India has the highest percentage (59%) of habitual savers, shows a recent retirement study conducted by Aegon Insurance across 15 countries. The survey collected responses from 14,400 employees and 1,600 retired people.

The survey showed globally, too few people make a habit of saving for retirement. Even though this is the best route to becoming retirement ready, fewer than two in five workers globally make sure that they always save for retirement. Among the original nine countries included in the 2012 to 2016 surveys, the percentage of habitual savers has increased by just 1.4% to 34.6% in 2016.

“Of the 15 countries included in the 2016 survey, the percentage of habitual savers is higher at 38% and is buoyed by a greater proportion of habitual savers in India (59%) and the United States (54%),” shows the report.

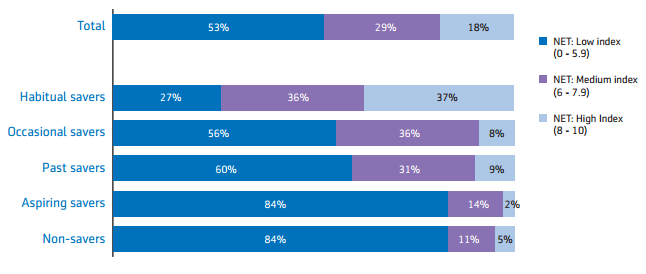

Interestingly, there is a strong correlation between Aegon Retirement Readiness Index (ARRI) scores and saver types. For example, habitual savers are seven times more likely to achieve a high ARRI score than non-savers. Also, people who save occasionally or have saved in the past achieve a significantly higher ARRI score compared to non-savers. India ranks first in the ARRI and has achieved a rating of 7.3 which is higher as compared to last year’s ranking.

Habitual savers score higher on the ARRI

When and why do people start saving for retirement?

Workers start saving for retirement for a wide variety of reasons. The survey asked respondents who are saving or intend to save for retirement what prompted them to start saving and their responses were broken into two broad categories – ‘life stage’ and ‘employment-related.’ The most frequently cited response is that they turned a certain age (32%), which suggests that there is a time in life when people feel that they are ‘supposed to’ start saving or that they have reached an age when they cannot put it off any longer. These findings imply that milestone birthdays could be a good opportunity to engage some workers on the need to save for retirement.

However, this approach may not work for all. Others may start saving for different reasons, implying that a variety of nudges would be helpful. For example, some people seek financial advice when taking out or re-mortgaging their home, which is a potential opportunity for advisors to introduce other savings options such as retirement planning products.

Major lifestyle changes such as having children may encourage people to consider their long-term finances and presents another possible opportunity to engage them in discussions about retirement.

The report suggests that creating more nudges to help people become habitual savers has become essential. Many people may be slow to start saving and planning for retirement. In order to save, they need a nudge. In the workplace, employers play an important role in encouraging savings.

Globally, 39% of workers said that employment-related factors prompted them to start saving for retirement. 16% started saving for retirement when their employer started paying into a retirement plan and 10% started saving when they started their first job. The design of workplace retirement plans therefore provides a major opportunity to build a more inclusive retirement savings system.

The survey suggests that convenience and making it easy to save should be key features of any sustainable retirement system in which people are expected to play a role in financing their old age. Hurdles such as complicated investment products, difficulty accessing savings information and hard-to-reach professional advice when needed, are deterrents for saving.