – Sales & Co-Head, Marketing, DSP BlackRock Mutual

Fund.

JM Financial Mutual Fund has announced change in exit load structure under all equity schemes (except JM Arbitrage Advantage Fund and JM Tax Gain Fund) with effect from September 24, 2014.

Revised exit loads

The revised exit load will be 1% if redeemed or switched out before three months within the date of allotment of units. These schemes will charge an exit load of 3% are redeemed within one year from the date of allotment, 2% if redeemed between the first year and second year, 1% if redeemed between second year and third year. No exit load will be charged after three years.

Besides

equity, DSP BlacKRock, Franklin Templeton and Religare Invesco have also

revised exit loads under some of their debt schemes. For instance, Franklin India

Income Opportunities Fund will charge an exit load of 3% if units are redeemed before

12 months (earlier 6 months) of allotment, 2% if redeemed before 18 months (earlier

12 months) and 1% if redeemed before 24 months (earlier 18 months).

While equity funds have increased exit load tenure to dissuade early redemptions, debt and international fund of funds have hiked exit loads to align the schemes in line with the changes in tax structure of debt funds. The budget 2014 hiked the tax (20% from 10% earlier) for non-equity mutual funds. To be qualified for long term capital gains, the holding period was also increased to 36 months from 12 months earlier. “In case of international and debt funds, AMCs have increased the tenure to align the scheme with the new tax structure,” said Vinod Jain of Jain Investments.

After

the changes in tax structure of debt funds, fund houses started pushing arbitrage

funds which are more tax efficient. Industry experts said that liquid fund

investors had started parking their money in arbitrage funds which disturbed

the portfolio of arbitrage funds due to constant entry and exit of flows. Thus,

Religare Invesco has introduced an exit load of 0.50% from September 18 in its arbitrage

fund. It will charge 0.50% exit load if units are redeemed or switched out

before three months from the date of allotment.

Unlike

in the earlier regime when exit load corpus was utilized for marketing purpose,

now the exit loads charged from investors is ploughed back in the scheme.

Exit

loads act like a signal for investors which indicate that they should remain invested

for a particular period. Exit loads are used tactically by fund houses during

different market cycles.

Last year, HSBC Mutual Fund had scrapped exit loads

under all its schemes. Very recently, Motilal Oswal too has scrapped exit load

under all its schemes. However, some say that zero exit load encourages

churning.

Let us know your thoughts.