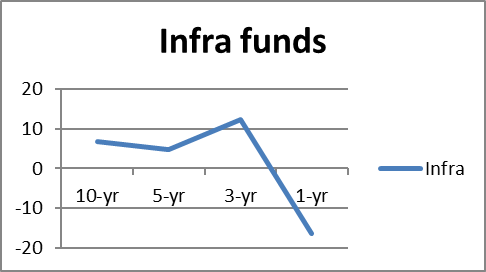

Infrastructure funds which posted stellar performance (a few funds delivered over 70% returns) in 2014 on the hopes of an imminent revival in economic activity are now down by 16% over a one year period, shows Value Research data. Over a one year period, infra funds are the second worst performing category after banking funds (-19%).

If you take a closer look, the infrastructure sector has been very volatile, especially from 2007 till date which doesn’t paint a good picture.

Performance of infrastructure funds

*data source: Value Research as on 16 March 2016

*source Bloomberg. Data as on Dec-15

So is the current fall in this sector an opportunity to invest or can we see further downside from here? Let’s take a look at some of the factors working in favor of this sector.

- Oil prices are at their all-time low, easing the pressure on oil marketing companies. This will also help in reducing the fiscal deficit.

- Coal production could improve as Coal India Limited (CIL) plans to substantially enhance production of coal to 1 billion tons by 2019-20 from 494.23 Mte produced in 2014-15.

- The Union Budget has allocated Rs. 2.21 lakh crore for the infrastructure sector. The government has also announced a series of measures to modernize existing ports and build new ports along the Indian coast. These initiatives are being taken to revive the infrastructure sector through public-private partnership.

Rohit Singhania, Fund Manager of DSP BlackRock T.I.G.E.R Fund says, “The government has taken a more realistic view on the overall infrastructure sector by finding solutions to revive stuck projects and help increase the pace of execution. The pick up in road building and the change in thought process in the railways (jump in spending and a focus on infrastructure rather than rolling stock) will ensure more work for the related companies. Over the last 2 years we have seen good increase in domestic coal production, revival of stuck projects which again augurs well for companies in the space. With this, and the measures to come (PPP renegotiation and dispute resolution, and reduction in the invested duty structure for capital goods), in the near term, apart from te boost to infrastructure focused companies (developers, constructors and equipment suppliers), we also expect to see increased capacity utilizations for cement, power and steel companies as the economy picks up. So does he recommend investing in infra funds? “Measures taken by the government have helped built up investor confidence and Infra should be a part of every investor’s portfolio.”

Rohit’s views about this sector are echoed by Tejal Gandhi of Money Matters, “It’s a sector that investors should invest in but I would only advise investors with a higher risk appetite to invest in such funds. Retail investors can invest in diversified funds which have exposure to all sectors.”

But we need to remember that infrastructure funds are suitable for investors with a high-risk appetite who believe in economic development and are willing to hold their investments for a long term. This sector is very prone to volatility. Such funds are easily affected by any change in policy or delay in project implementation.

With that let me know your views and what are you suggesting your clients!