Of the 15 countries, India ranks first in the retirement readiness survey conducted by Aegon Insurance. The survey, which measured the attributes and aspirations of people for their retirement, found that around 44% Indians are confident that they will retire as they desire.

The survey covered 16,000 respondents (1,000 Indians) in 15 countries with India scoring 7 out of 10 in the Retirement Readiness Index. Of the 1,000 Indian respondents, 900 were working and 100 were retired.

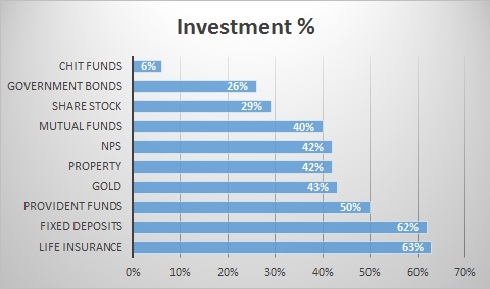

Preferred products to build retirement corpus

Of the 1,000 Indian respondents who were surveyed, 42% preferred to invest in mutual funds to save for retirement. Fund officials say that the turnaround in market has helped change the perception about mutual funds among people. Vikaas Sachdeva, CEO, Edelweiss Mutual Fund says, “The transition from other safe products to mutual funds is really good. It shows that our hard work has paid-off. People are now realizing the importance of investing in markets. An increasing number of advisors are recommending clients to invest through SIPs to build their retirement kitty.”

Hemant Rustagi of Wiseinvest Advisors believes that more people will prefer to invest in mutual funds to save for retirement in future.

Vishal Dhawan of Plan Ahead Advisors believes, “There has been a shift from physical assets to financial assets. They are now understanding the importance of diversification. Retirement is now a priority for Indians. As the markets grow, more people will start investing in mutual funds to save for retirement.”

While there has been a gradual shift among people towards mutual funds, life insurance, fixed deposits and provident funds remain the three most preferred instruments for retirement. “Earlier, only banks were the most trusted institution in the country. A majority of Indians are risk averse and this is the reason for a high preference for fixed deposits and other safe instruments,” adds Hemant.

After from life insurance (63%), fixed deposits (62%), and provident funds (50%), gold (43%), property (42%) and NPS (42%) were most preferred by Indians as a means to save for retirement. “NPS is emerging as the most preferred investment avenue for salaried individuals to build retirement corpus because of its tax benefits,” adds Vishal.

Retirement Expectations and Aspirations

Indians are generally positive about retirement. More than three-quarter (76%) perceive retirement positively, associating it with words such as freedom (39%), leisure (37%) and enjoyment (37%). Compared to people in other countries, they are also much more likely to be confident that they can retire comfortably. Over two-fifth (44%) of working Indians are very or extremely confident that they can retire with a comfortable lifestyle, compared to just 23% globally.

Life after retirement

While the vast majority (79%) of Indian workers plan to continue working to some extent after they retire, most plan on doing so not out of financial necessity but because they want to be active (66%) or because they enjoy their work (59%). However, a significant majority will continue to work because of anxieties over how long their retirement income will last (23%), concern that their retirement plan benefits will be less than expected (22%), and a general sentiment that they have not saved enough on a consistent basis (19%).

Employer’s contribution

Indian workers tend to feel a greater attachment to their employers than employees in other countries. Only in China do workers feel that retirement plans play an invaluable role in making employees feel valued to a greater extent than Indians (83% versus 74% respectively).

The survey shows that Indian workers place much importance in employer contributions to retirement plans, with nearly a third (31%) using a workplace pension plan with employer contributions to prepare for retirement. Furthermore, 38% say that a better retirement plan match from their employer would encourage them to save more.

Recommendations

- The report says that Indians need to be saving more consistently for retirement in order to stay on track of their retirement income goals and to feel more secure about not working entirely in retirement.

- A key incentive for Indians saving more for retirement are higher employer matching contributions to work retirement funds, which in turn would help employees feel more valued in the workplace.

- Indians have a strong appetite for different kinds of investment products and a wider diversity of available products would encourage Indians to save more for retirement.