Banking sector stocks were rallying strongly in 2014. As we entered 2015 we saw increased volatility and huge sell-off in the financial sector stocks, including banks.

Banking stocks have reached new lows during March 2016 as banks reported one of the worst quarters in the last decades with no near term visibility in operational improvement.

So how does this affects banking and financial sector funds? Since banking and financial services funds are sector funds, any stress in the underlying stocks of such schemes can hamper the performance adversely. We decided to review some the performance of such sector funds and what fund managers and distributors are advising investors.

So what should investors in such funds do and is this a good opportunity to take exposure to these funds?

Performance

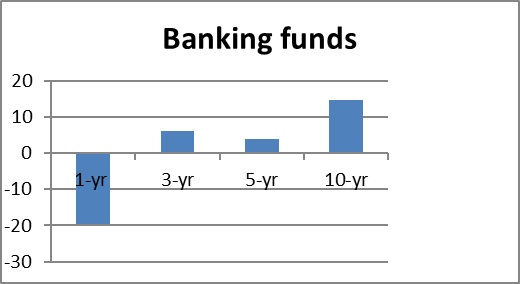

According to data compiled from Valueresearchonline.com, these funds have given an annualised return of approximately 4% in 5 years, 6% in three years and 15% in 10 years. The performance of such funds has taken a beating, particularly in the last one year.

*data as on 10th March 2016 Source: Value Research. BFSI Funds

Outlook ahead

Let’s look at what caused banking stocks to fall. The RBI governor’s demand of asset quality clean up, to recognize errant borrowers as NPAs and to provide higher provisioning on restructured debt (5:25) have hurt banking sector stocks. Further, the fall in commodity related companies accounts for 5% of loan book, of which 30% has been recognized as bad loans has added to the pressure.

But experts say that the steps taken by RBI will lead to better transparency and healthier financial system. “Banks are the crux of an economy. So for economic revival, banks will be capitalized too. One has to look at valuations and the potential of such stocks. They are trading so low for a reason,” observes Vidya Bala, Head of Mutual Fund Research at FundsIndia.

But is she recommending investing in these sector funds? The answer is no. She would rather have her clients buy a diversified fund than a sector fund. “If they want more exposure in banks, they can go for funds which are overweight on banks,” advises Vidya.

Her views on sector funds are seconded by Nikhil Kothari of Etica Wealth Management, “Investors should avoid sector funds unless they are risk takers with sound knowledge about markets. If they wish to invest in sector funds, the exposure shouldn’t exceed more than 5% of their total portfolio. Otherwise, invest in diversified funds which have exposure to banking stocks.”

Vinay Sharma, Fund Manager, ICICI Prudential Mutual Fund says that because of strong fundamentals and good valuations, investors should go over weight on equities by this year end and diversify into banking sector funds too.